TerraVest Industries Inc.

This report was originally published in August of 2023.

You can find a PDF version here:

I first invested in TerraVest Industries Inc. (TSE:TVK.TO) in early 2018, and it has grown into my largest position today (you can read my initial write-up here). At the time, I thought it was a good company that was consistently growing and generating good cash flow by executing a successful roll-up strategy in several very fragmented markets. Today, I think the investment case is even stronger. Since 2018, the company has quietly grown into the dominant player in markets that are ripe for consolidation and simultaneously viewed as undesirable by any large would-be competitors.

The company is a Canadian compounder, and in my opinion the safest and most consistent roll-up play you’ll find. It operates in several industries, but primarily restricts itself to (1) the manufacture of North American propane storage and transportation tanks (as well as heating oil storage tanks), (2) the manufacture of wellhead processing equipment, storage, transportation, and other equipment for the Western Canadian oil and gas industry, and (3) services for the Canadian oil and gas industry, including fluid management, water hauling, environmental management, etc.

TerraVest itself is structured as a holding company. It typically acquires one to two companies (more recently, more than that) a year and usually allocates the cash from its acquisitions towards new acquisitions, dividends, or share buybacks. Today, almost all acquisitions are bolt-on acquisitions. TerraVest has grown to be the largest player in most markets it operates in – including the wellhead processing equipment industry in Canada, the heating oil storage industry in the U.S., and propane storage and transportation equipment industry in Canada. In pretty much every other market it operates in – propane storage and transportation equipment in the U.S. and oil field services in Canada – it is at least in the top three.

Overall, the company has found its niche both in terms of acquisitions and operational competence. To be honest, since I’ve invested in the company I’ve become skeptical of Buffett-type CEOs and CIOs who come into an industry from asset management and try to excel at capital allocation. But TerraVest has been one of the few exceptions to the rule. By all measures, the current management team has been extremely successful, and has only bolstered its position in an industry that still offers it a ton of opportunity going forward.

Since 2014, the company has grown its revenue at a CAGR of 20%, its adjusted EBITDA (it works in this scenario) at a CAGR of 18%, its earnings at a CAGR of 23%, and its Distributable FCF at 16.9%. The vast majority of this growth has come on the back of acquisitions and organic growth from acquired companies – the company has completed 16 acquisitions since current management took over in 2013/2014.

And that leads into the opportunity here. Much like OneWater Marine from last week, TerraVest is the largest consolidator in a very fragmented market – a market where the other small players just can’t compete with it on scale or in terms of competing for acquisitions. This leaves TerraVest with the opportunity to steadily make smart acquisitions, building its position in the industry through cheap purchase prices (4-5x FCF and typically 1.0x net assets). So far, this strategy has been very effective. TerraVest typically generates an ROE over 20% (lately over 25%) and a Distributable FCF ROE (which is calculated to smooth FCF by adding back working capital changes) of anywhere from 27-30%.

TerraVest is strange in that it doesn’t put out a lot of investor material. Over the last few years, it has mainly just filed its SEDAR filings and been done with investor relations. No quarterly earnings calls, and no investor presentations. The last investor presentation was from 2019, and besides the occasional press release related to an acquisition, TerraVest is pretty quiet on the IR and media front.

Honestly though, TerraVest may be the easiest layup in the public markets. A history of good performance, an impressive and incentivized management team, likely trading at ~10x forward earnings (less for distributable FCF), with a long runway of acquisitions ahead of it. Though it has become more popular in recent years, the company is still relatively unknown. A company trading on a Canadian exchange with no earnings calls, analyst coverage, or any recent investor presentations isn’t going to attract a ton of institutions. But as long as it keeps growing and executing, you’ll get a good (and safe) return by investing in TerraVest. Just look at its return over the last 10 years, and even over the last five (and I assure you things were a lot less certain in 2018 than today).

Before I move any further, I also want to say that even though TerraVest is listed on the U.S. OTC exchange (OTCMKTS:TRRVF) as well as in the Canadian market, it reports its financials in Canadian dollars, so I will be using that going forward. The numbers below will NOT be in U.S. dollars. To make sure this is understood, I will use a C$ to indicate that I’m quoting the numbers in Canadian dollars.

History

Before 2011, TerraVest Capital (as it was called then) operated as an income trust that competed in industries adjacent to the handful it operates in today. Around 2011, Clarke Inc. (a noted private investment shop in Canada) made a large investment (around 30%) in the company. It converted TerraVest into a corporation from an income trust in 2012 (though the dividend stayed around), and installed its own management team.

The company began its transition into its current form with the acquisition of Gestion Jerico from Clarke Inc. (75% owner) and Charles Pellerin (25% owner) – who became the Executive Chairman of TerraVest – for $35.9 million in 2014. Jerico was a manufacturer of home heating and propane storage products, and had (prior to the TerraVest acquisition) completed an acquisition of its own, purchasing Pro-Par – a propane storage equipment manufacturer.

After the initial conversion in 2012, Dale Laniuk become the CEO and President of TerraVest, and remained in place until 2015. Dustin Haw joined from Clarke Inc. in 2014 (where he was a Vice President) as a Director. By 2017, he had become the CEO of TerraVest and remains so today. The CIO – Mitchell Gilbert – who is in charge of sourcing and completing acquisitions, joined the team in 2013 and is still the CIO today. Charles Pellerin remains the Executive Chairman today and the former CEO, Mr. Laniuk is also serving as a director of the company.

With the acquisition of Jerico, the company made its first large move into the propane and heating oil storage/transportation market. In 2014, the company was generating C$131.6 million in revenue and about 65% of its was coming from the Canadian oil and gas market. The Jerico acquisition initiated a shift towards propane storage and transportation, making that portion of the business more than half of total revenue by 2017. It’s still 56% today.

TerraVest continued with its strategy of making cheap bolt-on acquisitions in industries it had experience in. Over the ensuing 9 years, it made a total of 16 acquisitions:

2014

Jerico (Fuel Containment): C$35.9 million

NWP Industries LP (Processing Equipment): C$12.8 million

2015

Signature Truck Systems, LLC (Fuel Containment): C$21.2 million

2016

Segretech Inc. (Processing Equipment): 54.9% stake for C$1.75 million

EnviroVault Corp. (Processing Equipment): C$1.4 million

2017

Fischer Group (Fuel Containment): C$11.3 million

Vilco Group (Fuel Containment): C$7.1 million

2018

MaXfield Group Inc. (Fuel Containment): C$16.3 million.

2019

Iowa Steel Fabrication LLC (Fuel Containment): C$11.7 million.

2020

Argo Sales Inc. (Processing Equipment): C$15.5 million

2021

Green Energy Services (Service): Total C$25.58 million – previously owned a stake that they purchased for C$9.5 million, increased their stake to 66.1% for C$16 million more.

ECR International (Fuel Containment – now HVAC under restructuring): C$37.5 million.

2022

JCAC Fortin Inc. (Fuel Containment): C$2.5 million

Platinum Energy Services (Processing Equipment): C$4.85 million.

Mississippi Tank Company (Fuel Containment): C$28 million.

2023

Secure Energy Inc. (Service): C$15.8 million.

At the beginning of 2018, when I first invested, TerraVest’s growing list of subsidiaries looked like this:

Source: TerraVest Industries Inc. 2017 Annual Financial Statements

By the end of 2022, the company had expanded further into the United States and grown its list of subsidiaries to include the following:

Source: TerraVest Industries Inc. 2022 Annual Financial Statements

Over the years, the company’s acquisitions have gotten larger and (more recently) more numerous. But, overall, the revenue streams have remained diversified.

In 2016, Clarke upped its stake to 31%, but by 2020, it had spun off its 28% stake to its own shareholders, giving them 0.33 TerraVest shares per every Clarke share, thereby erasing TerraVest’s largest single stockholder from the books.

As far as growth goes, TerraVest had some setbacks in 2016 – primarily because of the slowdown in O&G. But the diversification into Fuel Containment as well as the continued acquisitions in the O&G service and manufacturing industries provided a continued avenue for growth, even if the industry itself experienced a pullback. Besides 2016, TerraVest has grown revenue every year since 2014.

Business Operations

By the end of FY 2022, TerraVest was a company with C$576.7 million in revenue (~84% from product sales and ~16% from services), C$86.7 million in adjusted EBITDA, C$46.8 million in earnings, C$615.5 million in total assets, and C$195.9 million in equity.

Roughly 53% of sales came from Canada and 47% in the U.S. in 2022. Compare this to 2018, when TerraVest generated close to 70% of its sales in Canada.

Source: TerraVest Industries Inc. 2022 Annual Financial Statements

Through acquisitions and organic growth, TerraVest has expanded its geographic diversification to include not just Eastern Canada, but the Western Canadian oil sands, the Northeastern U.S., the Midwestern U.S., and now the Southeastern U.S. And today it is the number 1 player in most markets it operates in – including heating oil in the Northeastern U.S. and Canada as well as the manufacture of propane storage and transportation tanks.

For most of its history (though this has changed in 2023 – which I will address below), TerraVest has separated its operations into three distinct areas:

Fuel Containment (56.8% of revenue) – Through this arm, TerraVest manufactures storage and transportation products primarily for the propane and heating oil industries. These products include residential and commercial storage tanks as well as transportation tanks and transport trailers, delivery and service trucks, and furnaces and boilers. These businesses operate primarily in the Northeastern U.S. and Eastern Canada, though TerraVest has recently expanded, through acquisitions, to the Midwestern and Southeastern United States.

Processing Equipment (27.5% of revenue) – This segment fabricates a variety of equipment for the oil and gas industry, primarily consisting of wellhead processing equipment, desanding units, NGL storage tanks, central facilities processing equipment, and more. This segment of the business primarily serves the oil and gas industry.

Service (15.6% of revenue) – This segment provides a wide range of services to many of the largest oil and gas companies in West Canada. This includes fluid hauling, water management, environmental solutions, heating, and well servicing.

Although the company has grown revenue, earnings, and FCF at a pretty impressive rate, its performance metrics (like its margins, ROE, asset turnover, etc.) have stayed pretty steady. TerraVest had a Gross Margin of 21.6% in FY 2022. This is actually the lowest its gross margin has been in recent memory, going all the way back to 2014 (the highest was 26.2% in 2021 though).

Its adjusted EBITDA margin was 15% in 2022, its net margin was 8.1%, and its Distributable FCF margin was 9.5%. None of these were the highest margins that TerraVest has ever generated, though net margins in general have been demonstrably higher over the last few years (at 7-11% compared to 4-6% previously). Overall, TerraVest’s margins jump around a good bit, but there hasn’t been any kind of sustained increase or decline.

Regardless of margins, though, the company has seen a pretty sustained rise in ROE and ROIC. In 2014, TerraVest’s ROE was 11.1% and its ROIC was 6.5%. By 2022, TerraVest’s ROE and ROIC had grown to 23.9% and 10.7% respectively. And while there has been a general rise in returns since 2014 and earlier, the end-point numbers do mask the fact that, if you survey the year-by-year numbers, there hasn’t been any kind of consistent uptrend over the last 8 years.

But one constant has been growth. Growth that is primarily driven by acquisitions, but growth that is, nonetheless, fueled by high returns on capital. Between 2014 and 2022, TerraVest made 15 acquisitions for a total consideration of about C$234 million. I know, though, that not every acquisition (especially the five in 2021-22) has completely developed into a full-time contributor to the company’s financial results nor have all of the expected synergies been achieved.

Source: My Own Calculations

So, it may be better to judge returns at this point based on the results prior to 2021. To do this, we can remove about C$89 million in invested capital and compare 2020’s results to what we have. What we would have, at that point in time would be C$145 million in invested capital (in acquisitions, that is) and C$36.6 million in distributable FCF. That would imply a return on total acquisition consideration of 25%.

This isn’t the best return you could hope for, especially considering some of this C$36.6 million is attributable to businesses that TerraVest owned before 2014, but it’s still better than at least 90% of the companies out there.

Looking at TerraVest’s balance sheet, you can see hints of the effectiveness of its acquisitions. When TerraVest reports a new acquisition, it typically reports the net assets acquired. And, on average, it buys companies at roughly 1.0x book value. Because of this, TerraVest’s goodwill assets (at 3.9% in 2022) are actually a lot smaller than most roll-ups.

PP&E is really the main asset that TerraVest acquires, but because they don’t break out the revenue, earnings, or cash flow numbers for their acquisitions (besides saying what they contributed since the acquisition in some instances, which usually only incudes a few months of data), it’s hard to say how well each of the acquired assets are performing.

Source: TerraVest Industries Inc. SEDAR Filings

To get an understanding of its long-term effectiveness though, you can calculate the return on fixed assets. This measure divides earning or FCF by PP&E, investments, intangible assets, and goodwill. It excludes cash, other intangibles, inventory, and accounts receivable. TerraVest’s inventories and accounts receivable can be real drags (or sometimes boons) to its FCF, but overall they’re based on TerraVest’s future revenue and demand for its products, not necessarily the assets that TerraVest acquired through acquisition.

Given the returns that TerraVest has been able to generate on its fixed assets – 17% and over for earnings and 20% and over for Distributable FCF – it’s pretty apparent that TerraVest is (1) acquiring assets on the cheap and (2) knows how to continuously execute with the capital base it already has.

Overall, TerraVest has been dominating in the markets that it operates in. It has essentially taken over the eastern Canada and Northeastern U.S. heating oil and propane markets, and it’s looking to continue its expansion across North America. In addition, it’s the largest wellhead processing equipment manufacturer for drillers in Western Canada. These are all good positions to be in, even if they are cyclical industries.

Fuel Containment

To me, the Fuel Containment segment is probably TerraVest’s most promising segment. It currently comprises 56.8% of TerraVest’s revenue, but makes up 64.8% of its adjusted EBITDA and 58.3% of its earnings. Compared to oil and gas, propane demand and production are much less cyclical, though it can go through its own cycles and is somewhat affected by weather patterns in certain parts of North America.

As I mentioned in the “History” section, the company has been growing the Fuel Containment segment of the business since 2014, first with the acquisition of Gestion Jerico, then with subsequent investments such as Fischer Tanks, MaXfield, Iowa Steel Fabrication, and Signature Trucks.

Overall, the business is primarily split between propane storage/distribution and heating oil. The heating oil business – which is primarily restricted to the Northeastern United States and which TerraVest is the number one player in – is operated under TerraVest’s Granby Brand, which was part of the business before the 2014 transition with Jerico.

Source: TerraVest Industries Inc. Website

TerraVest’s heating oil storage business is probably TerraVest’s only consumer-based business. Compared to propane storage – where TerraVest primarily sells tanks to businesses who then use them for transportation or sell them to customers – the heating oil business goes through third-party distributors and retailers (like Home Depot) straight to the customer.

The heating oil business is relegated primarily to the Northeastern United States and Canada – really the only places (because the cold weather and outdated infrastructure in some areas) where heating oil is still in demand. And, in my opinion, its not necessarily ripe for a ton of growth going forward. I don’t foresee a ton of increased demand in heating oil storage products, and my assumption is that this is why TerraVest separated out the two Fuel Containment businesses (into HVAC Equipment and Compressed Gas Equipment) in 2023.

On the propane side of the business, which offers a much larger market to expand into, Jerico was the original entry point. Subsequently, TerraVest expanded into the propane distribution industry with the acquisition of Signature Trucks in 2015, steadily purchasing more businesses (like Fischer Tanks, MaXfield, and Mississippi Tank) over the ensuring years to expand its geographic presence in the propane industry, both increasing route density and consolidating operations.

Source: TerraVest Industries Inc. 2019 Investor Presentation

Propane is a relatively small part of the energy industry, but honestly probably larger than most people think. It’s hard to find up-to-date numbers, but this study has a lot of useful information. On the residential side, it’s estimated that 50 million American homes still use propane (which is surprisingly just over a third of the total homes in America), and over 11 million of these homes (which sounds like a much more realistic number) still use propane as their primary energy source for space and water heating. Other sources place the number at roughly 5% of total homes that use propane as their primary space heating source – about 7 million homes across the U.S.

And let’s be clear, we’re not talking about the small Blue Rhino tanks that you use to power your gas grill on the weekend. We’re talking about large tanks used to heat a home that are regularly serviced and filled by trucks that distribute propane from a centralized hub. Many people aren’t familiar with this because many of these homes are in rural areas that gas lines don’t reach. These larger tanks and truck tanks are the kinds of tanks that TerraVest manufactures and refurbishes.

Residential propane demand typically makes up about 45% of total propane sales, and it’s been increasing recently (though 2022 and 23 may tell a different story). From 2017-2019, demand for propane was already growing, and after the pandemic, residential propane demand was at 9.54 billion gallons (in 2021), well above the 10-year average of 8.9 billion gallons.

Source: National Propane Gas Association

TerraVest wisely has started its clustering strategy across the states that generally consume the most propane – which are typically those in the upper Midwest and the Northeast (Michigan consuming more propane than any other state in the U.S.).

Source: National Propane Gas Association

In addition, the production of propane has more than doubled over the last decade, as a result of increasing shale gas production (of which propane is a by-product). This is, in general, actually good for TerraVest, considering this propane has to be stored in tanks and transported to different areas.

Source: EIA

But contrary to what you might expect with such an increase in supply, the residential price of propane has actually risen over this period. My assumption is that a lot of this excess propane has been exported to other countries. Exports are around 1.1 million barrels of propane a day, compared to around 91,000 before 2010.

Source: EIA

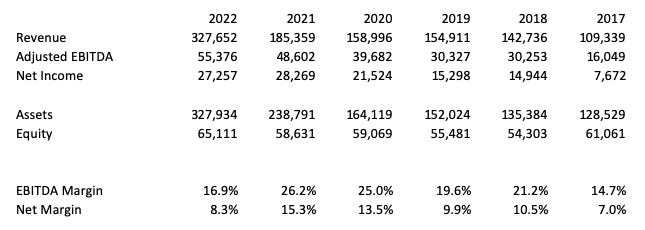

For the Fuel Containment segment, things have been steadily improving over the last five years, with the rare exception of 2022, where it seems that rapidly rising inflation combined with what management described as an unfavorable product mix as well as increasing financing costs caused margins to drop by quite a bit. This was after EBITDA margins had been steadily rising from under 15% in 2017 to over 25% in 2021 though

Source: TerraVest Industries Inc. 2022 MD&A

Something that really jumps out at you if you dig into the different business segments is that Fuel Containment is currently generating a 41.9% ROE (48% in 2021). That’s up from an ROE of 12.6% in 2017. At first glance, this looks amazing, but after further inspection, it seems that the majority of the improvement came from increasing leverage. Net margins haven’t really increased during that time period (fluctuating anywhere between 8% and 15%), and asset turnover has remained pretty much the same, even exceeding what it does today in years where ROE was lower. What has changed is that equity as a percentage of assets fell from 47.5% in 2017 to 19.9% in 2022.

But regardless, the ROE has still been maintained in the 18-20% range (with one year down at 12.5%) every year going back to 2014. That’s pretty impressive returns and consistency, even when equity was at 50-60% of total assets. And even if, say, equity was at 45% of assets in 2022, the Fuel Containment segment would still be generating an 18.5% ROE, which isn’t anything to sneeze at.

I don’t necessarily think the leverage is a bad thing, in the long run. Propane markets – though prices do fluctuate – aren’t really subject to the same cyclical swings that the oil and gas industry is. Most of TerraVest’s customers will demand the same amount of storage products year after year. This is a part of the business that can actually afford to lever up. And TerraVest has likely done so for good reason – it’s made several larger acquisitions over this time period and has had to take on the increased inventory load associated with these new acquisitions.

And there’s no denying that with this leverage, TerraVest been able to grow revenue and earnings at an impressive rate. Revenue grew at a CAGR of 24% from 2017 to 2022 and earnings, even more impressively, grew at a CAGR of 28.8%. In a market that appears to be as stable as propane (and heating oil), I don’t think it’s a bad idea for TerraVest to lever up its asset base to drive more growth. In fact, I named this as one of the potential catalysts in my 2018 write-up, and it has apparently played out.

Processing Equipment

Processing Equipment, though it involves a similarly fragmented market and similar levels of specialized manufacturing, is actually a very different business than Fuel Containment. Don’t get me wrong, there are some cross-overs. The Processing Equipment segment does offer storage tanks to some of its O&G customers. But, for the most part, the big difference is in the industry that TerraVest is serving.

Although propane production is typically a by-product of natural gas exploration and production, the industry just doesn’t experience the kind of cyclical swings that oil and gas does. And since TerraVest is primarily focused in Western Canada, it’s subject to the production levels coming out of the Canadian oil sands.

This largely comes through in its operations.

Source: TerraVest Industries Inc. Financial Statements

Now, make no mistake, the Processing Equipment segment (with the exception of 2020) has been growing revenue every year since 2014. But, if you think about it, what happened in and after 2014? It was essentially the peak of oil and gas investment in North America. The shale revolution had driven increased productivity in the sector, and everyone was ramping up production. This led to a glut that, by 2015, started to rear its ugly head.

Back in 2014 and 2015, TerraVest’s Processing Equipment segment was generating an ROE of 21% and 25.3% respectively. Their manufacturing facilities were operating at full capacity to meet demand from the Canadian O&G sector and asset turnover was at over 1x.

But since then, ROE has fallen to single digits in some years, though has risen as high as 15% in others. And as you can see from the chart below, Canadian oil sand capex hasn’t risen to the level it was at in 2013-2014.

Source: Statista

Any cursory search for Canadian oil sands on Google will give you an idea of the controversy surrounding the area. Multiple environmental groups and governments have concerns, and it’s possible that the level of investment won’t ever sustain a level like that in the early 2010s.

But, regardless, TerraVest still has the opportunity to continue to acquire competitors. It’s the largest player in the industry, and I believe (though I don’t know for sure) that it could achieve some serious synergies as it grows.

At least back in its 2019 presentation, all of its production was focused in three facilities in Western Canada. I don’t know if that’s still the case today, but if you think about it there are a few ways for TerraVest to centralize operations further and therefore generate the highest ROE.

First, it could just grow organically, which I believe it does to some extent. But – much more likely – TerraVest could continue to acquire small fabricators in Canada. Increasing capacity from that point is simple – logically speaking, though probably difficult operationally speaking. The potential synergies mainly involve TerraVest moving manufacturing to its more centralized locations to (1) increase capacity at its facilities, (2) decrease operating costs associated with multiple facilities, and (3) decrease the distance it has to move inventory and finished products around.

Even though this area of the business isn’t, in my opinion, as promising as propane storage and transportation, it has had its moments. The good news is that TerraVest hasn’t levered it up as much as Fuel Containment, given the inherent cyclicality in this business. Though I will note that they have increased the leverage since 2014, going from 72% to 36.8% of equity to assets. And, as I’ll not below, 2023 is turning out to be pretty good year for the Canadian O&G market, and therefor TerraVest.

Service

The Service arm has always been the smallest part of the business, and has never really seemed to be core to TerraVest’s operations. After the slowdown in 2015, it’s kind-of stagnated every year since then (until 2022, of course) with revenue dropping from C$31.4 million in 2014 to as low as C$10.9 million in 2020 and C$14.6 million in 2021.

Source: My Own Calculations

From 2016 to 2020, the business saw extremely low or even negative net margins (I’m talking around 1% or lower), but has recently had improvement over the course of 2021 and 2022. Back in 2014 and 2015, adjusted EBITDA margin were 16%-23% and net margins stood at around 10-11%. Recently, TerraVest has been seeing those levels again, with ~20% adjusted EBITDA margins in 2021 and 2022 and 8-9% net margins over the same period.

Returns have begun to recover as well. Back in 2014 and 2015, the Service segment’s ROE was consistently around 15%, but dropped to around 1-2% (when net income was positive) in the ensuing years. Since 2021, ROE has returned to its previously impressive levels, with the Service segment putting up a 22% and 18% ROE in 2021 and 2022 respectively.

According to TerraVest’s website, it has 21 service rigs and claims that is serves many of the largest producers in Western Canada. I honestly don’t know what the company’s plans are for this division – TerraVest has never claimed market leadership like in its product-based businesses, and in most years Service’s results have honestly just weighed the company down.

Overall, you have to just accept that it’s a cyclical business. But, on the bright, the industry is entering a better part of the cycle. TerraVest made its two largest acquisitions in this segment in the last three years, by acquiring a majority stake in Green Energy Services in 2021 and purchasing Secure Energy (Drilling Services) Inc. in 2023.

Assets have increased to C$120.8 million as of the first nine months of 2023, revenue has grown to C$114.9 million (higher than the entire year of 2022), and earnings – surprisingly enough – were the highest out of any segment, at C$23.9 million for the first nine months of 2023. This implies an ROE of almost 24%, and that’s not even on a full year’s results.

It’s pretty obvious that spending on O&G capex has been increasing in Canada over the last couple of years, and TerraVest has been a beneficiary. Like other cycles, I’m sure this one will end at some point, but for the moment it looks like TerraVest is making the most of it – operating at full capacity with much higher utilization rates and service rates than that last several years. My only concern is that TerraVest may have paid up for its recent Service acquisitions in this favorable environment. But with management’s performance over time, I’m inclined to defer to them and trust that they are making the right decisions for this environment.

Competition

The competition angle is a tough one to visualize. For the most part, I can’t find any real large-scale competitors. Of course, there are thousands of small competitors. The industries TerraVest operates in are almost exclusively made up of mom and pops. And TerraVest is, to some extent, operating in a commodity industry. It serves commodity markets, and it develops products that are for the most part (though not all – some are more specialized products) commodity products.

So, even though TerraVest is the largest player in most of the markets it operates in, it doesn’t necessarily set prices. It may, given its size, have an advantage in securing raw materials and other inventory at a better price than its competitors, but it honestly isn’t that big, so it may not have any kind of actual advantage in that area.

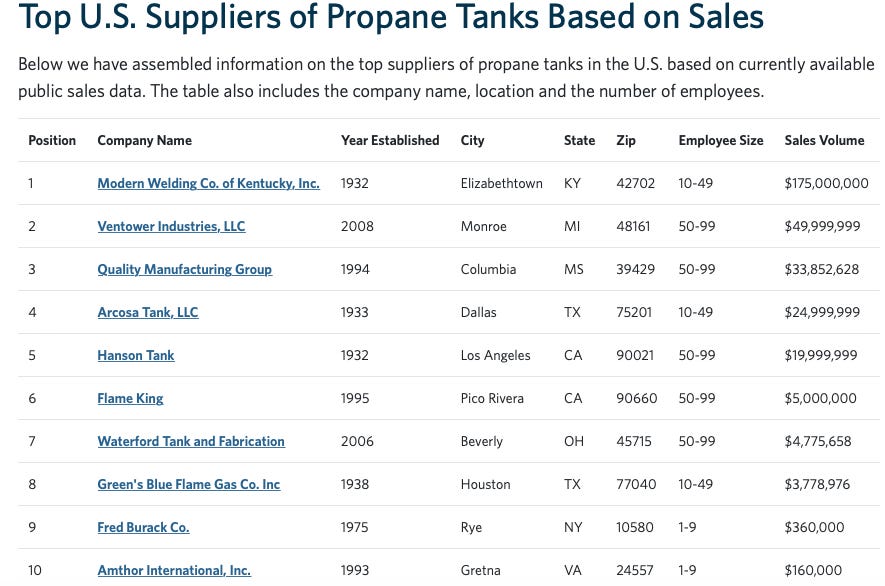

For propane, this website lists the largest propane tank manufacturers in the U.S. as of April 2023. If accurate, it’s honestly a pretty damn good source (the website is owned by Thomas, which was recently acquired by Xometry), giving revenue numbers as well.

Source: Thomas

Right off the bat, you’ll note that this is an industry populated by smaller companies. Even the largest company on the list is smaller (in terms of revenue) than TerraVest’s combined Fuel Containment segment. At $175 million in revenue, it may be larger than any one subsidiary owned by TerraVest – I don’t know. But with the next largest company dropping to just under $50 million in revenue, I think it’s safe to say that TerraVest’s competitors are pretty small. Which, in my opinion, is good for the company – a lot more room for acquisitions. If the ninth and tenth largest companies are bringing in $360k and $160k respectively, then this has to be a very fragmented industry.

The situation is a little like OneWater Marine’s, in that most of the competition will be on the acquisition side of things. Now, TerraVest doesn’t have the kind of local monopolies that OneWater does, but it seems to do pretty well even without barriers to entry. In my 2018 article, I opined that this was probably because it buys companies cheap enough to where it can make a good return, even if every potential synergy doesn’t go according to plan.

I don’t think there’ll be a lot of new tank or wellhead processing equipment manufacturers coming into the industry. The service industry could see some new competitors occasionally, but overall it’s not a huge part of TerraVest’s business.

The only real competition that TerraVest could face in the future will likely be competition for acquisitions. Private acquisitions and holding companies have become a lot more popular in recent years, with PE firms and search funds entering into what are known as traditionally “boring” industries to generate higher returns with less competition. This could, and probably already has (to some extent), led them to enter some industries that TerraVest operates in.

Luckily for TerraVest, the kind of manufacturing it does is relatively specialized, and may scare off some of the more inexperienced potential acquirers. But I don’t think competition will stay away forever. Right now, it looks like TerraVest is still able to acquire subsidiaries at prices comparable to those in the past. Throughout 2020-2023, TerraVest’s acquisitions were typically priced at roughly 1.1-1.4x net assets, with TerraVest even scooping up Platinum Energy Services in 2022 for roughly a third of book value. Who knows if prices will get pushed up in the future, but over the last decade, TerraVest has shown that it knows how to find a bargain.

Management

TerraVest’s management is probably the most impressive thing about the company. But it’s a strange analysis because they’re probably the least “out there” management team you’ll find. They don’t do earnings calls, they don’t really do interviews, and they stopped doing investor presentations in 2019 (as far as I can tell). The two primary leaders of the management team appear to be the CEO – Dustin Haw – and the CIO – Mitchell Gilbert. Both have been with the company since the initial Clarke investment and subsequent turnaround in 2013/14.

Up-front I will say, as I did above, that I’ve been presently surprised by management’s performance over the years. Because this business relies so much on acquisitions and integrations of existing businesses, management’s capital allocation and even operational skills matter a lot more than in other businesses. There are plenty of small businesses that are being run inefficiently, especially in the industries that TerraVest operates in. The fact that TerraVest has been able to continuously grow (at a high rate I might add) while generating an ROE above 20% is indicative of a management team that is skilled at making acquisitions (at a cheap price) and successfully integrating those businesses into TerraVest.

The insutry roll-up strategy by an investor-focused management team usually makes me think of people trying to create the next Berkshire Hathaway but failing to do so. I’ve seen some management teams over the years who have come from the investing field and think they can allocate capital effectively through a holding company while simultaneously managing a business – most fail. But TerraVest’s team – who were primarily from outside of the propane and O&G industries – have managed to find their niche and consistently generate good returns. It’s a rarity, but if you can find a management team who knows how to allocate capital like this, you should probably stick with them.

Perhaps what is most encouraging about TerraVest’s management team though is that both Haw and Gilbert are relatively young. Most successful roll-up operators are over 50, with many over 60 years old. By contrast, Haw appears to be around 40, and Gilbert under 50. Even Pellerin, the executive chairman, appears to be under 50.

Since Clarke Inc. spun off its stake in TerraVest, Charles Pellerin is now the largest shareholder, with ~20% of shares outstanding. Behind him is the former CEO, Dale Laniuk, with around 11%, and Mawer Investment Management with just under 10%. Haw and Gilbert both own a little less than 1%, which may seem small, but given their relative youth and the size of the holding (around C$3-C$4 million each), I’d say they’re incentivized.

Going Forward

2023 has, so far, been good to TerraVest. They’ve increased revenue, cash flow, and earnings throughout the year, seeing 21.2% growth in revenue, a much smaller 4.3% growth in earnings, 35.6% growth in adjusted EBITDA, and 33% growth in Distributable FCF.

As I discussed above, the company’s Service segment is actually driving a lot of that growth, increasing sales by 83% in the first nine months of 2023 and adjusted EBITDA by 153% over the same period.

So far in 2023, TerraVest has made a structural change, separating its Fuel Containment business into two segments – HVAC Equipment and Compressed Gas Equipment. From what I can tell, the compressed gas business is the traditional propane tank and distribution manufacturing business, with its customers primarily being propane distribution and storage businesses across North America. The HVAC Equipment business appears to be comprised of TerraVest’s legacy heating oil business as well as its brand-name heating and cooling product business (ECR International) that it acquired for C$37.5 million back in 2021.

Source: TerraVest Industries Inc. Q3 2023 MD&A

The HVAC Equipment business has been the only business to see declining sales, with revenue decreasing by 8% and adjusted EBITDA shrinking by ~23%.

The Fuel Containment business, on the other hand, saw steady 23% revenue growth so far in 2023 and has sustained healthy 16% adjusted EBITDA margins (though they are lower than its margs of ~25% a few years ago).

Source: TerraVest Industries Inc. Q3 2023 MD&A

The O&G focused businesses – Services and Processing Equipment – have outperformed the other two segments so far in 2023, primarily because of increased demand for TerraVest’s products and services in the Canadian oil field. Processing Equipment grew revenue by 24.7% in the first nine months of 2023, and grew adjusted EBITDA by an impressive 156%, increasing its margins to 12.2% from just under 6% in the first nine months of 2022.

Source: TerraVest Industries Inc. Q3 2023 MD&A

And, finally, as I mentioned above, the Service segment has been the best performing segment of the year so far. Its revenue grew by 83.7% in the first nine months of 2023, and its adjusted EBITDA increased by an impressive 153%.

Source: TerraVest Industries Inc. Q3 2023 MD&A

The Opportunity

The opportunity is pretty simple. Much like OneWater Marine, the money will be made in the consolidation of the industry. As we saw from the chart I included above, the largest company in the industry only generates $175 million in revenue, and the number drops pretty dramatically as you move down the list. Given that there are an estimated 4,000 companies in the propane industry (75% of which are independent moms and pops), there is a ton of room for continued expansion for TerraVest. I will note that the 4,000 number probably includes some larger propane distribution companies like AirGas, Blossman, and Suburban. These companies probably make up that 25% of non-independent companies mentioned above.

But the propane tank manufacturing industry appears much more fragmented. There may not be 4,000 companies in that industry, but I’d be willing to wager that there are at least 1,000. The same probably goes for the wellhead processing equipment industry.

I don’t know the exact number of wellhead processing equipment manufacturers in the U.S. or Canada. This source puts the total value of the industry at $5.83 billion in 2022. I honestly don’t typically rely on numbers from sources like the one I just cited to, but that number sounds right to me. I doubt the industry is nearly as large as the O&G industry itself, or even the O&G services industry.

If you think about it, though, all of the segments that TerraVest is involved in could be in secular decline. The propane industry has seen rising production as well as demand, but overall I think propane as a method of general space heating may eventually disappear. The same goes for heating oil. Though I could be wrong. There are all kinds of theories about the electric grid crashing due to excess demand once everything becomes electrified. Not that I take any of those at face value, but we all learned from the pandemic that things can happen that we don’t expect. And if the electric grid has some kind of widespread sustained problem, propane starts sounding pretty good. It’s a clean-burning fuel for the most part, and it’s relatively easy to store and transport. So, maybe I’m wrong about the long-term secular decline.

I won’t go so far as to say that oil and gas is an industry that is in secular decline, but over the long-term I think it’s hard to be extremely optimistic about growth. Overall though, industry growth doesn’t really matter for TerraVest. Once again, we have a company that can grow into highly fragmented industries, and continue growing for a long time, even if the industries are in decline.

In TerraVest’s case, I honestly think the overall decline could be a good thing. The last thing TerraVest wants is more competition, which would probably come about in the form of competition for acquisitions. If the industry is undesirable or in decline, then more new entrants will be discouraged to try to roll it up. TerraVest has been operating in relative obscurity for years, and it would be best for all involved if it stayed that way.

Overall, I don’t know how large the industries are that TerraVest operates in. I have an idea of the potential acquisition targets, and I know that TerraVest is already the largest player in a lot of markets. In the end, I have confidence that management will continue to execute, and with roll-ups like TerraVest that’s what really matters.

Risks

TerraVest is Focused in Fossil Fuel Energy Markets

The markets that TerraVest focuses in are split between relatively stable and unthreatening with propane, and extremely controversial with the Canadian oil sands. Propane, as many people know, is a cleaner burning fuel than oil, but it’s still on the wrong side of a potential renewable transition.

More important than that, though, propane is on the wrong side of a demographic shift. Yes, prices and production have been increasing, but multiple major sources of residential and commercial consumption have dried up over the last 20 years or so.

From a 2015 study on the long-term demand for propane:

Source: LP Gas Magazine

In the Canadian O&G sector, 2023 is supposed to mark the start of serious carbon emission reduction policy across Canada. We’ll see how it plays out, but the government is forcing the industry to get emissions 40% lower than 2005’s level by the year 2030, which may, over time, cause some serious pain for TerraVest.

Overall, I think structural decline of the industries that TerraVest serves is a real risk that any investor should think about. But I also think that it doesn’t really matter for TerraVest. Even if the O&G and propane storage industries slowly decline over the next 20 years, I think TerraVest will still grow and create value through acquisitions. The only difference may be that organic growth dries up, which has been (in some years) pretty high depending on how much TerraVest funnels into growth capex.

Debt Load

TerraVest has kept a consistent debt load (that’s actually been slightly increasing over the last few years) since about 2011, typically consisting of multiple revolving credit facilities and multiple long-term loans, several of which it has imposed on itself by way of acquisition.

At the end of 2022, its debt load looked like this:

Source: TerraVest 2022 Annual Financial Statements

As you can see, the largest piece of debt are the revolving credit facilities. The larger of the two is carrying a floating rate in both Canadian and U.S. dollars. As of 2022, the Canadian rate was at 5.70% and the U.S. rate was at 7.0%, compared to 2.45% and 3.75% respectively in 2021. The term of the credit facility was extended to December 1, 2024 in 2022. The C$45.6 million credit facility carried a rate of 5.70% in 2022 (compared to 2.70% in 2021) and expires in February of 2024. The $50 million term loan has a fixed 6% rate and matures in 2028.

As of year-end 2022, the maturity schedule looked like this:

Source: TerraVest Industries Inc. 2022 Annual Financial Statements

As of Q2 2023, TerraVest’s total debt load was sitting at C$241 million. While this may seem alarming, I think it’s important to look at historic comps here. TerraVest’s debt to total assets ratio has stayed roughly the same over the last 9 years, sitting at 37% in Q3 2023 and 39% at the end of 2022. Compare this to 2014, when debt was at 33.8% of total assets. So, honestly, not much of a change.

What may be cause for concern, however, is that interest rates are rising. As I noted above, the largest portion of TerraVest’s debt load – the revolving credit facilities – carry floating rates. This caused actual cash interest paid to shoot up to C$8.9 million in 2022, compared to C$3.8 million in 2021.

In the first nine months of 2023, the cash interest paid increased even more, growing by 86% to C$11.1 million from C$5.98 million in the first nine month of 2022. At the end of 2022, Debt-to-adjusted EBITDA was the highest it has ever been, at 2.76x. Though, in fairness, most years it is over 2x. At the subsidiary level, which is where it maintains its debt, TerraVest is in compliance with all debt covenants.

Debt is something to watch with TerraVest. The company has historically managed its debt load well, even over cycles. But with buying larger and larger companies and making more and more acquisitions, I do worry about the debt management over industry cycles.

Valuation

Like every company I invest in and write-up, I try to keep the valuation simple. I try to buy when it’s obvious that even mediocre performance (compared to the past) will produce a good return, while knowing that the company itself is more likely than most to surprise to the upside.

For TerraVest, things are pretty simple. With 18.1 million diluted shares outstanding, the company is currently trading at a market cap of roughly C$650 million. With C$46.8 million in 2022 earnings, the company’s trading at roughly 14x trailing net income, likely a good bit lower when compared to expected 2023 net income. It trades for roughly 11.9x 2022 Distributable FCF, and again, likely much lower compared to 2023 Distributable FCF.

Obviously, the share price has increased quite a bit over the course of 2023, probably more than it ever has in a single year before. Regardless though, I still think TerraVest has a lot more growth left ahead of it. The company’s still cheap on 2022’s measures, and revenue and FCF have been growing at a pretty nice clip so far in 2023.

In my 2018 write-up, I did a pretty simple DCF to determine an adequate value – which, in the end, was pretty far below the mark at C$14 a share. Today’s share price on the Canadian exchange is over C$36 a share. Luckily, I didn’t fall prey to my own inaccuracies and realized that this was a good business that was compounding in value every year. While I won’t flat-out condone a DCF, I think the real problem for most investors is getting anchored to their predicted price. Fortunately, I went into the 2018 DCF knowing it was a conservative hypothetical. I knew that if I try to determine an exact value for TerraVest, I would become wedded to it – to my own detriment.

Nevertheless, today I’m going to use a similar method to estimate TerraVest’s potential future valuation. I will, like I did then, use it simply as a measuring stick. Things never work out exactly like we plan, and I know that all this is just a way to show to myself that I’m not overpaying (all the while hoping that my valuation is vastly undershooting TerraVest’s potential – which I think it is).

Source: My own Calculations

The “model” – if you can even call it that – isn’t complicated. All I did was take the total capital invested for 2022 (debt+equity) and apply a normalized Distributable FCF ROIC (14% is what I came up with, based on past performance). Then I subtracted the dividend from the Distributable FCF, and assumed it was reinvested in the business (probably by way of acquisition), with the new capital base once again generating a 14% ROIC.

Essentially, I created a hypothetical scenario where TerraVest only grows as fast as its return on capital will allow. After 8 years, I applied a 15x multiple to the 2030 estimated Distributable FCF number and got C$2.3 billion in market value. Assuming no share buybacks (which seems unlikely), TerraVest’s estimated share price would be C$128.26 a share. That’s roughly 3.56x today’s share price (~20% CAGR). It’s not 10x, but a 20% CAGR over 7 years is still a great return on your investment.

Keep in mind though that this scenario is about as simple as it gets. It doesn’t assume improvement in operations – which his very possible as TerraVest grows larger and larger in industries that it is beginning to dominate. I would expect it to gain some economies of scale and have better pricing power with suppliers over time. This could drive earnings growth (or Distributable FCF growth) to exceed sales growth over a comparable period.

In addition, given TerraVest’s average share price over this period, it could also buy back a good bit of shares. The scenario I presented above doesn’t take debt into account, but instead assumes that all acquisitions are funded by cash generated from operations. TerraVest has been juicing returns lately by buying more businesses with debt. As long as it can sustain this debt level, I have no reason to believe that it wouldn’t be able to significantly boost returns in the future by making its acquisitions with debt and funding share buybacks with Distributable FCF.

Finally, the above valuation doesn’t really assume that much multiple expansion. I don’t know what TerraVest’s future prospects could look like in 2030. But what I do know is that compounding-type roll-ups like Constellation Software (I know, heresy to compare the two) are typically trading at around 20x FCF or higher. If, in the above scenario, the market bestows a 20x multiple on TerraVest’s 2030 Distributable FCF, then you’d be looking at a 4.7x return.

Conclusion

TerraVest is a company that you can get comfortable with. It has a great track record; good experienced, and young management; as well as a long potential road of growth ahead of it. TerraVest already dominates most of the markets it operates in, and acquires its competitors at what appear to be multiples that would make most public market investors drool.

Yes, its share price has been on somewhat of a tear this year. But for what you’re getting, I think TerraVest is still a great buy right now. You could be looking at stable and strong growth from operations as well as multiple expansion given a sufficient period of time. Even with management being relatively quiet on the investor relations and media front, the company has still started to garner somewhat of a following. I expect this to only increase over time, driving the valuation higher as TerraVest continues to outperform.

This Publication is for informational purposes only, and nothing we say should be taken an investing advice. Past performance is not predictive of future returns. If you are considering a purchase of securities, please consult a licensed financial advisor. This is not a solicitation or an offer to buy any of the securities mentioned. This is not advice to buy, sell, or hold any of the securities mentioned. The author of this Publication may have positions in the securities mentioned or may initiate a position in the securities mentioned in the near future.