I-Tech AB

This report was originally published in October of 2023

You can download a PDF version here:

I-Tech AB (STO: ITECH) is kind-of the ideal microcap stock I’m looking for. It’s a company that is growing fast (over 80% revenue growth this year), has great economics, has developed an innovative product that could become a market leader, has very little direct competition, and has strong barriers to entry. In short, I-Tech AB is an impressive company with a long runway for growth ahead of it and requires very little to no capital to grow.

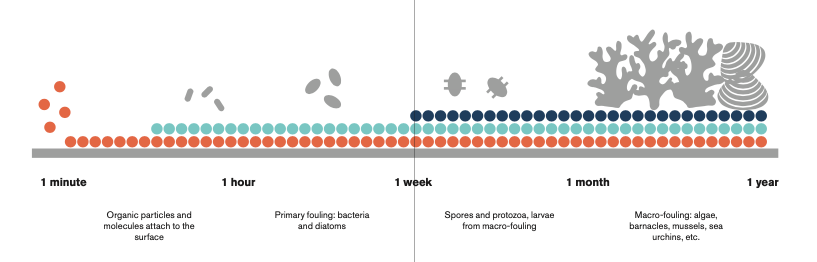

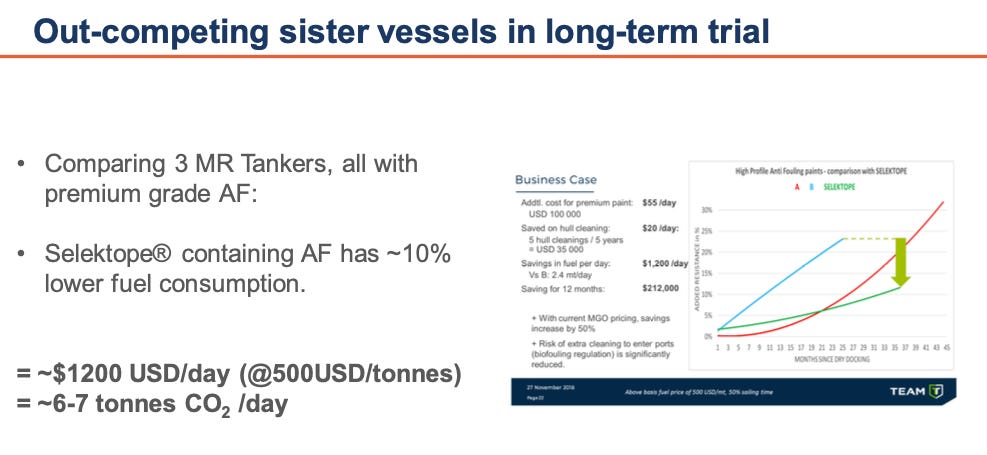

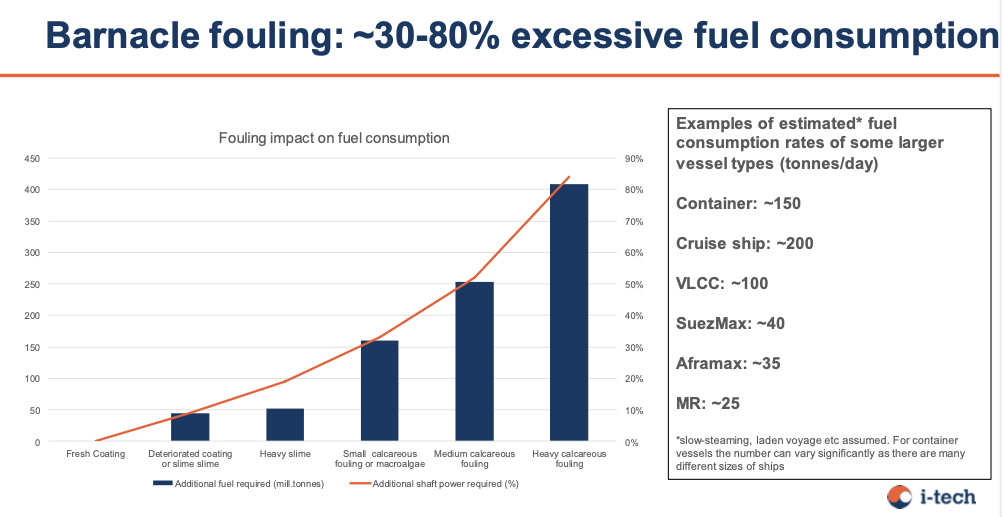

Much like VieMed Healthcare, I-Tech got my attention because it has developed an interesting (potentially market-leading) product and has regulatory barriers to entry. It is a Swedish company, and it is the creator and owner of the antifouling marine coating ingredient: Selektope. Fouling, in maritime talk, basically occurs when some type of sea creature implants itself on a ship’s hull and makes that its permanent home. There is soft fouling (weeds, worms, slime, etc.) and hard fouling (mainly barnacles and mollusks). Hard fouling is a pretty major issue for certain types of vessels in global maritime trade because the build-up of barnacles on a ship’s hull creates a drag in the water when the ship is transporting goods. This means that the ship has to expend more energy and fuel to maintain the same speed it would have if there was no fouling. Essentially, a ship’s hull is made to be hydrodynamic with the ocean water, and fouling prevents that.

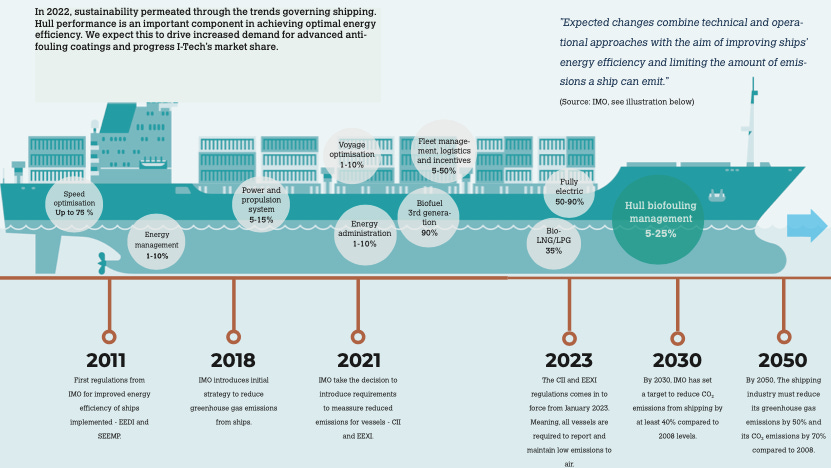

This may not seem like that much of an issue, but in many instances hard fouling on just 10% of a ship’s hull can require the same ship to expend 36% more power to maintain a speed it would have if no fouling were present. Combine this with the fact that the IMO standards are requiring shipping companies and ship owners to decrease emissions by 40% by 2030 and 70% by 2050 and you have a major issue with fouling. An issue that has traditionally been solved by including some kind of biocide (i.e., barnacle preventative that typically kills larva or biofouling organisms) in the coating on the ship’s hull.

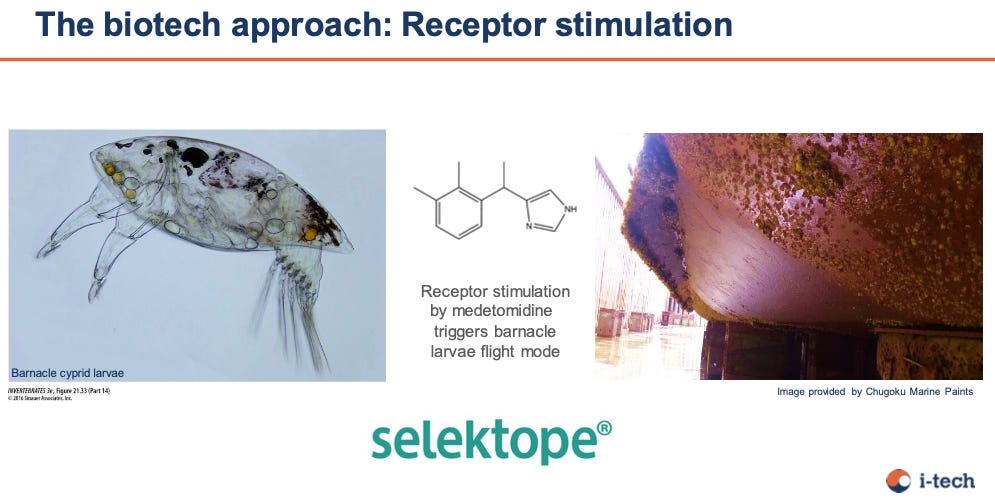

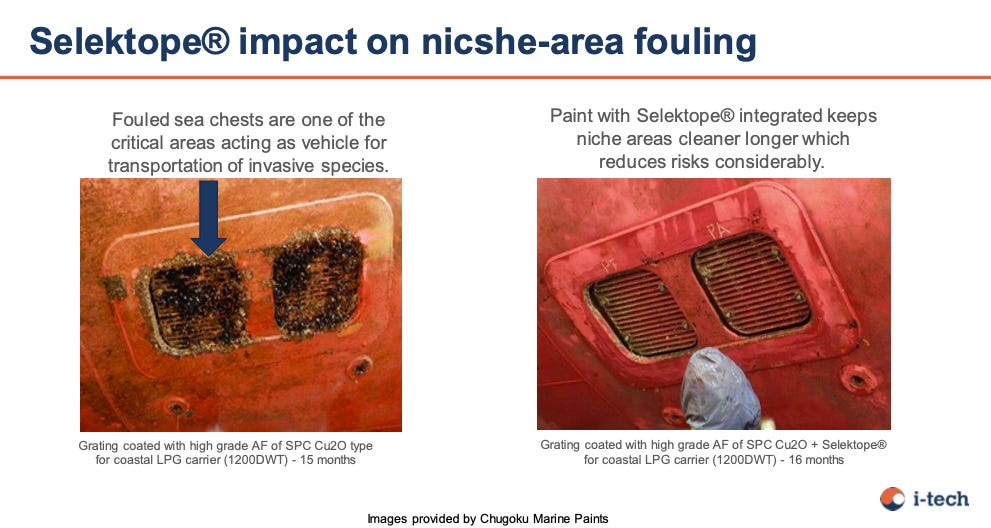

Selektope is essentially I-Tech’s only product. Developed over the last 20 years or so, Selektope is a biological compound that primarily works by using the synthetic drug medetomidine to stimulate a barnacle larva’s swimming legs as it approaches the ship’s hull. It has a temporary receptor-stimulating effect that causes hyperactivity in the larva and prevents it from settling on the hull, but wears off once the larva is out of the vicinity of the Selektope.

To some extent, I-Tech operates kind-of like Coca-Cola. It owns the IP to, but outsources the manufacturing of, its Selektop product that it then sells to paint manufacturers in concentrated amounts. This ingredient is used by the paint manufacturers (in very small doses and in a variety of formulations) to create the antifouling marine paint coatings they sell to ship yards and owners.

Because of its unique nature – and because I-Tech is only one of two companies that offers non-metals based antifouling paint ingredients – the product is high margin. Like a drug (this is a biological compound we’re talking about), I-Tech spent years developing Selektope, passing regulatory scrutiny, and determining how to best manufacture and formulate it to ensure long-lasting performance on a ship’s hull.

Much like Coke, I-Tech sells its product to a heavily concentrated group of customers (Coke sells its syrup to bottlers) – the paint manufacturers. The six largest paint manufacturers control over 80% of the world-wide marine coatings market. The major end-market consists of over 100,000 total cargo ships around the world (that number is increasing every year), and potentially millions of leisure boats as well (though that’s more of a long shot).

I-Tech is in an interesting position right now. It’s having some regulatory push-back in the EU (which we will discuss below), but it’s also growing faster than ever and is further entrenching its position with some of the largest paint manufacturers in the world.

The company trades in and reports in Swedish Kroner (SEK). It has a market cap of ~SEK 507 million. In USD though, it trades for around $46 million. It’s an extremely small microcap company with ambitions to serve a pretty large market. It’s trading at 10-15x of 2023’s estimated FCF and is seeing some serious operating leverage as it grows. Overall, I think – though I’m no expert on antifouling products/technologies – I-Tech appears to be a great bet.

History

I-Tech AB doesn’t really have a long operating history because it spent the majority of its early years developing and trying to obtain regulatory approval of its Selektope product. In that sense, it’s kind-of like a pharmaceutical company, spending years in R&D trying to develop and receive approval of a product. Unlike most pharmaceuticals though, the entire commercial shipping fleet (and even the leisure fleet) is I-Tech’s market. And further, international regulations are basically forcing cargo ships to use Selektope.

I-Tech’s story starts in the year 2000. For most of the 20th century, the cargo ship industry dealt with fouling by using organotin (TBT) as an antifouling ingredient in marine paint. By the 60s, TBTs were the most popular antifouling paint in the world. But they worked by essentially poisoning the organisms that would attach to a ship’s hull. This had the added effect of poisoning unintended marine life as the TBTs leached into the marine ecosystem.

Early bans of TBT use on leisure vessels was already taking place by the 70s, and by the 1990s, the commercial shipping industry and environmental protection agencies had decided that something should be done. Under growing pressure, the International Maritime Organization (IMO) initiated a phase-out of TBTs in 2002.

During the 1990s, biologists at the University of Gothenburg in Sweden had been researching alternative antifouling agents, and figured out the medetomidine (commonly used as sedative in animals) had the opposite effect on fouling species like barnacle larva. It stimulated the larva, causing them to become hyperactive. And it was characterized by its reversible effect, wearing off shortly and having no long-lasting effects.

By 2000, some of these biologists spun out I-Tech AB as a separate company and continued to research and develop Selektope. From what I can tell, they didn’t quite figure everything out until 2003, but at that time the winds of the commercial shipping industry had shifted. Because of increasing global trade, a lot of the focus was on soft fouling (slime, weed, etc.) prevention, while hard fouling was considered a thing of the past in most of the industry’s eyes.

But over the ensuing decade, things started to change. With more ships on the water in general, ports and routes were more congested, leading to longer idle time (which is a big proponent in fouling development). In addition, many more ships were sailing through warmer waters that allow for much faster biofouling development.

Over the ensuing years, I-Tech received seed funding from the likes of Volvo as well as MISTRA, the Foundation for Environmental Strategic Research, the Swedish Energy Agency, and the EU Eco-Innovation Project. Still, after Selektope was initially approved as a product in 2006, it underwent several more years of regulatory scrutiny and tests by potential customers. By 2014, Selektope was officially in use by its first (and still largest) customer – Chugoku Marine Paints (CMP).

By 2015, CMP launched the first antifouling coating product with Selektope in it, and it was applied to the first ship – the Team Calypso (which by 2020, after five years, was found to be completely barnacle free).

Selektope continued to receive interest and be tested and even applied in products by other large paint manufacturers like Hempel. But CMP was really the only manufacturer moving forward in a meaningful way at this time. I-Tech did have some wins though, with Maersk choosing Selektope as the antifouling agent for newbuild ship projects in South Korea in 2015.

Starting in 2014, I-Tech brought in SEK 1.5 million in Selektope sales. This grew to SEK 28.9 million by the time they were listed on the Nasdaq First North Growth Market in Sweden in 2018. By 2018, I-Tech had entered into a long-term supply agreement with CMP, and started adding other customers over the next few years. Since then, even with some hiccups during the COVID lockdowns and associated supply-chain issues, I-Tech’s revenue has grown to over SEK 86 million.

The Business

Operations

Some businesses are still early on in their journey, but you can just tell that they’re poised to outperform. They don’t have the absolute best numbers out there, but they have the structure to achieve some amazing results. I-Tech is one of those businesses.

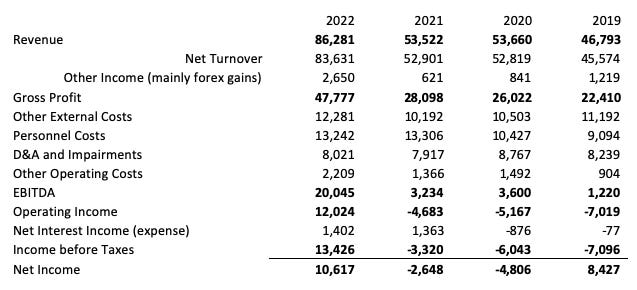

First, and most obviously, it’s growing its top line very fast. Net Turnover (which is essentially revenue minus forex gains) has grown by 55x since 2014. In most years, revenue has grown extremely fast, but there have been occasional setbacks. Revenue growth slowed to a crawl in 2017, and the top-line actually slightly decreased in 2021, primarily as a result of pandemic supply chain issues and visibility into purchasing. In 2022, I-Tech grew its revenue by an impressive 61.2%. And growth in the first half of 2023 has been even more impressive, coming in at over 80%.

Over its lifetime, I-Tech’s margins have been increasing at a pretty rapid rate. In 2017 – the year before it went public – I-Tech’s gross margin was 35.9%, and it was losing money (over SEK 6 million). For a company that was only bringing in SEK 18.9 million, this is understandable. Its operating costs easily exceeded that number. But over the ensuing five years, its gross margin rose to an impressive 52.5% in 2021 and 55.2% in 2022.

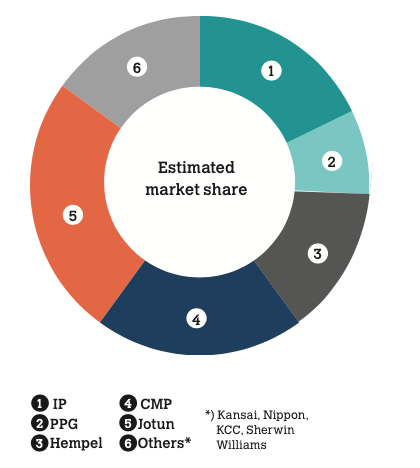

I-Tech’s fluctuations in revenue growth (and also extremely fast revenue growth in some years) are primarily a result of the market that I-Tech operates in. The marine coatings industry is very concentrated. The 6 largest companies control over 80% of the market, and with the next three largest after them (who are significantly smaller), the top 9 pretty much control the entire market.

Source: I-Tech AB 2022 Annual Report

The largest companies are:

1) Jotun (the largest) – based in Norway

2) Chugoku Marine Paints (CMP – the second largest) – based in Japan

3) IP – subsidiary of a Dutch company

4) Hempel – based in Denmark

5) PPG – based in the U.S.

6) Others

a) Kansai Paints – based in Japan

b) Sherwin Williams – based in the U.S.

c) Nippon Paint – based in Japan

d) KCC – based in South Korea

I-Tech operates in this market by supplying the Selektope ingredient for antifouling to the paint manufacturers and working with them to determine the best formulations for certain products. The paint manufacturers then sell the paint to the end markets for the products – which are primarily shipyards (over 90% are in Asia – South Korea, China, and Japan) or the ship owners and operators themselves.

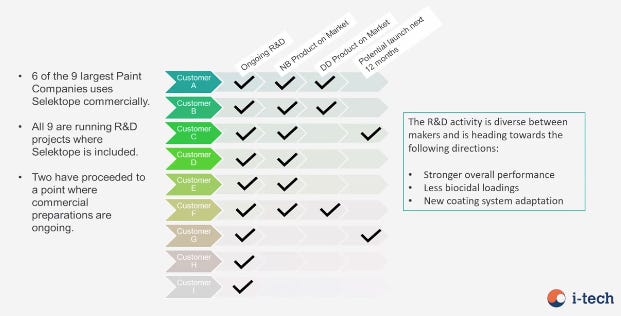

As of Q2 2023, I-Tech is working with all 9 of the largest paint manufactures in the world, but with many of them it is still just at the R&D level.

Source: I-Tech AB Q2 2023 Earnings Call Presentation

I-Tech has paint products for ship newbuilds on the market (with Selektope in them) with the 6 largest marine paint companies, and has dry docking products (a much larger overall market) with 3 of them. It also has plans to launch another product with two of the existing customers over the next 12 months.

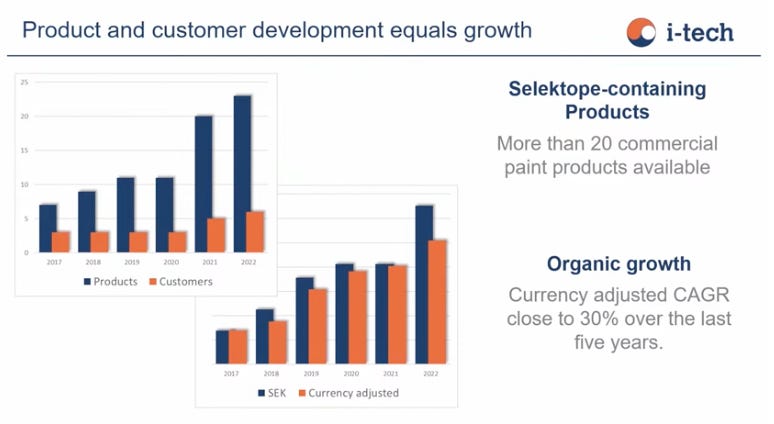

Part of I-Tech’s growth is determined by how many paint manufacturers it counts as customers. But, more than that, its growth is fueled by how many products the manufacturers are using Selektope in and how much they’re selling to ship yards and owners. Since 2017, the number of products with Selektope as an ingredient have increased from just over 5 to over 20.

Source: I-Tech AB Q4 2022 Investor Presentation

It’s no secret that, out of these large paint manufacturers, Chugoku Marine Paints (CMP) is by far I-Tech’s largest customer. They appear to be the second largest marine paint manufacturer in the world, and they were I-Tech’s first major customer. I-Tech has launched multiple products with CMP, and as of Q2 2023, CMP still made up over 68% of total revenue. This number fluctuates quarter-by-quarter depending on order volume – CMP made up 80-85% of total revenue in Q1 2023 – but I-Tech has been slowly expanding its total customer base.

Source: I-Tech AB Investor Presentation

The second largest customer (who remains unnamed but is certainly one of the top 9) made up 29% of I-Tech’s revenue in Q2 2023. I won’t lie, this is pretty extreme customer concentration, with 97% of revenue in Q2 2023 coming from just two customers. But there’s some promise on the customer breadth side of things. In 2022, roughly 25% of overall revenue growth was from customers outside of the top two.

All of this concentration is the nature of the industry though. And it shapes how I-Tech operates. There are thousands of potential end-users of Selektope, but the top paint manufacturers basically act as distributors for I-Tech. In my view, this has a few impacts on the business.

First, the marine paint companies may have more bargaining power than a bunch of smaller ship owners, but they are great for fast and lower-cost distribution. This is perfect for I-Tech’s business model because they are the sole owner of Selektope – really the only kind of antifouling paint of its kind on the market. I-Tech has bargaining power itself, as evidenced by its gross margins.

On the distribution and growth side, the concentration is a good thing. If I-Tech, for example, had to sell directly to the shipowners or ship yards, it would likely have to do a lot more marketing. Expenses would be higher, and it would have to acquire every individual customer – which could take a lot longer. As things currently stand, I-Tech works with the paint manufacturers to determine the best formulations, launches the products with them, and sells the Selektope to them. The paint manufacturers themselves actually market the product to the ship yards and ship owners. I-Tech doesn’t have to shoulder that burden.

Source: I-Tech AB Investor Presentation

I-Tech’s business is actually extremely capital light, and is set up to run with very low costs and capital requirements. The company outsources all of its manufacturing to third-party subcontractors. It also works with a supplier to choose the raw material used in the manufacturing (a manufacturing method that I-Tech created), but surprisingly enough I-Tech never has to end up holding large amounts of inventory or making capital outlays for raw materials.

Source: I-Tech Investor Presentation

The Selektope product itself is merely an ingredient in marine coatings, and given the nature of the Selektope product, it can be very effective in very low quantities. So, I-Tech may sell an extremely small amount of Selektope to a paint manufacturer, but the paint manufacturer may use it in a large amount of paint.

Like I said with the Coca-Cola analogy above, I-Tech is capturing the best part of the value chain here. Its product is becoming the essential ingredient to prevent fouling. Even in small quantities, it’s very valuable to the paint manufacturers and the ship owners. I-Tech handles the finished product logistics and inventory, but those are very small quantities compared to the amount of paint the manufacturers have to create and sell with Selektope in it.

You can imagine that I-Tech’s logistics operations may be like a specialty drug manufacturer’s. They handle and transport very small quantities of very expensive and effective ingredients. In fact, I-Tech even uses manufacturers who specialize in pharmaceutical and biotech manufacturing.

What this all means is that I-Tech can operate with very little overhead. This is evidenced by their operating leverage, which is very, very high. Yes, their gross margin has increased, but their EBITDA grew from SEK 1.2 million to SEK 20.4 million between 2019 and 2022. And you can see how EBITDA stayed roughly the same between 2020 and 2021 when revenue hardly grew, and how it exploded higher in 2022 when revenue grew very quickly – operating leverage.

Source: I-Tech AB Income Statements

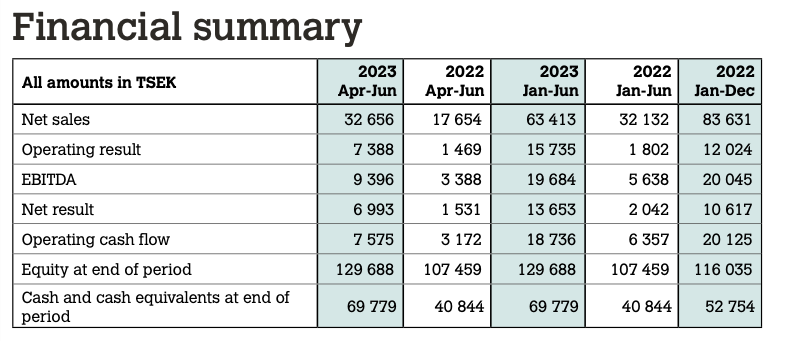

And if you want any other evidence of how much leverage I-Tech is operating with, just look at the first half results for 2023.

Source: I-Tech AB Q2 2023 Interim Report

Net income was higher for the first six months of 2023 than the full year 2022. And EBITDA and Operating cash flow were almost as high. Margins are exploding higher with growth, and, as I mentioned above, this is primarily the result of I-Tech’s low overhead.

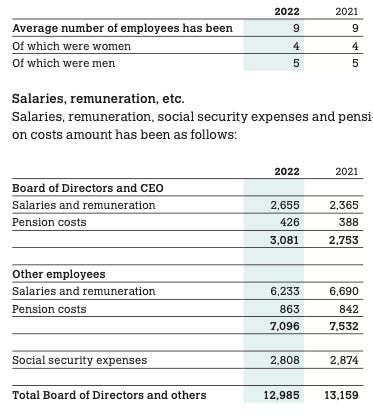

I-Tech only has 12 total employees, and I believe only 9 of these are full-time. Their main expenses are obviously the COGS (roughly 45% of revenue), what they call “Other External Costs” (14.2% of revenue), and Personnel Costs (15.3% of revenue). Other External Costs have fallen from 41.7% of total revenue in 2017 to 14.3% today. And Personnel Costs have fallen from 24.6% of revenue to 15.3% over the same period.

Personnel costs are pretty obvious – the costs of the few employees the company does have. Other External Costs are a little harder to define. The company doesn’t appear to break them down in their annual reports, but given the CEO’s past comments, I can be fairly confident that Other External Costs consist of: (1) R&D costs (internal and with customers to create new formulations); (2) Regulatory costs (paying for scientific studies, regulatory fees, and lawyers associated with regulatory compliance); and (3) logistics/storage costs associated with the final Selektope product.

I-Tech’s balance sheet is also essentially free of physical assets. As of Q2 2023, it has over SEK 69 million in cash on hand – a number that has grown from around SEK 40 million (raised by the IPO in 2018) because of the cash flow I-Tech has been able to generate over the last couple of years.

Outside of cash, I-Tech’s assets are primarily made up of receivables (SEK 21.97 million in Q2 2023), intangible assets (SEK 33.87 million as of Q2 2023 – which are primarily made up of patents related to Selektope), and deferred tax assets (SEK 11.1 million as of Q2 2023 – a number that has been shrinking since I-Tech started turning a profit).

Although in its earlier years, I-Tech operated with debt that was equal to about 25% of its total assets, it has since been able to significantly reduce this number, funding its operations with cash flow throughout the year. As year-end 2022, total debt was just over SEK 2 million.

Despite the fact that I-Tech is regularly deducting over SEK 8 million in D&A/Impairment costs on its income statement, its actually incurring less than SEK 1 million in capex. The company doesn’t really need to make any kind of investments into anything. Remember manufacturing is outsourced, and R&D seems pretty relaxed on the capital requirement front. Really, a large chunk of its assets are just made up of the value of the Selektope patents that I-Tech has created over the last 20 years. These have a value that’s represented on the balance sheet, regardless of whether I-Tech has to continuously amortize these intangibles. It doesn’t have to continuously reinvest in them for them to have value to the business.

Which also brings me to I-Tech’s returns on its invested capital. ROE and ROIC (on a FCF basis) don’t look that great right now (around 16% or so), but in my opinion this is just the beginning. I-Tech’s steadily decreasing intangible assets present a false impression when it comes to invested capital and returns on it. Yes, they are real assets that are very valuable to I-Tech, but there is no required reinvestment to keep them up (besides the R&D expenses on the income statement). Further, the ~16% return I-Tech is currently generating is not representative of future results – when the operating leverage (which we’re already seeing in the first half of 2023) starts to kick in. And this is really where a lot of massive returns come from in the stock market isn’t it? A company whose returns on its capital are rapidly rising at the same time that its experiencing rapid growth.

The Product

The Selektope product was created because there was a need – what appears to be a long-term need – for antifouling paints that don’t include any kind (or at least high concentrations of) biocides. The International Maritime Organization decided in the early 2000s that the primary antifouling paint ingredient needed to be phased out.

At the same time, global trade started to explode, and more ships started moving through warmer waters. Copper-based biocides came into favor and are still in wide use today, but are increasingly coming into question over harm to marine life and the marine ecosystem.

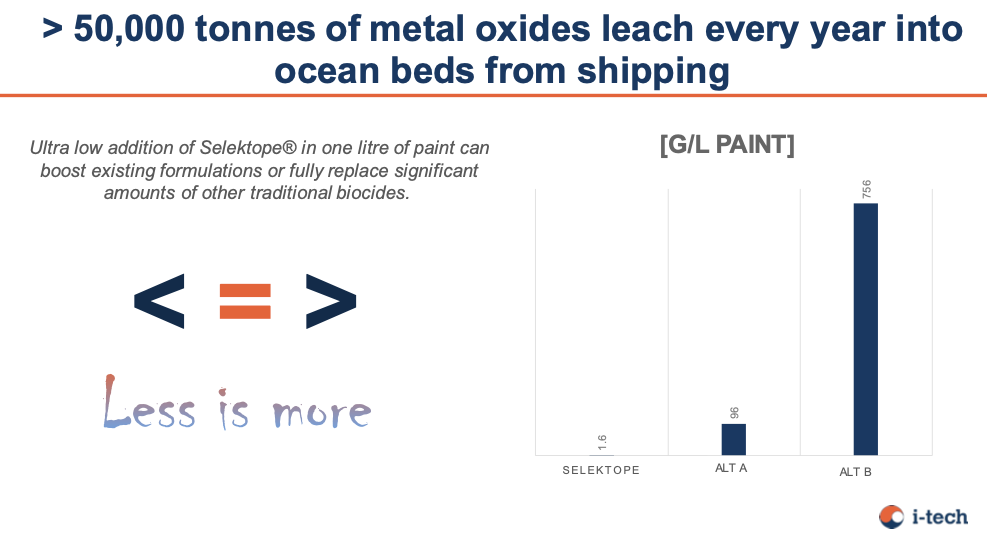

Selektope, on the other hand, is a very low concentration ingredient that works by temporarily stimulating the barnacle larva into hyperactivity to prevent any form of fouling. Selektop is not made to leach much into the marine environment – it is long lasting, and doesn’t intentionally peel like silicon based antifouling products.

Source: I-Tech AB Investor Presentation

Unlike some silicon-based or other non-toxic coatings, I-Tech’s Selektope is still considered a biocide because it has an external effect (though it’s much more effective than other non-toxic “attachment” coatings) on the organisms that are trying to attach to the hull.

But it does a good job of solving some of the major issues inherent with other antifouling paints. First – despite the new classification by the ECHA – I-Tech still maintains that Selektope doesn’t harm any marine organisms. Second, because it can be applied in such low quantities, Selektope has a very low biocide concentration, and doesn’t really pose a leaching problem.

Selektope binds to pigments in the paint it is mixed into, so it doesn’t require a high concentration but spreads evenly across a surface. It’s also biodegradable, meaning it won’t permanently impact a marine environment without breaking down like some copper-based products.

Source: I-Tech AB 2022 Annual Report

Usually, after manufacture, Selektope is delivered to the paint manufacturers in powder form and is directly introduced to a paint batch during production. Because of its very low concentration, I-Tech claims that, depending on the formulation, Selektope can reduce the amount of biocides released from paint by 90% while still maintaining performance. Compared to typical copper-based antifouling paint, there is much less leaching in terms of biocides – and remember the Selektope biocide isn’t even harmful to the organisms that come into contact with it. A typical liter of paint only requires 2 grams of Selektope for barnacle prevention, compared to 500-700 grams of copper oxide per liter.

Source I-Tech AB Investor Presentation

Overall, the global paint market is moving towards lower biocide concentration, even as 95% of paints on the market contain biocides. Selektope is a biocide itself (though it’s not toxic to marine life or larva), but as mentioned above, its concentration is extremely low. In self-polishing paints (not attachment-based gel coatings), Selektope is one of the main ways to decrease biocide concentration (by 90% or more) while performance remains the same.

Source: I-Tech AB Investor Presentation

I-Tech and another third party also recently conducted a study involving 249 cargo ships and found that 44% of them had 10% of their hull covered by fouling during transit. As I stated above, fouling on just 10% of the hull can lead to 36% more fuel use to maintain speeds. It also spreads alien species that may be invasive to some areas – something more governments and environmental agencies are trying to avoid.

Source: I-Tech AB Investor Presentation

Source: I-Tech AB Investor Presentation

Competition

I-Tech is pretty unique among competitors in that it’s the only antifouling marine coating that actively affects the biological organisms that attach to a ship’s hull without killing them. The most common forms of antifouling paint today are biocides that are typically copper-based (more than 95% of paints on the market). Biocides act just like the name sounds – they kill the organisms that would attach to the hull. Many claim to be able to leach into the environment at such a slow pace that they don’t really have an impact, but multiple environmental agencies and governments are finding problems with copper-based biocides.

Other relatively popular options include attachment-focused antifouling paint. Typically made with silicon, these types of coatings basically make the surface so slippery that larva for barnacles and other organisms can’t effectively attach. And even if they do, the coating periodically comes off, carrying the fouling organisms with it.

This stuff is all relatively effective, but with the move away from biocides, many governments and ship owners are looking for an alternative. I-Tech only has one other non-metals based competitor in the antifouling market, but the company doesn’t specifically name the competitor. But it makes clear that it has only 1 of 2 non-metals based antifouling ingredients that have been approved in both Europe and other regions around the world.

Regardless, it’s clear to me that I-Tech actually has multiple competitors – even if it claims that it doesn’t have any. Yes, I-Tech works with everyone in the industry and tries to develop formulations that will work best for customers – even with competitors. But it just doesn’t make sense to say that all of the silicon-based and copper-based antifouling paints are I-Tech’s competition. They are.

The good news is that, as I-Tech has explained multiple times, just because these products are used, doesn’t mean that I-Tech won’t be used. Self-polishing paint with copper oxides to prevent fouling may have to be reduced substantially if shipowners want to meet new proposed regulatory requirements regarding biocide concentration (in South Korea, for instance). So, Selektope can help with that. In addition, many attachment-based gel coatings are also including Selektope in their formulations just in case they need it if the coatings wear off. Selektope is long-lasting and it doesn’t pose any real toxicity threat, making it a good choice for customers who want to avoid metals-based biocides but still want an effective, and long-lasting antifouling product.

What I-Tech is really free of is direct competition. If the industry decides to go with I-Tech’s demonstrated method of antifouling ingredients, then it’s is going to make a lot of money. But, if its method of antifouling is rejected in favor of some other method, then I-Tech could be worth very little or nothing. Its standard has to be adopted by the industry.

But this also isn’t saying anything about new developments. At the moment, I-Tech has identified certain antifouling or cleaning procedures that hope to replace biocide-based antifouling paint, but none of them have achieved widespread adoption.

One is the potential application of hull cleaning robots. These are already in use, but to me just seem like they don’t address the overall problem very well. If every kind of antifouling paint is outlawed in the future, I could see these robots being used by every shipyard in the world. But not today. First, a vessel owner has to wait until the boat is in a port (though not dry docked as many of the robots can clean underwater). The robots cannot clean the hull while the boat travels. This means that the cleaning must take place every time the boat stops, which is a cost of $15,000-$45,000 per clean. One application of Selektope can last 5 years or longer. Another problem with the robot solution is that there is a much higher likelihood of hull damage. A machine can malfunction and puncture a hull. Plus, there’s just a lot more potential for damage when a robot is constantly cleaning off hard fouling.

There are other more out-there technology proposals like UV rays that prevent fouling growth on vessel hulls. I really don’t know how to analyze these, as it’s hard to take them super seriously at the time without some kind of in-depth knowledge of the technologies or any kind of adoption by the shipping industry. I’ll just say that there’s always the potential for new technologies to come in and make Selektope obsolete. Not as much from the antifouling paint ingredient side of things – as regulatory approval will probably slow any kind of new entrants down to a crawl. But as far as things like robots or UV lights go, there’s always a possibility.

Finally, I think it should be noted in this section that I-Tech has one patent that apparently expired in 2021 and another that will expire in 2030. I don’t know the full extent of their patent protections, but when the CEO was asked about this on the Q4 2022 Earnings Call he didn’t seem too concerned. Obviously, given that Selektope is just composed of one moleclule that everyone knows about, it seems like it wouldn’t be hard to copy. But the CEO claims that anyone trying to develop a competing antifouling ingredient would have to go through years of regulatory approvale and building customer relationships. I-Tech went through ~20 with Selektope, but there’s probably some reasonable assurance that it wouldn’t take a competitor that long if Selektope has received all the prior approvals as the first novel use of medetomidine on ship hulls.

But, if I-Tech does have to 2030, then it has a while to get a pretty big lead. It already has a relationship with every major paint manufacturer, and it is being used in multiple places around the world. Also, any potential competitor would have to figure out how to effectively manufacture the product to effectively compete with I-Tech, even after I-Tech’s 25-30-year head start. This would be very difficult to do. Finally, because the industry is so concentrated, who’s to say that any paint manufacturing customer would want to take a risk on a new generic product when they have been buying the original from I-Tech for so long. They don’t want to go through all the risks and formulation know-how (there’s a lot of that – I-Tech and the manufacturers working together to determine the best formulations) all over again.

Management

There’s not a ton of background out there on the management team, but I will say that all of them have pretty much been around for a while. The CEO – Philip Chaabane – has been with the company since 2014, the first year it really became an operating business instead of just an R&D concern. Prior to that he worked at PowerCell Sweden AB (a battery company), where he was responsible for business development. He also held positions at Volvo Aerospace. The CFO and Head of Operations – Magnus Henell – has been with the company since 2017, the year before it went public. He has leadership experience at several smaller enterprises and was also the CEO of PowerCell Sweden AB. He has also held positions at Volvo prior to that. So, it looks like the CEO and the CFO/Head of Operations have a history of working together.

The Head of Regulatory Affairs – Cecelia Ohlauson – has been in that position since 2013 and has been working on regulatory issues with I-Tech since 2008. At other companies, this regulatory-focused position may not seem as important, but at I-Tech it is essential. It gives me comfort that she has been with the company for this long and has been leading the regulatory efforts since 2013. This likely means she knows the company, the product, the regulatory procedures, and the history of the product’s regulation very well. She probably also knows a lot of the regulatory personnel in Sweden and the EU (as well as Asia) – which, in my estimation, would be one of the most important factors in I-Tech’s continued success.

The head of R&D came relatively recently – in 2019 – but he did come from a customer (Hempel), which probably gives him significant knowledge around what paint manufacturers want and how to best formulate Selektope with their products.

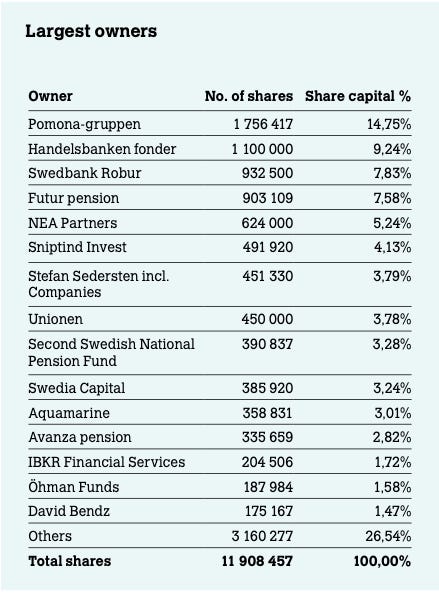

I really don’t know how many shares – if any – management holds. The largest owners, as of Q2 2023, are listed below, and management isn’t anywhere on the list that I can tell (though they could be in “others”).

Source: I-Tech AB Q2 2023 Interim Report

In 2022, the CEO’s salary looks like it made up around 3.5% of revenue (though this number does include board compensation, so his is likely lower). The total staff salary – which is probably the other members of the management team (CFO/Head of Operations, Head of Regulatory Affairs, Head of R&D, and Head of Sales) – made up 8.2% of total revenue.

Source: I-Tech AB 2022 Annual Report

To me, these numbers are kind-of high on a percentage of revenue basis, but keep in mind that I-Tech is still a very small company, and it’s growing very fast. Also, keep in mind that total compensation actually decreased from 2021 to 2022.

As far as share-based compensation goes, the company hasn’t been seriously diluting shareholders as far as I can tell. The company typically approves warrants for management each year (long-term incentives, it calls them), that usually result in dilution of less than 1% when exercised. Below is a brief history of the incentive program:

· In 2023, the program amounted to 89,331 shares maximum (in the form of warrants on a one-to-one conversion basis). Because the share price dropped so much though (after the regulatory announcement), there were no subscriptions.

· In 2022, the program amounted to 89,320 shares, which were fully subscribed and may result in 0.8% dilution. The exercise price is SEK 46.01 per share.

· In 2021, the program amounted to 83,348 shares, which may lead to 0.7% dilution. The exercise price is SEK 96.59 per share.

Overall, I think management has experience and has the right team in place to lead the company forward. No, I don’t know much about them, but I’ve seen what they’ve done since I-Tech has gone public, and it’s been impressive. With the potential that I-Tech has, I’m excited to see what they will do in the future.

The Opportunity

I-Tech operates in a market that is fragmented at some ends and very concentrated in others. Like I said above, the good news for I-Tech is that it doesn’t really matter if the part of the value chain it sells into is concentrated. I-Tech is the only one with an antifouling product like this on the market. And, in fact, the concentrated nature of its customer base makes distribution easier and can make I-Tech a much larger company much faster than it would if it was selling into a fragmented market.

As we discussed above, the top 9 paint manufacturers are I-Tech’s primary customers. I-Tech counts all of them as customers, but really only 6 of them have reached the product level. As it stands, all six are offering products to the ship newbuild market, but only three are offering products to the larger maintenance (dry docking) market. CMP – the largest customer by far – has a typical revenue share that breaks down 60%/40% in favor of new building products. The rest of the customers are tilted more 70%/30% towards newbuild.

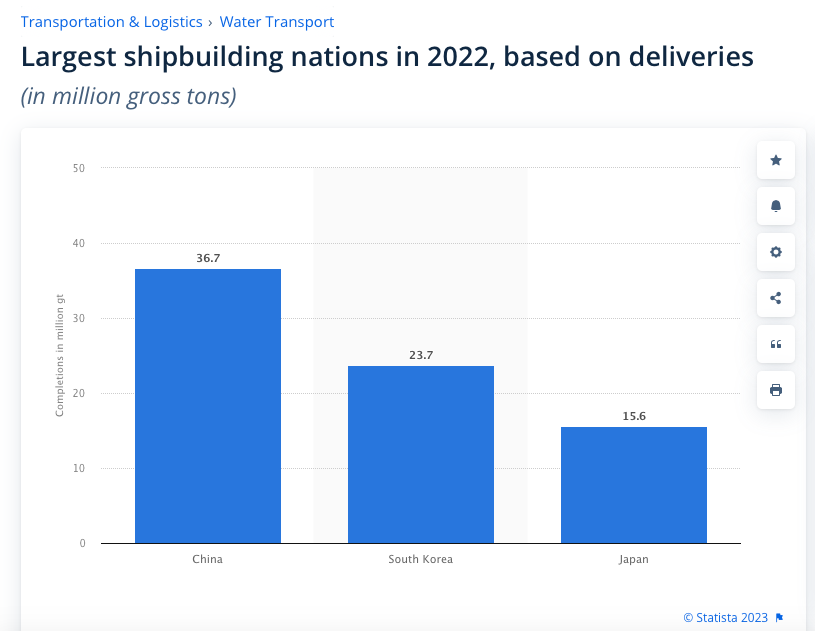

The majority of the world’s large cargo ships are built in Asia – over 90%. This means that I-Tech’s revenue is typically tilted heavily towards Asia. Revenue from South Korea made up 50% of total revenue alone, and revenue from Asian shipyards made up ~90-95%.

Source: Statista

South Korea captured 29% of all global orders for cargo ship newbuilds in the first half of 2023. More importantly for I-Tech, 61% of total orders for larger ships went to South Korea as well (they build a lot of the new LNG vessels). CMP alone also has about 20% of the worldwide demand for ship coatings and 60% of demand in Japan.

So, we know who I-Tech’s direct customers are, and we know that the customers that I-Tech currently does business with can pretty much reach the entire cargo ship newbuilding market. But what does the end market look like?

Source: I-Tech AB Investor Presentation

Well, I-Tech estimates that there are a total of ~100,000 potential cargo vessels that have the potential to use a paint product with Selektope in it. Just over 50% of these are the larger cargo ships that travel longer distances. And Just under 45% of the total vessels are smaller coastal cargo ships that stay in more coastal areas. Both need antifouling paint to reduce emissions overall, but the larger vessels are obviously a larger part of the market given they demand more paint because of their larger surface areas. As a whole, ocean-going cargo ships make up about 70% of the demand for antifouling marine coatings.

Of the ~100,000 cargo ships on the planet, today roughly 30% are demanding premium-style marine coatings. According to I-Tech, these are the coatings that are most likely to include Selektope. My understanding is that the vessel owners or ship builders who choose to pay for these higher-priced and more effective coatings are much more likely to pay for a new kind of antifouling coating. I-Tech estimates that demand for this type of coating is growing pretty rapidly and soon 50% of all cargo vessels will be purchasing premium coating.

Outside of the cargo market, I-Tech also estimates that ~10,000 megayachts and superyachts, and multiple other leisure boats, will one day be in the market for the antifouling coatings they help produce. And this isn’t just a fantasy. As of 2020, I-Tech has entered into an agreement with Pettit Marine Paints to offer antifouling products for the U.S. leisure boat market. Now, this is a good development, but there’s also a catch – I-Tech and Pettit Marine have been working since 2020 to get the EPA to allow the sale of Selektope-based biocides in the U.S. Much like the regulatory issues in Europe, the EPA’s processes are very slow moving – I-Tech claims that there is still a 2-3 year backlog preventing their product from moving forward.

In my opinion, that’s okay for the time being. Widescale adoption in the leisure market is probably still a long way off. While there are a lot of potential customers in that market, it’s still only ~30% of total demand, and a much smaller market than the large cargo market – which is $350-$500 million in size compared to ~$200 million for the leisure boat market.

Even with all of this discussion, though, you may be wondering why this is a growth market for I-Tech. Why would more and more cargo ships need to adopt antifouling marine paints – in particular, non-metals based antifouling marine paints? Well, fouling has always been an issue for vessels. It makes them less hydrodynamic, thereby hurting fuel efficiency, which inevitably ends up costing the vessel owner or operator more in fuel costs or time lost. In addition, fouling allows for the transportation of potentially invasive alien species to new ecosystems.

But for the purposes of a more rapid adoption, the new IMO standards are the biggest tailwind.

Source: I-Tech AB 2022 Annual Report

The IMO standards – which really went into full gear in 2021 – have imposed some pretty hard standards on ship owners. By 2030, IMO has set a target to reduce CO2 emissions from shipping by at least 40% compared to 2008 levels. And by 2050, the IMO standards are requiring the shipping industry to reduce overall greenhouse gas emissions by 50% and CO2 emissions by 70% when compared to 2008 levels.

I-Tech estimates that anti-fouling hull paint (that is actually environmentally compliant) can reduce emissions by anywhere between 5-25%. There are obviously other methods that will make more of a difference (like going fully electric), but when you think about it, antifouling paint may be one of the easiest and most cost-effective ways to reduce emissions quickly. Ship owners don’t have to drastically redesign their boats or even build new ones. I-Tech’s products can be applied to boats that already exist and reduce fouling without running afoul of any laws.

Another potential tailwind is the fact that South Korea (which handled ~31% of new ship build deliveries in 2022) is strongly considering a requirement that all marine coatings contain a biocide load of 1% or less. There’s a lot of pushback from the coatings and ship building industry, but at the moment, the current timeline for enforcement is roughly two years, though there could be a grace period. What’s interesting about this is that I-Tech’s management thinks that the only way for most of the industry to achieve this is to use Selektope as its antifouling ingredient, considering it can be effective at a concentration of 0.1%. This could be really huge for Selektope, and since there are already discussions about doing this (even if the requirement doesn’t end up getting enforced in the near-term), there will likely be paint manufacturers looking into new Selektope-based formulations very soon.

Today, products that include Selektope have been applied to just over 1,000 vessels around the world, and Selektope is used in a total of 25-30 products. That’s a big jump from where I-Tech was when it went public, but it’s tiny in the grand scheme of things. There are over 100,000 cargo vessels around the world, with 1,000 or so new ones being built each year (though some will also be scrapped). So, in total, I-Tech really only has 1-2% of its total potential market.

Risks

Regulatory Issues

I’ll start off by saying that Selektope has received market approval in the EU, China, South Korea, Japan, and the Phillippines (all of the major ship building and dry docking countries/geographies). So, it is currently, and has been for at least a little while, operating in all of these areas without restriction.

The real regulatory risk actually arose relatively recently. I-Tech made a submission for active substance reapproval of Selektope to the European Chemical Agency (ECHA) in 2021. I think the understanding was that this would be a pretty straightforward process. Certain aspects of medetomidine were approved by the ECHA in 2009, and Selektope was formally approved by the agency back in 2016.

Apparently, it took the agency a while to get around to looking at Selektope. But in May of 2023, a panel of experts for the ECHA stated that they were going to classify medetomidine as an endocrine disruptor. The criteria for approval seems to have changed since the last time that Selektope was approved. But I-Tech is challenging this.

The stock sold off on the news, but it’s extremely hard to tell how this will shake out. This was just the first advisory panel comment on medetomidine, and there’s a long road ahead with a lot of chances for I-Tech to defend itself.

From what I can tell, there was a panel of experts who got together and made a recommendation regarding medetomidine. Basically, they found – by looking at pharmacological data, not any actual reported cases or issues with medetomidine as a biocide – that medetomidine presents a risk to humans as an endocrine disruptor. Therefore, it should be classified as an endocrine disruptor, which apparently means that it will be banned from sale and application in the EU.

First, I-Tech’s management made very clear that this is just a recommendation at this point – it’s not any kind of final decision and has no legally binding effect. This was a closed meeting, and the minutes are confidential. The applicant (I-Tech) is not allowed to be present, though they do have access to meeting notes afterwards. Because of its preliminary nature, I-Tech can’t even challenge this recommendation yet.

As of right now, there are no guarantees that the ECHA will actually go through with or even really consider a ban. In Q3 of this year (may have already happened – we’ll have to pay attention to the Q3 report in a few days) – a working group consisting of representatives of 27 state chemical authorities will start to get together and decide if they will recommend the expert panel’s recommendation. If they do, this will go to the Biocide Products Committee, who will then decide if they will make a recommendation to the Commission. The Commission will then decide whether they will ban medetomidine for sale or not.

These member state meetings will take place in the first half of 2024, and I-Tech will be allowed to work with them – challenging the recommendation and presenting their points of view. If it moves to a Biocide Products Committee decision, this will likely take place in Q3 of 2024. A final decision by the ECHA is supposed to take place by 2025, with a subsequent grace period for appeals by I-Tech. I-Tech’s management, however, has been very clear that this timeline is not rigid and will probably not be followed. A final decision will probably take place later than 2025, and they said they’ve seen some of these proceedings lasting as long as 8 years from the time of the initial recommendation.

There’s a lot to unpack here, but basically I-Tech’s main argument is that the expert panel should not be looking at pharmacological data and medetomidine’s affect on humans to determine its safety as a shipping hull biocide. Medetomidine has been in use for a long time – everyone knows what it is. They know it has sedative effects on humans and large animals. The issue is that there may be some side effects in humans that affect endocrinal tissue. I-Tech doesn’t think this is the case, and has its own group of experts to refute this. But they’re also making the legal argument that just switching to this pharmacological standard (that’s only based on dated pharmacological data) is not appropriate.

From the outside looking in, it’s going to be very hard to predict which way this will go. I-Tech will obviously have its take, and the ECHA will have its own. But really, you have to ask yourself how big of an issue this actually is. Obviously, the vast majority of cargo ships are manufactured and even dry docked in Asia. And, as far as anyone knows, none of the primary Asian markets have banned Selektope or imposed any kind of regulatory barriers. So, if the European market is currently 5-10% of I-Tech’s total revenue in a given year (this is basically end markets that the paints are sold into), then this may not be that much of an issue – even if Selektope is banned in Europe.

But I don’t think it’s that easy. First, some of the Asian nations (and the U.S. in regards to leisure boats) may follow in the EU’s footsteps. If they ban Selektope or find problems with it, all bets are off. But I-Tech’s management has said that this is unlikely. Japan has just recently approved medetomidine and likely won’t backtrack, and South Korea has new requirements in place regarding biocide concentration that almost require everyone to use Selektope. You have to remember that China, South Korea, and Japan rely heavily on shipbuilding industries and oceanic trade in general. They’re probably not going to shoot themselves in the foot. They want something like Selektope to work because they need it to work. The ship owners and builders have to comply with the IMO standards, and Asia wants to remain the place where they build and dry dock their ships. So, it’s unlikely that any of these major Asian shipbuilding countries will ban Selektope when it helps them achieve their goals without any proven negative impacts on the environment or humans.

Second, even though most of the coatings that contain Selektope are and will be sold into the Asian markets, some of the largest paint manufacturers – I-Tech’s actual customers – are actually based in Europe. This has to have some kind of effect right? Just because they sell into Asia and Asia allows it doesn’t mean that these companies that are based in Europe will keep purchasing Selektope to use in their products. Right now, I-Tech’s largest customer – CMP – is based in Japan, and doesn’t appear to be subject to the EU’s regulatory issues. But the largest marine paint company in the world – Jotun – is based in Norway. IP is the subsidiary of a Dutch company, Hempel is a private company based in Denmark, and PPG is based in the U.S. In all honesty – while they sell to the Asian markets – the majority of the largest paint manufacturers are based on Europe. Some of the smaller ones – like KCC, Kansai Paints, and Nippon Paint – are based in Asia, but three of the largest (Jotun, Hempel, and IP) are based in Europe.

Fortunately, I-Tech’s CEO said in a May 2023 update on the issue, that even though many of the big paint manufacturers are headquartered in Europe, they have operations in Asia, I-Tech mainly sells to them in Asia (less than 5% of Selektope is actually sold in the EU), and they actually create the product in Asia. I-Tech’s CEO said any potential ban will be on the application of the paint containing the medtomidine in the EU. Any potential ban wouldn’t prevent ships using Selektope from transit in EU waters or even prevent them from docking at EU ports. So – according to I-Tech’s management – the ban shouldn’t have any real effect on I-Tech’s that are based in Europe. They’re already completely insulated from regulatory attack by the EU.

I-Tech’s management also feels that the entire industry has been moving away from Europe for some time. There have apparently been no new antifouling paint formulations (with one or two exceptions) approved in Europe over the last 5-10 years. All of the manufacturers understand this, and they know that if they want to start using a new ingredient or a new product, it wouldn’t get approved in Europe anyways.

Valuation

For the potential it presents, I think I-Tech is very undervalued. Today, it trades at SEK 42.60 a share – a SEK 507.3 million market cap. That’s at about 26x 2022’s FCF number, but likely significantly cheaper for 2023’s full-year number, considering I-Tech is already generating almost as much OCF (and subsequently FCF) at the half-way point in 2023 as it was for the full year 2022. So, more than likely, I-Tech is trading at ~10-12x 2023’s FCF. Which is crazy when you realize this is a company growing its top-line at over 80% this year with significant operating leverage and almost no capital requirements.

Of course, the bear case is that Selektope’s future is now much more unpredictable after the initial advisory board comments from the ECHA. In addition, I-Tech is a very small company that only has about 1-2% of its total market. It’s a small fish in a big pond, and it could get stomped out any minute. In addition, given I-Tech’s recent improvements, it’s hard to tell whether they will be seriously affected by the cyclicality of the shipping market. If they can get into the dry docking market – which is traditionally much more stable than new ship building – I think they can have stable revenue, even when they are significantly larger.

These things are all true, but consider this: I-Tech’s customers are now buying more than ever in 2023, even after the ECHA’s comments. Given the current growing demand, I believe I-Tech at its current price is a great deal. But, it’s going to be a company whose growth is very hard to predict. Considering the large and concentrated customer base it serves, there’s a chance that revenue growth will be stable once it picks up – new products created by large paint manufacturers that are continuously bought by vessel owners.

But who knows what growth will do in any given year. A massive customer could create a new product with I-Tech next year and it could take off. To get an understanding of the potential for I-Tech, we need to look at the market.

At the very high end, I-Tech probably won’t be much more than a $1 billion to $2 billion company. Keep in mind that this would be very far down the road, so I’m not saying that they’re going to grow that large next year or even in the next five to ten years. But, remember that I-Tech’s concentrated customer base can allow for very fast growth. Also, keep in mind that I’ve been quoting I-Tech’s financials and market cap in SEK instead of USD.

On a USD basis, I-Tech is likely trading at around a $46 million market cap. So, you can see that the potential is huge. I get to that total number by simply looking at I-Tech’s total market potential. It’s estimated that the total end-market for I-Tech’s product is worth $350-$500 million (not including leisure boats). If I-Tech captures all $500 million of this in revenue, then I think it could generate ~$100 million in FCF – 20% margins are probably even too low for I-Tech at this size, but I’ll use them anyway. Regardless, with a 15x multiple applied, I-Tech would be worth about $1.5 billion – roughly 32x today’s value.

That would be a fantastic return (and I believe it is possible), but make no mistake, I don’t just expect this kind of return from investing in I-Tech. A more reasonable assumption would be that I-Tech captures 30% of the $350 million market. Today, roughly 30% of marine coatings are considered premium – the kind that typically include an antifouling ingredient like Selektope. If I-Tech captures this segment of the market, it could be bringing in $105 million in revenue. With a 20% FCF margin and a 15x multiple on that FCF, I-Tech could be worth $315 million – just under 7x the company’s value today.

This is all great, and you can see that the potential is massive. But it’s not like this is a guarantee that I-Tech’s revenue will reach this point year-after-year. Because once it does reach a certain size (one much larger than today), it will likely stop growing and become much more susceptible to the cyclicality of the marine shipping market. The number of newbuilds every year can fluctuate (though the number is typically around 1,000), and the number of dry dockings can decrease as well if a large chunk of the global fleet is scrapped and no replacements are there to fill in.

Even if all of these $350-$500 million numbers are off, I still think it’s just basic common sense that I-Tech is a pretty good bargain here. I’m looking for value based on the expected upside of the company, not on a reversion to the mean in valuations (though the valuation has ample room to expand here). And it’s clear that I-Tech only has 1% of the total cargo vessel market. I don’t know if it can even capture 15% of the total market, but if it can get close to that, we’re probably going to seem some pretty great returns. And at 10-15x 2023’s expected FCF, I think the risk-reward ratio is in our favor and the upside is enormous, even if it’s not well defined.

Conclusion

There are obviously a lot of moving parts here, but sometimes you just have to simplify things and think of the entire picture. I-Tech has created an innovative product that has the chance to be a market leader. It has regulatory barriers to entry that, yes, are also coming back to bite it in the EU. But they, along with significant patents and R&D know-how, are barriers to entry none-the-less – it took I-Tech roughly 20 years to create and get approval for Selektope.

I-Tech has a relationship will every large paint manufacturer in the world, and is constantly working with them to create new products that include Selektope. Though there are competitors in the antifouling field, there is nothing like Selektope on the market, meaning that if it is eventually chosen as the industry-wide standard, I-Tech will benefit immensely. In addition, there are significant tailwinds in the form of cost savings for ship owners as well as IMO compliance, which will require them to take any advantage they can get.

Finally, I-Tech is a very impressive company that is now growing extremely fast and throwing off a ton of cash. It has good margins, high operating leverage, and very little capital requirements. It’s still small and relatively unproven, but the business model is every investor’s dream.

This Publication is for informational purposes only, and nothing we say should be taken an investing advice. Past performance is not predictive of future returns. If you are considering a purchase of securities, please consult a licensed financial advisor. This is not a solicitation or an offer to buy any of the securities mentioned. This is not advice to buy, sell, or hold any of the securities mentioned. The author of this Publication may have positions in the securities mentioned or may initiate a position in the securities mentioned in the near future.