Basic-Fit N.V.

This report was originally published in July of 2023

You can find the PDF here:

Basic-Fit N.V. (AMS: BFIT) is the first foreign stock that I’ve written about. And it’s interesting primarily because it’s a foreign stock. If it existed in the U.S., it’d probably be late to the game. You see, Basic-Fit is a European budget gym. And budget gyms – or going to gyms regularly in general – haven’t caught on in Europe like it has in the United States.

Source: Basic-Fit June 2023 Investor Presentation

In the U.S., fitness membership penetration is just over 20%. In Europe, only a couple of Scandinavian countries are close to the U.S. numbers. In the countries that Basic-Fit operates in, penetration numbers are typically lower than 15%. And in some of the countries Basic-Fit hopes to expand into, the rates are below 10%.

No one can say for sure why this is the case. Europeans overall aren’t less healthy than Americans, but the gym culture is just slightly different. One reason this could be – and Basic-Fit believes this to be the case – is that the budget (i.e., cheap and casual) gym model expanded much earlier in the U.S. than in Europe. Basically, Basic-Fit believes that the reason there aren’t more gym memberships in Europe is because someone hasn’t built enough budget gyms.

Planet Fitness is by far the largest gym operator in the U.S. It took the cheap $10 a month gym model and used it to expand its total members to roughly 17 million (that’s around 5% of the U.S. population), and the number of gyms to over 2,300.

Basic-Fit has started doing something similar in Europe. The big difference being that the U.S. could be saturated, but Europe is nowhere close to that level of saturation. Basic-Fit is the largest gym operator in Europe, and it’s growing much faster than anyone else.

Source: Basic Fit June 2023 Investor Presentation

Unlike Planet Fitness, Basic-Fit doesn’t franchise. It owns all of its stores, and is planning on opening 200 to 300 a year going forward. It has already expanded to become the largest gym operator in the Netherlands, Belgium, Luxembourg, Spain, and more recently France over just the last 7 years or so.

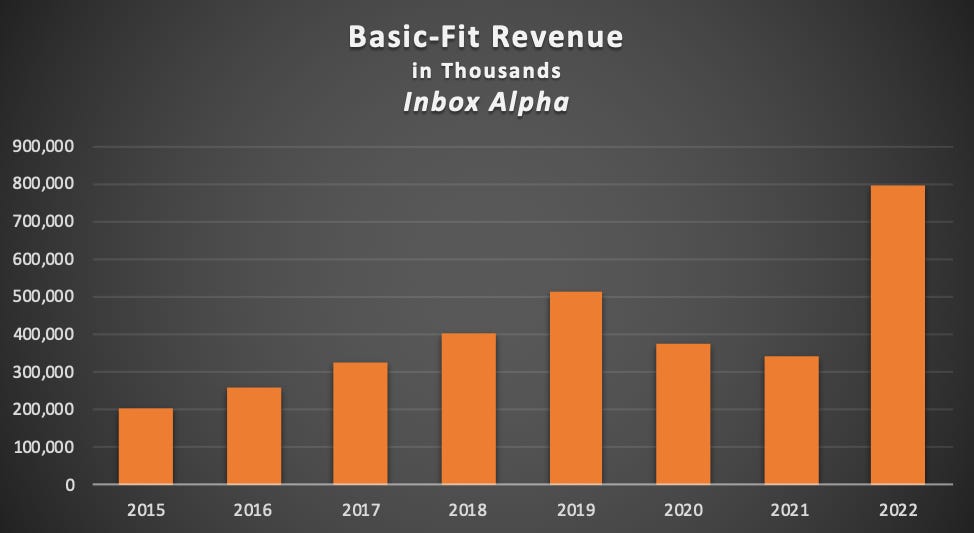

The company had some trouble during COVID (nothing serious) with the complete closure of all of its gyms for an extended period of time, and partial closures in some countries thereafter. Basic-Fit lost money for a few years, and had to raise equity capital (grew its share count by 11% in 2021 to over 64 million, but has since reduced to 61 million). But it continued to grow its footprint, and has emerged with over 1,268 clubs today. Its FY revenue in 2022 was €794.6 million – an increase of 133% over 2021 and 54% over 2019 (the last normal pre-COVID year). In normal times, the company generated an underlying EBITDA margin of around 25%, a FCF margin of around 20%, and a FCF ROE of over 20%. As of Q1 2023, Basic-Fit has 3.6 million members, and quarterly revenue of $240 million (an increase of 51% YOY).

Basic-Fit has rebounded pretty quickly from the COVID lockdowns over 2020 and 2021. And there’s some concern that, with so much recent growth, it’s had an influx of new members that will churn a lot quickly than the traditional membership base. On top of that, it’s been expanding its club footprint – through use of cash flow and debt – at a rate of over 100 new clubs a year (now increasing to 200-300). The company’s recent results are promising, but if it’s wrong about the new customer LTV or traction in new countries (like Germany) then the leverage could make things more difficult. Basic-Fit has over €700 million in debt on its balance sheet – roughly half through a syndicated loan facility due June 2027 and half through convertible bonds due June 2028.

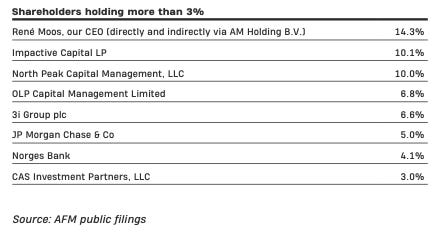

So, the investment isn’t without risk. But, I’ll say that the way management has handled the last several years gives me confidence. The company is founder-led with a CEO – Rene Moos – who is fully aligned as the largest shareholder, owning roughly 14.3% of the company. Further, they seem to have perfected construction of new gyms – building quicker and cheaper than everyone else out there. And finally, they have momentum. Revenue is growing, EBITDA and FCF should start to creep back up with the initiatives we’ll discuss below, and overall investor sentiment on the stock seems to be kicking in. The stock has increased by about 31% YTD, but the company still appears to be pretty cheap, given its growth potential. Far from dissuading me to buy, I think this run-up is an indication that Basic-Fit could be in for some good returns if it keeps up its growth. I think this is an apt quote from Ian Cassel regarding stock returns: “For a stock to double other investors need to think it can triple.” And that seems like the scenario we may be getting here.

With their planned expansion to eventually over 3000 clubs, the returns alone from club expansion could be massive. Throw in the fact that their expansion could itself lead to penetration throughout Europe that rivals that of the U.S., and you’re talking about some serious returns.

The Business

History

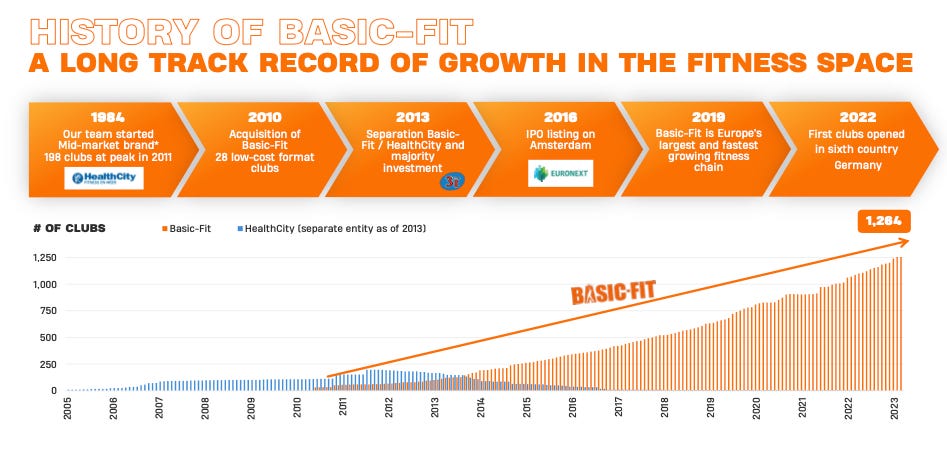

Rene Moos is a former Dutch professional tennis player who started a string of tennis clubs in the 80s after his professional career ended. He and his team shifted to HealthCity in 2004 – more of a premium fitness brand with all the amenities a premium brand offers (showers, sauna, classes, etc.). But growth was relatively limited.

Source: Basic-Fit June 2023 Investor Presentation

With the success of Planet Fitness in America, Moos saw an opportunity to expand into a market that didn’t really exist yet in Europe. He created Health City Basic (a low-priced value fitness club) inside of Health City in 2006, and in 2010 acquired Basic-Fit (28) clubs and merged their Health City Basic brand into it. The company started to expand across the Netherlands and Belgium. They expanded into France and Spain by acquiring clubs there in 2011, and by 2013 decided to spin-off Basic-Fit into its own independent company.

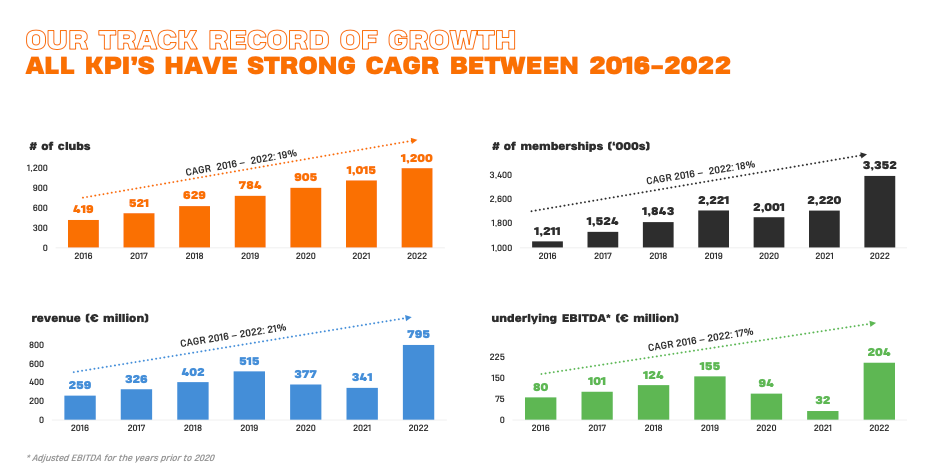

After seeing rapid initial growth, Basic-Fit came public on Euronext Amsterdam in 2016. Since then it has grown its revenue, memberships, gym locations, and underlying EBITDA at a CAGR of anywhere from the high teens to low 20s per year, with growth accelerating much faster coming out of the pandemic restrictions in 2022.

Source: Basic Fit June 2023 Investor Presentation

Obviously, 2020 and 2021 were difficult years, with revenue decreasing, and Earnings/FCF going into the red. But the company has emerged with a few more shares, a little more debt, and a fast-growing business.

Basic-Fit’s growth so far has mainly been organic, but it does occasionally make acquisitions. In a typical year, it will purchase (on an asset basis) clubs in order to expand quickly into a certain area. In most years, the number of acquisitions is limited to 4 or 5 clubs – it’s really nothing huge. Obviously, Basic-Fit’s history involved some pretty transformational acquisitions (like the Health City acquisition of Basic-Fit itself). But the only real acquisition of any note was a 2019 acquisition of 31 clubs in the Netherlands and 4 in France for a total consideration of €26.4 million net of cash acquired. The clubs in the Netherlands were a competitor’s – Fitland – clubs, which Basic-Fit acquired and quickly rebranded to Basic-Fit clubs.

Operations

Basic-Fit’s operations are pretty simple overall. Its main source of revenue is comprised of fitness memberships. It builds basic clubs that typically range in size from just under 4,000 ft2 to 5,000 ft2 (compared to something like a Planet Fitness gym, which is 20,000 ft2). Basic-Fit builds four different types of locations overall – a Standalone Location (at ~4,000 ft2), a Shopping Mall Location (typically between 4,000 ft2 and 6,000 ft2), a City Center Location (at 3,000 ft2 to 6,500 ft2), and a Large Format Location (usually up to 9,800 ft2). At the end of 2022, Basic-Fit had a three-tier membership model:

Basic at €19.99 a month. You can access the club you are a member at.

Comfort at €24.99 a month. You can access any club in the country you live in.

Premium at €29.99 a month. You can access any club in Europe and you can always bring a friend.

In France and the Benelux (Netherlands, Belgium, and Luxembourg), Basic-Fit has also recently introduced another tier – the All-in Membership for €49.99 a month – which lets you rent a stationary bike at home. All new memberships are now made only through the Basic-Fit app instead of an actual key card. And members have access to Basic-Fit’s in-home or (if they upgrade their membership) the live, virtual in-club fitness classes (through its GXR program).

Basic-Fit also generates additional revenue through the sale (about 3% of revenue in 2022, but growing over 3x YOY) of their sports water (which has a 20% penetration rate in all clubs), the sale of €9.99 day passes, the sale of sports nutrition through vending machines, fees from personal trainers and physiotherapists (a €500-€1,500 a month licensing fee), and the sale of ads on their multiple Samsung TVs hanging in the clubs.

Source: Basic-Fit June 2023 Investor Presentation

They also generate non-club revenue through their NXT Level nutrition brand, which they sell inside the club, through stores, and through their online webstore that they launched in 2022. This non-club revenue was just under €6 million in 2022 (still under 1% of revenue), but I think the potential for a supplement brand could be larger than most people think, especially in a relatively untapped market like Europe. I know the Basic-Fit members are typically more casual gym-goers, but watch this video to get an understanding of the potential for supplement (or nutritional brand) revenue for gyms.

The club layout is simple. The only things actually in the gym are weights and cardio machines. There are no showers or saunas or any other extra amenities. The typical Basic-Fit customer profile is a lot like Planet Fitness in America. Most of the members are looking for a cheaper, more casual exercise experience. Rene Moos has said that the vast majority of new members are actually new gym goers, not really converts from other gyms. And this is honestly what you would want with the low penetration rates in Europe. The current gym environment consists of a small number of niche gyms that committed members go to regularly. That’s not who Basic-Fit is going after. They’re going after the new user.

After they opened back up from COVID, management said that by far the largest influx of new members came from the 17-24 age group. 50+ was their slowest growing segment. The average length of stay for a Basic-Fit member is 22-23 months, which, as short as it may sound, is actually a lot longer than the international average of less than 12 months. And this two-year number is actually up from the average stay of 18-19 months at Basic-Fit when it first IPO’d.

Basic-Fit has said that churn was traditionally around 4%, but has decreased recently to 3.5% or so. The strange thing about this model – which Rene Moos hit on in this video – is that a lot of Basic-Fit’s members are returning members who have cancelled their membership previously but now renewed it. And to understand this, you need to understand something about the type of customer who goes to these clubs. Honestly, this customer is just your average joe. They usually aren’t someone who goes to the gym multiple times a week. They’re more of the New Year’s Resolution type who might cancel their membership by June, but renew next year after the new year. This type of member is actually pretty common to the value-based gym experience, and is honestly a better member than those at heavier-use gyms (they don’t wear down the equipment as fast). This type of member typically just wants a gym that they can go to if they feel like going. They’re looking for convenience and cheap fees. And Basic-Fit knows that.

That’s why their strategy is based around clustering new club openings. They go into a city or general metropolitan area (though they do build in more rural areas too), and build/open 5 or so clubs at a time. Rene Moos has said that, with this kind of club customer, he believes that being top of mind and most convenient is extremely important when brining on new members. Building one club in an area to see how it does isn’t going to differentiate you from any other gyms in the area, even if your prices are lower. You need multiple clubs so everyone can have one close to where they live/work, and so it’s just generally easier to go. Basic-Fit does some initial marketing in an area before their openings, and then growth mainly happens through word of mouth. Friends join and tell someone about it, or someone sees one of the several new clubs in their area. The multiple openings at once feed on a network of people who want to easily become a member of a fitness club.

All of this further helps to entrench Basic-Fit in a geographical area immediately, and to make it that much harder for competition to come in and take customers. No one in Europe right now can build on the scale that Basic-Fit can. Opening multiple gyms at once is part of their company culture. They’re always in touch with real estate agents and are constantly scouting out new locations. They’re also developing a network of specialized contractors to build the gyms very quickly (much like a Dollar General or Chick-Fil-A in the U.S.). I should also note that they’re not typically constructing the building from scratch. They’re usually just renting an existing space and remodeling it to make it into a Basic-Fit gym.

Right now, the average cost to open a new Basic-Fit club is roughly €1.2 million, which is up from around €1.15 million a few years ago. Regardless of the total cost though, Basic-Fit doesn’t enter into any contracts to build a new club unless it believes it can get at least a 30% Underlying EBITDA ROIC on the investment. A typical Basic-Fit club is cash flow positive once it reaches 1,600 to 1,700 members. And by year 2, most Basic-Fit clubs are considered mature. Pre- and post-pandemic, a mature Basic-Fit club has an average of 3,350 members, and it typically takes three to four years to pay back the initial investment.

Today, Basic-Fit has around 3.6 million members, which is up from just below 2 million before the pandemic in 2019, and is up 37% YOY compared to Q1 2022. Membership demand seems pretty robust since the end of the pandemic – you can obviously see that it dropped off pretty heavily in 2020-21 just as it was starting to take off.

Source: Basic-Fit June 2023 Investor Presentation

Basic-Fit’s business model – and theory that demand will come if you build the clubs – is demonstrated by its growth since 2015. Back in 2015, only 7% of total clubs were in France – a new market that Basic-Fit was just expanding into. The Netherlands and Belgium (Basic-Fit’s original markets) made up over 82% of total clubs and 85% of total revenue. Basic-Fit’s theory was that it could expand into a much larger and far less penetrated market (fitness club penetration in France was at 8% compared to the Netherlands at 17%), and take the majority of the market share of new club members in the country. And it has essentially done just that.

Source: Basic-Fit Annual Reports

While it maintained annual club opening growth rates of roughly 7.4% and 6.7% in the Netherlands and Belgium respectively, new clubs in France made up the majority of the club growth over the last 7 years. The clubs in France went from making up 7% of the total to making up about 54% of the total number of clubs. This is the kind of growth that Basic-Fit is targeting in Germany as well.

Over this same period, Basic-Fit’s revenue has grown at a CAGR of roughly 21% with periods of serious drawdowns during the lockdowns in 2020 and 2021.

Source: Basic-Fit Annual Reports

One of Basic-Fit’s biggest advantages, in my opinion, is that it doesn’t franchise. It runs its whole operation very efficiently. It’s now the largest fitness club chain in all of Europe, so it has the largest scale, and therefore the most bargaining power, when it comes to purchasing equipment. It also runs its clubs with less employees than just about everyone else out there. It typically has about 3 full-time-equivalent (FTE) employees at each club, although most clubs don’t have any employees present during the late-night hours (a lot of clubs are open 24/7). Over the last few years, Basic-Fit has been investing in state-of-the-art real-time monitoring systems in its clubs so that it can meaningfully reduce employee presence. It already has a lower employee count than most gyms its size (which typically employ about 6 people per location), but the use of these cameras – which can detect motion, actions, and even raised voices in a gym environment – may help the company cut back to one employee per location or even none.

As of 2022, the company had 4,145 FTE employees (85% of these were club employees, the rest were corporate). It also has another 3,500 or so part-time employees. And these individuals, along with the annual rent payments (plus depreciation of equipment) make up the majority of Basic-Fit’s cost base.

If you think about how Basic-Fit operates, it helps to understand the cost structure of its income statement. Basic-Fit doesn’t necessarily grow by marketing, though it does spend about 6% of revenue on marketing expenses, and Rene Moos has said that the cost of acquiring a new customer is about €30 (which is extremely cheap given they bring in about €228 per year on average in revenue from a customer). This also helps when re-acquiring churned members. I honestly don’t even know if they have to spend to bring them back, but if they do, the cost is much cheaper than acquiring a new customer given they don’t have to build a new club to do so. So, instead of marketing, Basic-Fit acquires the majority of its customers simply by building new clubs.

This means that it spends a good amount on growth capex (€216 million in 2022 alone), and a lot of this has to be expensed through depreciation.

Source: Basic-Fit Annual Reports

Note that depreciation expense, which now effectively includes rent payments, is the largest expense on the income statement. Fortunately for Basic-Fit, the actual cost of repair and refurbishment of equipment and clubs is generally much lower than the set-up cost, meaning that actual maintenance capex is significantly lower than PP&E D&A (€61 million in maintenance capex compared to €151 million in PP&E D&A).

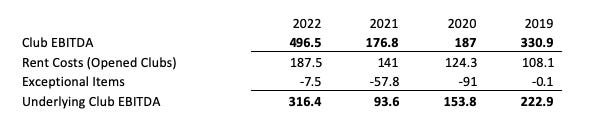

Also, given that the income statement is so convoluted with depreciation expense (depreciation of right-of-use asset and depreciation of PP&E even though actual maintenance costs are not that high), it doesn’t necessarily paint a reliable picture of Basic-Fit’s operations. Basic-Fit breaks down its income statement in another way, which I think is the best way to look at it. The major expenses at the club level are people, operating expense of the club (utilities, etc.), and rent. Then you have to add in corporate overhead and you get actual underlying company EBITDA.

Source: Basic-Fit Annual Reports

Note above that I reverse the negative and positive signs (i.e., the -7.5 million in exceptional items was actually an add-back to EBITDA). Because it capitalizes its leases, Basic-Fit doesn’t include rental expense in its actual operating expense, so it helps to look at the club-level underlying EBITDA to understand separate rental costs (which I think should be subtracted in order to get EBITDA). It’s obvious though that the expenses can be broken down to personnel costs, general operating costs, rental costs, and corporate overhead.

Source: Basic-Fit Annual Reports

To some extent, Basic-Fit is more of an infrastructure play, but one that’s growing. The business is mainly about acquiring the best real estate to attract the most customers. And, once you have that real estate, operating it as cheaply as you can while still delivering a lot of value to customers. Keep in mind though that rental costs may increase in future years. Basic-Fit’s management has said that they have lease caps in some countries of 3% on their lease contracts, and others prohibit those caps. Overall, they think rental costs won’t rise by more than 3-5% a year.

Underlying Club EBITDA margins seem to stabilize in the non-lockdown years at around 40%, and actual Underlying EBITDA is hovering around 25%. Overall, if you subtract maintenance capex (which was €61.2 million in 2022 and €47.7 million in 2021), then this is a pretty good proxy for FCF. Really the only different between this and actual FCF is the cash interest expense (which was essentially €20 million the last two years) and working capital changes. For Basic-Fit though, working capital isn’t that big of a deal. It has essentially no inventory (except for slightly elevated inventory the last couple of years because it originally purchased the stationary bikes for sale instead of lease), not much in the way of receivables, and payables probably positively affect FCF, as they are larger than cash, inventory, and trade receivables put together.

Based on the overall Underlying EBITDA listed above, FCF for 2022 was roughly €124 million (after interest expense). This gives Basic-Fit an effective ROE of about 30%. Keep in mind that cash flow is going to be temporarily deflated going forward because of constant club openings. This doesn’t just affect growth capex (which we didn’t take into account above), but also margins since a lot of the new clubs are running at full capacity expense-wise without a high number of members yet. So, like any good company that’s growing, Basic-Fit’s numbers are somewhat masked by what it chooses to do with its capital. If it just let all of the clubs mature and didn’t focus on opening any new ones, it would have higher margins, returns on capital (overall, not at the gym level), and less debt.

But one of my favorite things about Basic-Fit is its willingness to upsell its customers by offering them more value at a higher price. And, as Basic-Fit goes pretty much uncontested as a budget-level gym in most countries, these upsells are becoming more effective. In 2022, as membership started to surge after a complete reopening, something interesting started to happen. New member uptake rates started increasing from around a third to 50%. And, because of this, the amount of premium members jumped from around 27% to 38% by the end of Q1 2023.

I’m not sure what to think of this besides the fact that there is just a lot of untapped demand for fitness. The increase in premium memberships is sure to drive margins and returns higher. And with an uptake rate of 50%, it won’t take very long for that 38% number to keep growing. We’ll see how this plays out by the end of 2023, but it’s definitely a trend worth watching, and could significantly increase the value of Basic-Fit.

Competition

Basic-Fit’s competition is limited, but still present. The largest competitors are Pure Gym and Clever Fit, as both are really the only budget-level operators of any size in Europe. Clever Fit is probably the most direct competitor, as it operates mainly in Germany – a market that Basic-Fit is just now trying to enter. They have opened over 500 clubs in Europe, with most in Germany, and have been operating under a franchise model since 2007. Given their reach in their native country, I think that expanding into Germany against Clever Fit will probably be Basic-Fit’s most difficult challenge yet.

Yes, it expanded its presence widely in France over just 7 years, but that was slightly different. There was not a real value-based competitor in the entire country (fitness club penetration was just 8%). There’s a decent sized chain – L’Orange Bleue – but it mainly operates as a mid-market/premium fitness club. Germany is more saturated (14% penetration previously, but now may be down to 11% according to Moos).

The largest competitor, Pure Gym, operates mainly in the UK, but has expanded some into continental Europe. Obviously, neither of these brands are the size of Basic-Fit, but they both have large presences in the two largest countries that Basic-Fit is trying to expand into. At the moment, I don’t think Basic-Fit has said anything about expanding into the UK, but I think it’s probably on their radar as they expand across Europe. It should also be noted that Pure Gym has a lower price point than Basic-Fit, which could really be a differentiating factor. It’s the second largest gym chain in Europe, and it’s offering customers roughly €12 a month membership.

While, like I said, Basic-Fit isn’t really facing any real competition from these two companies, it does worry me that they operate in the two largest countries opportunity-wise. Basic-Fit has previously expanded throughout countries that didn’t really have a native value-based fitness club. Germany, at the moment, may be different. In fact, we may be seeing signs of that as Basic-Fit seems to have been having problems matching its previous expectations for expansion into Germany (5 opened clubs at the end of 2022 compared to 20 expected at the beginning of the year).

Management

Basic-Fit’s management is impressive. Rene Moos pretty much founded the budget-based gym concept in Europe, and has seemingly grown the brand of Basic-Fit (evidenced by the huge uptake rates in premium memberships) as well as the idea of joining a casual fitness club.

First, the decision not to franchise was an impressive one. Many founders decide that franchising makes growth easier, and that it will drive margins higher while decreasing capex. And this is all true. But Moos and his team seem to defy that with everything they do. As their growth rate indicates, they’re (to me) more like a Tractor Supply Co. or Dollar General in the U.S. than a franchise business. They know how to grow club count and have figured out how to simultaneously centralize and decentralize club growth.

In addition to this, Basic-Fit may be the only large-scale gym concept that is still founder-led. While they did engage with private equity before the IPO (much like Planet Fitness and Pure Gym), Rene Moos has remained in charge and still retains over 14% of the company.

Source: Basic-Fit 2022 Annual Report.

In short, I don’t know what else you could really ask for in a management team. But I will note that in 2022, Basic-Fit acquired 3 clubs in the Netherlands from Rene Moos himself for a total consideration of €4.1 million. I don’t know what to think of this, but it is a pretty small overall piece of Basic-Fit’s spend on new clubs.

Going Forward

In Q1 2023, Basic-Fit has grown overall revenue by 51% YOY compared to Q1 2022. Members have grown 7.5% sequentially and 37% YOY to 3.6 million. Basic-Fit has increased its number of clubs by 68 in the first quarter alone, and they claim in their June 2023 Investor Presentation that they’d opened 85 net new clubs by April of 2023.

Speaking of new clubs, Basic-Fit expects to open 200 new clubs by the end of 2023, and open 200-300 a year going forward. This is a pretty ambitious goal, and I have no doubt that they can probably achieve their growth goals in the countries they are already established in (the Benelux, Spain, and France). But a lot of this growth going forward relies on growth in Germany (they expect to reach 600 clubs in Germany in the medium-to-long-term).

The 2023 estimates, mind you, don’t actually take much German expansion into account. As of April 2023, they had 5 clubs in Germany, and management has said that German clubs should make up about 10% of net new clubs opened in 2023. So, if they open 200 clubs in 2023, about 20 of them will be German.

Source: Basic-Fit June 2023 Investor Presentation

At the moment they have an additional 88 clubs under construction, which if opened in 2023, would bring the total to 173. And they have 167 contracts signed for new clubs and 152 contracts currently being negotiated. That would add an extra 319 clubs to the pipeline, bringing the total (including those under construction, under contract, and in negotiation) to 1,675 or so. There are also over 400 apparently being researched at the moment.

As far as Germany goes, management claims that 65 contracts for new clubs have been signed, so that is some significant progress over 2022.

In their press release, Basic-Fit claims that average monthly revenue per member increased to €22.63, compared to €21.51 in Q1 2022. These numbers are a little off from my own calculation of average revenue per member of €19.77 in FY 2022, but things may differ on a quarterly basis.

This number, overall, should be increasing though given the growing number of members that are opting for the premium packages. Basic-Fit said that in Q1 2023, 38% of its members are premium members and the uptake rate continues to be 50% for new members.

The Opportunity

The gym industry – strangely enough – is really a winner-take-most market. It’s a market where – much like ecommerce with Amazon – the infrastructure matters. The more locations you have, the more members you can have. And the faster you capture those members, the more you remain top-of-mind to them and everyone else they know in that area. This is one reason why Basic-Fit has employed the cluster model. They go into a city, and build multiple gyms very quickly. They become the leading value gym in that area, and everyone who didn’t go to a gym before ends up going to a Basic-Fit gym.

Really what Basic-Fit is hoping for from all this is (1) a leading share of the value-based gym market, and (2) an increasing penetration rate of gyms in Europe. At the moment, Basic-Fit believes that the countries it has already entered will allow it to grow its club footprint to 2,650-3,200 clubs total by 2030. To do this they expect to open 200-300 new clubs a year for the foreseeable future.

Source: Basic-Fit June 2023 Investor Presentation

Their largest sources of growth are expected to be the countries with the largest populations – France, Spain, and Germany. I’m not saying that this will be easy, but I think the growth outside of Germany will be much easier for Basic-Fit to accomplish than it seems. They’ve already established their leadership position in these countries, and I think it’s now just a matter of execution. Can they keep establishing new clubs in the countries their already in – it seems like it’s inevitable honestly.

Germany is the biggest question, and I addressed that somewhat in the Competition section. Without Germany’s expected contribution of 600, Basic-Fit’s total club estimate would be left at around 2,000 on the low end – growth of just 800 or so clubs from today’s number. But, problems in Germany aren’t a foregone conclusion, and Basic-Fit’s competitor is definitely not as focused as they are on opening new clubs. They’re a franchisor as well, which is usually a good thing, but in this case I think it really detracts from the focus that a company like Basic-Fit brings to the table.

In addition, Basic-Fit confirmed that, even with Clever Fitness operating in Germany, the average monthly gym membership price is still €42, compared to €35 for the rest of Europe. So, worrying about the competition may not even be worthwhile. We’re also talking about a country with what now appears to be 11% fitness club membership penetration, which leaves a lot of room for new member growth.

And this brings up another point about the opportunity here. In the U.S., Planet Fitness is at roughly 17 million members with a country-wide gym penetration rate of 21% or more. Most European countries aren’t even close to that, certainly not the ones that Basic-Fit is trying to enter and grow in. So, these numbers above don’t necessarily take into account a huge increase in gym penetration rates.

While Planet Fitness can boast a chart like the one below, it doesn’t really take into account all of the competition.

Source: Planet Fitness November 2022 Investor Day

It’s true that Planet Fitness dominates the value-based gym landscape in the U.S., and I hope that Basic-Fit can achieve a similar outcome. But the U.S. is also home to more fad-driven (though some are looking like they’re not fads) fitness clubs like Pure Barr, Orange Theory, F45, and even Cross Fit. Now, I know most of you will say that those are a little more hardcore than joining a Planet Fitness gym. But I think the point is that there’s a lot more competition for the non-traditional or new gym-goer in the U.S. than in Europe.

There are 1,500 Orange Theory locations, and most of these are in the U.S. (there are hardly any in Europe). Europe doesn’t have the same kind of presence with these non-traditional franchised models. So, in effect, Europe doesn’t have the same kind of constant competition with fitness fads that pop up and draw new customers away.

Also, I think Planet Fitness’s chart above may be a little misleading. For instance, Snap Fitness (which is definitely a direct competitor to Planet Fitness) has an estimated 545 locations, and isn’t even included on the graph. I think the competition is a little more stiff than Planet Fitness is making it out to be.

Overall, though, I think Planet Fitness has shown that the low-cost gym model is probably the most durable. Fitness fads come and go. Obviously Peleton is even a threat to Basic-Fit and Planet Fitness, but the low-cost gym model seems to be the most stable, and the biggest draw for the average person.

Risks

Planet Fitness Expands to Europe

There’s obviously a chance that Planet Fitness could decide to expand to Europe and take on Basic-Fit. In the Q4 2022 Earnings Call, an analyst asked Rene Moos about this, and he said that he hadn’t heard anything about any big plans to expand to Europe. But, it’s a risk that I think needs to be at least addressed.

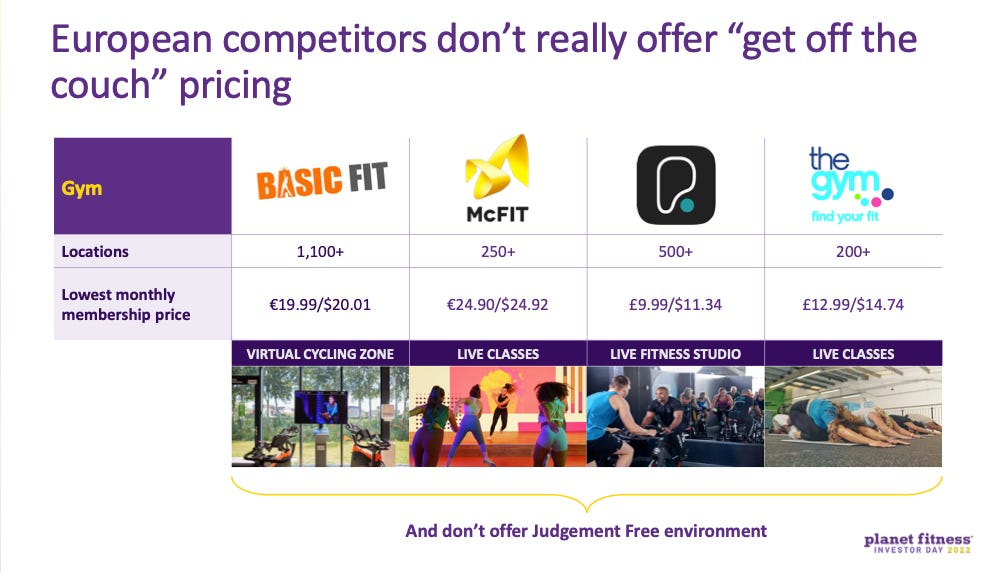

As you can see from the slide below, Planet Fitness is contemplating a potential move into Europe. So much so that it’s showing investors its pricing advantage compared to the European competitors.

Source: Planet Fitness November 2022 Investor Day

In Planet Fitness’s Q1 2023 Earnings Call, management said that Europe was interesting. They noted that there are already incumbents in Europe, but stated that they think they can be differentiated much like they are in the United States.

In the Q3 2022 Earnings Call, Planet Fitness’s management also briefly touched on international expansion, noting that there were already European incumbents in the low-cost gym industry and that they may need to acquire someone to enter the space.

Does this mean they will acquire Basic-Fit? It’s possible, but given Basic-Fit’s founder-led team, I doubt it will be them. Also, that would be a pretty large merger in and of itself. I think it’s more likely that Planet Fitness comes in and acquires someone like Pure Gym or Cleve Fitness (or maybe a smaller competitor).

This is actually a little more worrying than Planet Fitness just entering the market under its own brand. On the one hand, can they really grow a native brand that hasn’t been able to grow that fast so far, and that is second to Basic-Fit in brand recognition? It’s possible. But, Planet Fitness also has the experience growing a franchised gym brand, and maybe be able to disrupt Basic-Fit’s growth, even if they don’t become real competition.

Leverage

Basic-Fit has levered up to grow and survive in 2020-2022. It actually raised some equity during 2021 when it was experiencing club closures and wasn’t sure how much liquidity it would have, but honestly that doesn’t really worry me. I don’t think Basic-Fit will continue to dilute shareholders in any meaningful way – that was really just a one-time deal, and probably a smart decision to ensure Basic-Fit’s survival.

What I’m worried about is the leverage. At the moment, Basic-Fit has around €730 million in debt on its balance sheet. The borrowings break down as follows:

Convertible Bonds – €303.7 million issued in 2021 and that mature on June 17, 2028. They carry a low interest rate of 1.50% payable semi-annually. They are convertible into shares at €50.625 a share at the earlier of 7 days prior to the maturing date or any prior redemption date. The company can redeem all of the shares after July 8, 2025 if the average price of a share on the Euronext Amsertdam exceeds the redemption price by 130% for no less than 20 trading days in any period of 30 consecutive trading days.

Term Loan and Revolving Facility – a €250 million term loan and a €200 million revolving facility that expire in June 2025. The interest rate is variable and based on Euribor plus a margin that depends on certain leverage covenants. At the end of 2022, the rate was 4.4%, and it’s probably higher now. During 2022, Basic-Fit repaid the entire revolving facility, so it’s no longer outstanding.

Go-C Facility – €60 million issued in 2020 and guaranteed 80% by the Dutch state. It has a Euribor plus margin interest rate (which was 5.20% at the end of 2022). Basic-Fit repaid €20 million in 2022, so €40 million was left outstanding.

Schuldschein – Issued in 2019, only €18 million is left outstanding. €8 million has a fixed 1.55% interest rate, and the remainder has a Euribor plus margin variable rate. As of Dec. 31, 2022, the mixed rate was 3.45%.

Based on 2022’s Underlying EBITDA, they’re levered by about 3.6x. Interest expense was only about €19 million in 2022, so coverage is pretty good at the moment. The main thing I’m worried about is any potential covenant breaches if Basic-Fit has some kind of margin issues or cash flow issues related to their fast growth in the coming years. The convertible bonds also have the potential to dilute shareholders if they’re not repurchased.

New Weight Loss Drugs

This one is obviously a little out there. But I think there is a real existential threat to gyms everywhere with the new weight loss drugs like Ozempic and Wegovy. Obviously, not everyone is able to have access to these drugs at the moment, but I think it’s worth noting that the type of members that will join a Basic-Fit gym are probably the type of members that are mainly trying to lose weight.

Even if they’re using weight training as part of their fitness routine, I think the majority of average people (which is who Basic-Fit is after) will take the easier route if a shot or a pill will get them what they want. I’m not going to go into detail on this point, but just be aware of the potential threat in the long-term.

Valuation

Basic-Fit operates kind of like a retail store, except that pretty much all of their revenue comes from the membership fee. Their business model is built on gaining and maintaining an adequate number of members at each store they build. They don’t advertise that much, and grow mainly through word-of-mouth and their physical location presence. They’re basically at a point in their trajectory where if they build stores, the members typically show up.

To do this though, they spend a lot of time identifying the optimal placement of clubs, and don’t build unless they think that location can generate an ROIC of 30% at maturity. So, essentially Basic-Fit can create massive amounts of value by funneling cash into opening stores and keeping margins high (or growing them).

Their business model is relatively capex-heavy. But, in my mind, this is a competitive advantage that’s hard to beat. They need to get prime locations to attract members, and if they have those locations, no one else can really have them.

At this point in their growth cycle, it makes sense to funnel as much money as possible into gym openings, as long as they can maintain gym membership levels at maturity. So, if the return (as they calculate it) is comprised of underlying Club EBITDA-Maintenance Capex. Basic-Fit has said that average EBITDA per club is about €431,000 and Maintenance Capex is €55,000. Basic-Fit calculates its overall underlying Club EBITDA after subtracting rent expenses, so I am assuming for their average number here that rent expenses have already been subtracted. If that is the case, then the underlying FCF at each club is €431,000-€55,000 = €376,000. True to Basic-Fit’s word, the €376,000 in Underlying Club FCF represents a 31.3% ROIC on the average club construction cost of €1.2 million. It should be noted though that the 30% ROIC they’re targeting when opening new clubs is based on underlying EBITDA divided by the initial capex to open the gym. So, FCF may end up being below 30% going forward – it’s hard to know for sure.

There are a few different ways to estimate Basic-Fit’s potential return going forward. For one, you could use the FCF per club number listed above and just estimate what the total FCF would be if all of the current clubs were mature. We know that Basic-Fit expects to have 891 mature clubs in its system by the end of 2023. Throughout 2022, it had suspended its count of mature clubs over the last two years, so the 502 number it gives were mature clubs that were last opened in 2019, not any that were opened in 2020 or now 2021.

Right now, Basic-Fit trades at €33.38 a share, giving it a market cap of just over €2 billion. It has around €730 million in debt outstanding, so it has an EV of €2.7 billion. If Basic-Fit’s 891 mature clubs at the end 2023 are all even producing just €400,000 in Underlying Club-Level EBITDA, then Basic-Fit would be bringing in €356.4 million in Underlying Club EBITDA on a steady basis, even if it stopped growing forever. This would translate to about €307.4 million in Club FCF if you subtract €55,000 in maintenance capex on a club basis. But you also need to subtract overall corporate and administrative overhead, which was €112 million in 2022. I’m going to assume €120 million for this scenario because while Basic-Fit is larger, it would likely be able to stop incurring some of these costs if it slowed down growth. So, €307.4 million in FCF with 120 million in general overhead subtracted gives us €187.4 million in FCF. At today’s market cap, that’s a multiple of roughly 10.6x. That’s the multiple that you’re paying for an Underlying FCF if Basic-Fit stops growing and all 891 of those clubs achieve adequate numbers at maturity (about 3,350 in average memberships).

Now, let’s look at a future growth scenario. If Basic-Fit grows to its desired 3,200 clubs in 6-7 years or so, and those clubs are all bringing in an average of 400,000 in EBITDA (let’s assume some aren’t mature yet or aren’t operating at as high a rate as the mature clubs today), Basic-Fit would be generating about €1.28 billion in Underlying Club EBITDA. I don’t know exactly what the corporate overhead would be at this point, but considering it’s been about 30-35% of Underlying Club EBITDA in normal years, so that will leave us with about €850 million in Underlying EBITDA after overhead. If you slap a 12x multiple on that, you get an EV of €10.2 billion and a market cap of €9.5 billion assuming the same debt level of €730 million. That’s a potential return of 4.75x from today’s price. And that’s really assuming that Basic-Fit just has a market multiple.

If Basic-Fit can continue to generate those kinds of returns on capital invested per club, then there isn’t a better use of its cash. One way to think about Basic-Fit’s valuation is that you just assume it’s going to grow, then you figure out how it’s going to get the cash to get there. Now, obviously this growth isn’t guaranteed. But that’s what the several thousand words before now were about – they were about understanding Basic-Fit’s business and competitive position as well as its potential for growth. If you’re comfortable making a growth assumption (namely the one that Basic-Fit itself is predicting), then you just have to figure out how it will get there and what kind of margins it will generate when it does.

So, if you assume Basic-Fit reaches its goal of 3,200 clubs by 2030 and you assume that it still costs €1.2 million to open a new club, then the total amount of growth capex needed to reach this number is over €2.3 billion (1,932 additional clubs * €1.2 million per club). That kind of club growth comes out to about 276 new clubs a year. This would imply that Basic-Fit would have to spend (on a growth-only basis) about €331.2 million a year in growth capex. At the moment, it doesn’t have enough FCF left over to handle that kind of expansion totally from its own operations, so it will have to take on debt at least in the near-term. €124 million or so of FCF will cover just under half of these expenses, and I think funneling all of FCF into club growth is the best use of cash for Basic-Fit. FCF will obviously grow as more clubs mature in the future.

But if you just simplify it and say that Basic-Fit will have to take on debt to cover half of this growth capex expense, that’s only ~€600 million in additional debt over 7 years. Even if Basic-Fit is paying interest rates of 6% on this debt, that only adds about 36 million in additional interest expense. So, if Basic-Fit has 3,200 clubs and €674 million in FCF (€850 million Underlying EBITDA-€176 million in maintenance capex), you can go ahead and subtract another anticipated €55 million in interest expense from that number. Then you’ll have €619 million in annual FCF. If you throw a 15x multiple on that, you’ll get about €9.3 billion in market cap. Put a 20x P/FCF multiple on it, and you have a company worth €12.3 billion. I think the trade-off of the €55 million in interest expense is worth that growth.

This is all obviously a hypothetical scenario, and I have no real idea about what will actually happen. No one does, not even Rene Moos and team. But if you have an understanding of the business, and can make some reasonable estimates of the future return, then you can be comfortable buying the company. Yes, you have to understand the downside risks – and there are definitely risks. But I think the potential gains vastly outweigh the downside.

Conclusion

Overall, Basic-Fit is the leading European budget fitness club, and it’s growing faster than everyone else. If the market dynamics are anything like the U.S., then Basic-Fit is on track to the be Planet Fitness of Europe. Add to this the fact that the fitness club membership penetration rates are much lower and Europe, and you have a very large opportunity for Basic-Fit.

Basic-Fit does have risks, but what gives me comfort is its management team. They have executed over the years, and have surprisingly shown that a corporate-owned approach can actually outperform franchisers. The founder owns over 14% of the company, and he appears to be dedicated to making Basic-Fit the leading budget fitness club in Europe.

Given its growth, the company is relatively cheap on a current cash flow basis as well as when compared to potential future growth. It’s building out a fitness club infrastructure across Europe that will be hard to replicate, and is making its clubs more efficient on an operating basis every day.

This Publication is for informational purposes only, and nothing we say should be taken an investing advice. Past performance is not predictive of future returns. If you are considering a purchase of securities, please consult a licensed financial advisor. This is not a solicitation or an offer to buy any of the securities mentioned. This is not advice to buy, sell, or hold any of the securities mentioned. The author of this Publication may have positions in the securities mentioned or may initiate a position in the securities mentioned in the near future.