Wise plc

This report was originally published in July of 2023

You can download the PDF here:

I think almost everyone reading this will know what Wise plc is (LON:WISE). At a market cap of £7.9 billion ($10.2 billion), it’s the largest company I’ve written about, and may very well remain the largest. I have nothing against analyzing and writing about larger companies, but the opportunity has to be large enough to support their transformation into a much larger company.

On the surface, Wise may seem like an overhyped growth stock. And on traditional metrics, that may be the case. But you have to analyze Wise differently. I’ve said before that what I care about is how large a company can get. I don’t necessarily care about the valuation based on current metrics if they don’t reveal anything insightful. But normally, the companies I write about have lower multiples because they’re usually already producing so much cash. Sometimes it’s hard for people to comprehend, but there are some companies out there that you have to just do the simple back-of-the-napkin math on to get an idea of the potential returns. Wise is one of them. It’s also a company that, I believe, is in a great position to surprise long-term investors on the upside. And that’s what I’m always looking for.

If I told you that some company was trying to disrupt traditional banks, you would look at me like I’m crazy. In fact, I’d probably call someone delusional if they told me that would work. That’s why I, in particular, don’t like fintechs that are masquerading as tech companies and trying to take on traditional banks. There really isn’t a safer and more efficient way to take in deposits and make loans than the way traditional banks are doing it right now.

I would also think that any company that tries to take on the traditional payment networks – like Visa, Mastercard, Amex, etc. – is out of its mind and wasting its (and shareholders’) time and money. But there’s one area of the international financial markets that was and still is actually ripe for disruption. An area that is massive but also so insignificant and outdated that for most traditional banks it doesn’t make sense for them to try to really take it back from the upstart who’s stealing it. That area is the cross-border payments market.

Cross border payments can comprise anything from property transactions, foreign investments, paying foreign freelancers or employees, paying suppliers overseas, to remittances and peer-to-peer transactions.

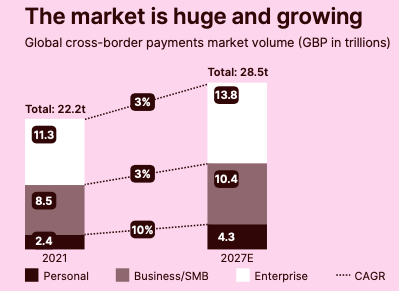

Source: Wise FY 2023 Annual Report

Right now, Wise estimates that their own addressable market (which is mainly Personal and Business cross-border transactions) is about £11 trillion, and will likely grow to £14.7 trillion by 2027. Wise estimates that traditional banks control around two-thirds of the total volume, while the remittance companies (like Western Union and Money Gram) control around 13% and non-bank payment companies control around 18%.

The interesting thing about this market is that it is dominated by incumbents who are (1) fragmented, (2) reliant on outdated procedures and technology, and (3) unable to change. Network effects are a real thing, but reverse network effects can also have an effect on an industry.

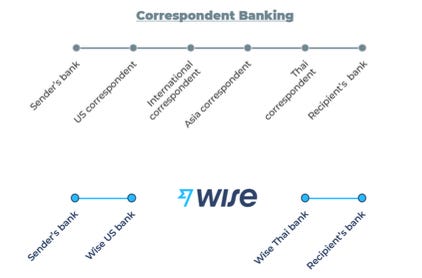

I believe this is happening with Wise. They say repeatedly in their annual reports and earnings calls that they are creating a new cross-border payments infrastructure. And, at first blush, it doesn’t really seem like it. They started by (and still mainly operate by), managing their own Wise bank accounts at local banks in separate countries. As I’ll explain below, they transfer money through their own internal system without ever actually transferring money across borders. It’s an extremely efficient, and much simpler, way of conducting cross-currency and cross-border transactions. And I think its simplicity hides the real threat to incumbent banks.

The international banking system isn’t Wise. It’s made up of many, many separate banks who all have to figure out how to settle their accounts with each other every day. To do this, they’ve created several standards and best practices that have been in place for years, if not decades. The most popular is the SWIFT payment network. SWIFT isn’t really a way for banks to transfer money (the SWIFT system never touches the funds), but is an encrypted messaging system used by banks to make cross-border transactions. Today, roughly half of all transactions are conducted through the SWIFT system. But each country or economic area typically also has its own mandatory payment system through which it transfers money (for instance, Europe has the TARGET2 system, which is mandatory for all banks in the Eurosystem).

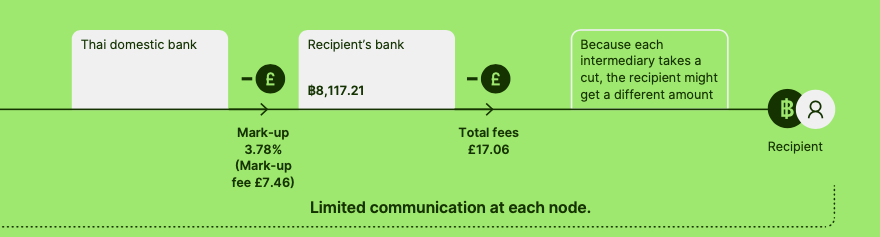

Source: Wise FY 2021 Registration Statement

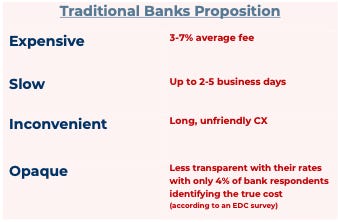

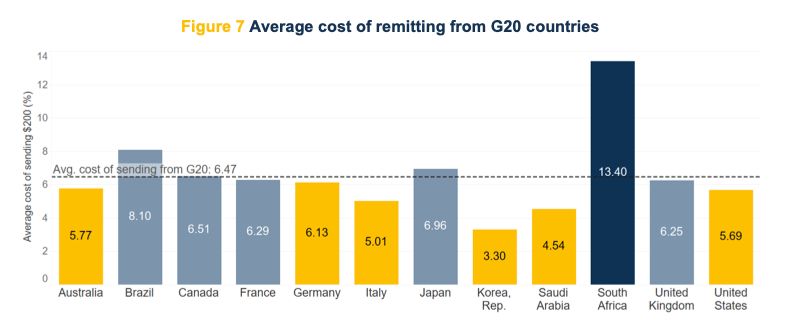

Banks’ cross-border transfer rates are typically several percentage points (typically hidden in the exchange rate), and the actual transfer itself usually takes days. Further, the money itself can travel across multiple intermediaries before reaching the recipients’ final destination, and incur many hidden fees as a result. Even in G20 countries, the average cost of sending money to another country is over 6%.

Source: World Bank

Through its own system, Wise has offered transparent rates, extremely low rates – typically fixed fees of 0.20 in combination with rates of 0.65% (higher or lower depending on the payment route) – and quick payment times (over 90% of payments are made within 24 hours, and 55% are made instantly).

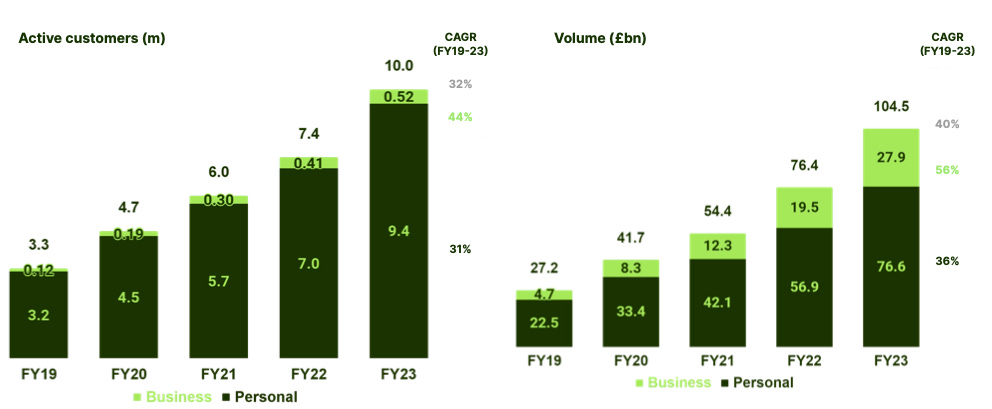

You can also tell that there’s a current need in the digital banking world for a solution like this. Wise is growing extremely fast – FY 2023 volume is up 37% YOY and active customers are up 37% YOY – and they claim that two-thirds of their growth is driven completely by word-of-mouth. They spend less than 5% of their revenue on marketing, so virality is essentially the main growth tactic at the moment. If there’s any indication that the market is in need of a solution like this, it’s the fact that Wise’s product is attracting so many customers without the need to advertise much at all.

Yes, Wise is a £7.9 billion company that generated just £114 million in earnings last year – I’m aware. But it’s still an amazing company that requires essentially no capital to grow, is attracting customers while spending almost nothing on marketing, is attracting a large amount of lucrative deposits to its platform, and has a high-quality revenue stream with a gross margin of 66% in FY 2023. The only real constraints on growth are the local regulatory environments and pace at which Wise can hire new employees (in particular, Service personnel).

You have to back up for a second and ask yourself what might happen to Wise. How could it succeed and how could it fail? It has the potential to be a Visa and Charles Schwab wrapped into one (operating as a payment network and attracting a massive amount of customer deposits that it can earn interest on). But in spite of all this, Wise is still determined to return as much of its profits to customers as it can while it scales. The only real risk I see (though it may not seem like it at the moment), is the potential to lose the customer’s trust.

The Business

History

Wise was founded as TransferWise by two Estonian immigrants living in London back in 2011. As the story goes, Kristo Kaarmann and Taavet Hinrikus met in London and were discussing their issues related to sending money across European borders. There were hidden fees, long wait times, and expensive transfers.

So, the two decided to create their own workaround to the system. One would transfer his British Sterling from his London bank account into the others’ bank in London. The recipient would then send the foreign currency from his bank (I assume in Estonia) to the other’s bank in Estonia. They would just look up the current exchange rate between the two currencies, and send the corresponding amounts to each other.

The pair eventually expanded this workaround between friends and acquaintances and decided to turn it into a company. Transfer Wise was founded in 2011.

Source: Wise FY 2021 Registration Statement

It was only operating in the UK and EU at the time, but it purportedly did £10 million in transaction volume its first year. TransferWise opened its first office in London in 2012, and raised $1.3 million in seed funding the same year.

At this point, Wise wasn’t much more than a digital Western Union. They used their own internal network to transfer money, and because they weren’t dealing with actual cross-border transfers, they were able to charge significantly less than major banks. There weren’t customer accounts and deposits in the beginning, just a way for people to cheaply and easily transfer money.

By 2014, the company had done £1 billion in volume, raised another $58 million in funding, and expanded into the U.S. and Australia. Two years later, it expanded from individual people into the business market, launching an SMB-focused offering. It also became the first tech company to get direct access to the UK Faster Payments Service. By 2017, Wise turned its first profit, was doing over £1 billion a month in volume, and launched its first Asian-Pacific hub in Singapore. Wise continued growing, and by 2020 had been approved by the FCA in the UK to offer investment vehicles (bonds, money market accounts, stock index funds) in its Wise Accounts feature.

Wise went public in 2021 after changing its name from TransferWise to Wise. It did a direct listing on the London Stock Exchange at a valuation of £8 billion, which was the largest ever tech listing in the history of the LSE, and the first direct listing. The co-founder Taavet Hinrikus (who was serving as Chairman) stepped down and the company brought on David Wells to be Chairman in his place.

Operations

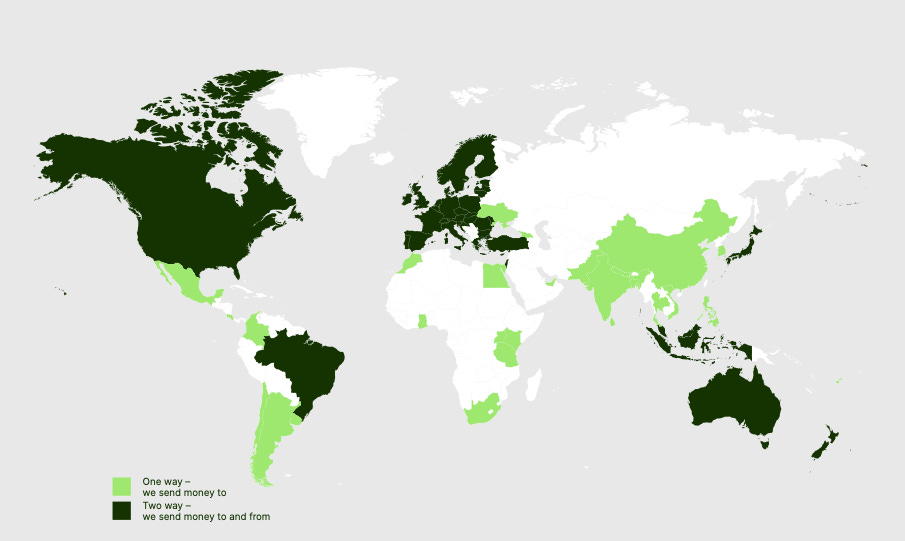

Today, Wise operates across 175 countries and 40 different currencies. They handled £105 billion in volume for FY 2023 (their fiscal year is essentially a year ahead of everyone else), serviced over 16 million customers, and had 10 million active customers use their services (measured as a customer who at least made one cross-border transfer in the last quarter).

Source: Wise FY 2023 Annual Report

As I stated above, Wise still operates on something similar to the model it started out on. It has bank accounts in separate countries and performs the actual transfers in the same country in which it takes place. The company, though, is also focused on expanding to integrate directly with local payment systems in each country in which it operates (which it recently did with Brazil’s PIX system in Q3 2023).

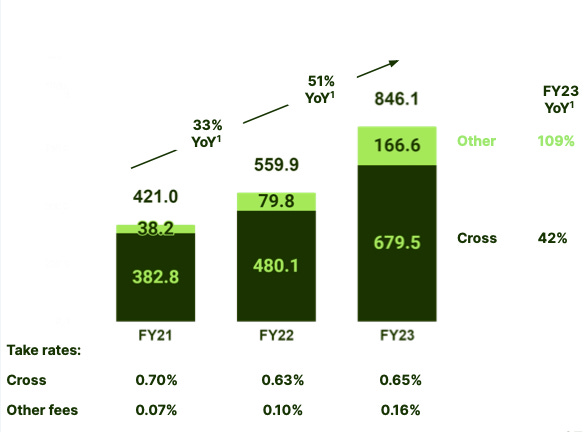

Overall, Wise still generates the majority of its revenue from fees charged on cross-border transfers, though other fees have started to make up a larger and larger portion of total revenue.

Source: Wise 2023 Investor Presentation

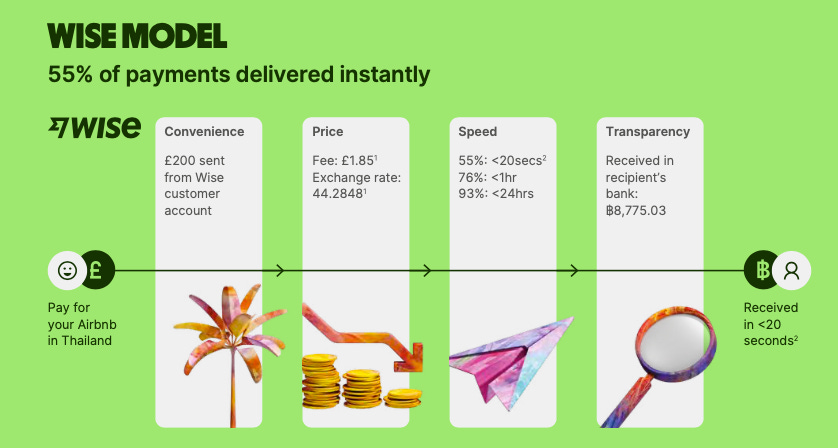

Wise’s strong competitive position – it currently handles £105 billion in total cross-border payment volumes and is the largest single player – is mainly due to its four core value drivers: (1) price, (2) speed, (3) convenience, and (4) transparency.

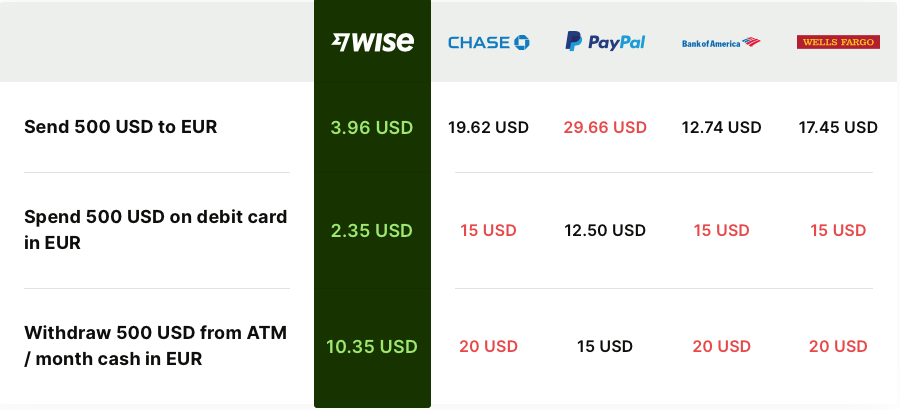

Although they vary across currency routes, Wise still offers some of the lowest rates out there. It definitely beats traditional banks and beats the majority of remittance providers on price. A typical Wise transaction (though, again, they vary per transaction and location) would involve something like a combination of a £0.20 flat fee and a 0.65% charge based on the volume of the transaction. Take a look at Wise’s fees compared to a typical big bank/payment company below:

Source: Wise.com

Over time, Wise’s average price per transaction has been coming down, though it has risen recently. Wise claims this is the result of currency volatility as well as the addition of new payment routes that are more expensive to operate. Wise itself plans to keep lowering rates over the duration of its life, eventually (so it says) reaching zero or close to zero.

Source: Wise FY 2023 Annual Report

As far as speed goes, I think it’s safe to say that Wise can’t really be beat. Over 90% of its transactions clear in less than 24 hours, 76% clear in less than an hour, and over half clear instantly. Compare this to a traditional bank, that typically takes 2-5 days to transfer money across borders.

Source: Wise FY 2023 Annual Report

Today, a typical Wise transfer looks like the following:

Source: Wise FY 2023 Annual Report

In this instance, the total price is £1.85 for £200 sent over Wise (an effective take rate of 0.925%), which takes place within 20 seconds.

Compare that to a typical bank transfer for the same transaction:

Source: Wise FY 2023 Annual Report

Convenience is a pretty underrated component of Wise’s offering, but perhaps the most important. I’d argue that price and speed were the two most important growth drivers in the past, but convenience is what will bring in the next cohort of customers, especially as Wise is no longer able to differentiate itself on price alone compared to other non-traditional payment providers. As long as the Wise app and Wise Account is a convenient place to transfer and receive funds across borders, I think Wise will continue to take market share.

As far as transparency goes, Wise has committed from the beginning to always be transparent with its pricing – and it is. It even takes it a step further, actually comparing its prices with all of its competitors on its website – and showing when someone else has a better price.

Source: Wise.com

It’s obvious that Wise isn’t afraid to show when it’s not the cheapest – they are all about transparency and trust with the customer. And, of course, depending on the country and currency exchanged, Wise may be the cheapest. It just isn’t always the cheapest everywhere – but it’s always close.

While continuously improving and building off of these core value drivers, Wise is also focused and investing in three main products/services. They are:

The Wise Account

Wise Business

The Wise Platform

Wise still services some customers who simply make transfers over their website without actually opening an account, but the focus is on attracting customers who open accounts, keep balances with Wise, and use Wise more often.

Source: Wise 2023 Investor Presentation

In fact, Wise has found that roughly 36% of their personal customers are multiproduct customers (customers with an account who do more than just transfer money) and 55% of their business customers are multiproduct customers. This is up from 24% and 49% in FY 2022 respectively. What they’ve found is that active customers with accounts typically make 3x more transactions than other customers and generate twice as much volume. Essentially, these customers are more valuable to Wise since they use the product more.

So, it makes sense that Wise will try to incentivize more customers to use multiple products, open accounts, and hold balances with Wise. Part of the way that Wise has tried to do this is by issuing debit cards. Both the personal Wise Account and the Wise Business account allow the customer to use a Wise debit card (and they’re now testing a cash back option), which generates interchange fees for Wise (a growing revenue source, and the largest portion of “other fees” collected by Wise) and drives higher use. Today, Wise has over 4 million cards in circulation, and has partnerships with Visa and Mastercard to issue these cards in a multiple countries.

Source: Wise 2023 Investor Presentation

Wise’s active customer base is up by 3x since 2019. And, as you can see, even though a small number of the total customer base was made up of businesses (just over half a million), they are starting to comprise a larger and larger portion of the total volume that Wise captures. This is primarily the result of the much larger volumes that business customers move across borders.

As of FY 2023, Wise’s average volume per customer (VPC) was at £10,500. That’s up from £8,212 back in 2019, but only slightly up from £10,270 in 2022. This is primarily attributable to Wise’s personal customers, who have apparently run into the limit of the general volume they’re going to transfer on the platform. And that makes sense – most individuals aren’t going to be transferring much more than £8,149 in one year (which is the latest VPC that Wise’s Personal segment recorded). Business customers, on the other hand, have provided Wise with a continuously rising VPC – going from £39,496 in 2019 to £53,654 today, and increasing by 12.8% in 2023 alone.

Overall, Wise has made significant progress on the Wise Account front. Its total deposits at year-end 2023 were at £10.7 billion, up more than 10x since it reached £1 billion in 2020. This growth really provides a double whammy type outcome for Wise. First, it just makes its entire customer base a lot more sticky. The more people have accounts with Wise, the more they will use Wise, and the more they will tell other people about Wise (remember 66% of growth from word-of-mouth). But second, it actually adds another income stream.

At the moment, Wise is susceptible to currency exchange rate volatility, macro issues, and decreasing volume on its platform (for whatever reason). But the interest it can generate from the new deposits it’s bringing in (at a rapid rate, I might add) will at least hedge its total income. Obviously, interest income has its own set of cyclical issues, given it is 100% dependent on what the interest rates are doing, which Wise cannot control. But, as we’ve seen with Charles Schwab, this can be a good business. Even if Wise returns some of the interest to its customers, it’ll still be generating revenue on customer accounts whether they’re making transactions or not.

A lot of Wise’s past growth has been supported by growth in both active customers and growth in VPC. I don’t think Wise is anywhere close to hitting the limit with Personal active customer growth, but it could be hitting the limit with Personal VPC growth. Fortunately, I have a feeling that business customers will make up for this. Not only can Wise likely grow its Business active customer base at a high rate, the VPC growth will probably keep growing as it brings in larger and larger businesses.

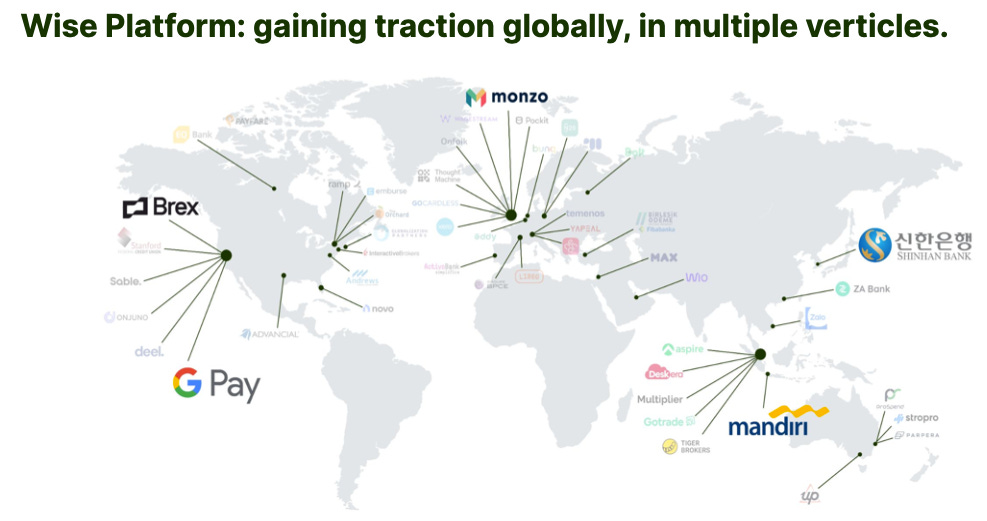

And that brings me to the Wise Platform business. Wise has now taken its underlying infrastructure and started offering it to a variety of banks, payment companies, and tech companies for them to white label. Essentially, if a bank wants to easily transfer customer funds across borders (for cheap) they can incorporate Wise’s API into their system and pay Wise a fee to do so.

Source: Wise 2023 Investor Presentation

Wise has about 60 partners that are using the platform right now, partnering with some of the more popular fintech and tech companies like Brex and Google Pay, as well as large foreign banks like Mandiri Bank (the largest bank in Indonesia). I think there’s a pretty big opportunity here – Wise has already said its platform is enabling 25 million more people to have access to its payment infrastructure. And, in my personal opinion, this is a direct route into the massive enterprise cross-border transfer market that Wise doesn’t really have access to right now.

Financials

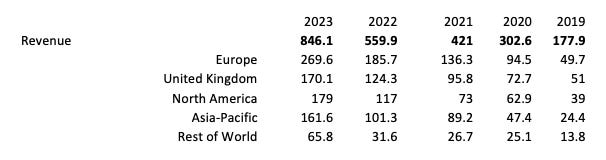

As of FY 2023, Wise generated £846.1 million in revenue on £105 billion in volume (a take rate of 0.805%). Revenue grew by over 50% in FY 2023, and has grown at a CAGR of 47.6% since 2019 (the oldest data I have). Total Income has grown even faster, driven by rapidly increasing interest income, and sat at £964.2 million in FY 2023. Interest income in FY 2023 was over £140 million, compared to £3.9 million in 2022 and 0 before that.

Roughly 31.8% of Wise’s revenue comes from Europe (27% in 2019), ~20% comes from the UK (28% in 2019), 21% from North America (21.9% in 2019), 19% from Asia-Pacific (13.7% in 2019), and 7.7% from the rest of the world (7.7% in 2019 as well).

Source: Wise Annual Reports

Overall, growth across regions has remained pretty steady. Asia-Pacific seems to have made the largest gain compared to the others, and the UK seems to have lost the most, but overall, Wise’s revenue base is still pretty geographically diverse.

Today, about 77.5% of Wise’s revenue still comes from the Personal segment, but the Business segment has been growing (as a percentage), albeit slowly, from ~18% when Wise went public to over 22% today.

Wise’s Gross Margin (as a % of total Income, not Revenue) has risen to ~66% in FY 2023, up from around 62% before Wise went public. A lot of this growth has come in the last two years as Wise has started generating interest income that it didn’t have access to before. In fact, with the exception of FY 2022 – when Costs of Sales actually decreased – this gross margin increase has primarily been brought about by interest income growth.

Wise’s margin profile as a whole has gotten better since 2019. But Wise’s margin improvements have primarily come from increasing gross margins, not any improvement in its overall expense management.

Source: Wise Annual Reports

Wise’s Administrative Expenses as a percentage of revenue have actually increased from about 55% to 58% since 2019. The majority of its expenses are pretty trivial – marketing, T&D, outsourced services, general overhead, D&A, etc. – and will likely remain stable as Wise grows, providing some operating leverage.

But its largest expense are its people. Wise spent £294.8 million on employee wages and benefits in FY 2023, and this expense has grown by 59.5% and 30.5% respectively over the last two years. This is primarily a result of its expanding headcount. As of FY 2023, Wise employed 4,411 people (a number that I think has grown to over 5,000 in FY 2024). More than half of these individuals provide servicing functions (customers service and fixing problems with the system), around a quarter are in product development, and the rest serve in a variety of other roles.

Now, you may look at this and think why would Wise be spending the majority of its money on servicing personnel. When you think about business strategy and execution, servicing seems like an insignificant task – something you outsource. But for Wise, I would argue that it’s probably the most important function they can invest in. As I’ll discuss below in the risk section, I think one of the largest risks to Wise’s business model is a failure to properly fix issues as fast as possible. With a business like this, there are going to be issues, and they are going to be very detrimental to customers if not handled quickly.

So, Wise has been investing pretty heavily in its Servicing employees – something I think is a good investment. As it grows, it’s probably going to need as many of these people as it can handle. Yes, it wants to develop new and better products, and yes it wants to have people that can communicate with local financial systems and regulators. But it already – for the most part – has its infrastructure system figured out. It hasn’t changed its model much since it was founded in 2011 – it has just added bolt-on products and constantly improved transaction times (all good things). But with a service like this, customers grow used to that – what they remember are the problems, which will only grow with size.

And, since we’re talking about growth, let’s dig into how Wise actually grows. Wise’s growth model (if it can continue to attract customers) is really the holy grail. It requires essentially no capital to grow – capex was £8.8 million in FY 2023. And, even more impressive, it doesn’t require much marketing at all to bring in new customers. Wise is focused with the marketing it does do, but it’s refreshing to see a consumer tech company that isn’t raising a ton of capital to constantly grow through excessive marketing spend – 66% of its customers are coming in through word-of mouth alone.

Now, will this always be the case? I don’t know. Wise may one day have to spend more to generate more growth, but at the rate it’s going it has the classic product-market-fit viral growth loop. It will – like a lot of companies – require marketing when it matures, but let’s hope growth continues to keep coming in for free.

How will Wise’s margins hold up as it grows? It’s hard to say. Its cost of sales (as a percentage of actual revenue) have stayed pretty steady throughout all the years of data I’ve seen. So I’m not necessarily worried about that – its unit economics are good. But you still have to take into account the fact that Wise is planning on continuing to cut prices and give more of its margin back to consumers. How will that work as it needs to bring on employees (especially Servicing employees) to scale? I don’t know, but I think that Wise understands the potential pitfalls around lowering prices when it can’t afford to – it’s actually been raising prices lately. With its level of growth, I don’t think Wise will find that it really needs to continuously lower prices very quickly to bring in new customers. Though things may change if competition heats up.

One thing is for sure though – if Wise can continue to grow customer deposits and earn interest on those deposits, its margins will likely increase. Even though it’s going to return a decent amount of this interest income to customers, almost all of this income basically drops to the bottom line. Wise doesn’t really incur any more expenses to earn this income. So, in my opinion, this is a segment of the business that will really juice margins in the future, and make Wise a lot more valuable than it would seem at first glance.

Source: Wise 2023 Investor Presentation

As far as cash flow goes, Wise is doing pretty well. Its cash flow statements actually misrepresent the real cash position of the company because increases in customer accounts are included in Operating Cash Flow. Wise can’t exactly use that money to cover expenses (though it can earn interest on it), so its actual FCF is much lower, though it has always been positive. It’s jumped around some over the years (mainly as a result of working capital changes), sitting at £36.5 million in 2023, £138.3 million in 2022, and £171.5 million in 2021, but has been positive since FY 2020. But overall, Wise doesn’t seem like a company that’s ever burned a large amount of cash.

If you want to get a better picture of FCF and kind-of even things out, you can take Wise’s EBITDA measure and subtract capex. This gives Wise £171.6 million of FCF in FY 2023 – a measure that probably better reflects its cash generating abilities.

Wise’s balance sheet is about as clean as they come. It has very little debt – I assume just a revolving loan to meet short-term cash flow needs, and it doesn’t have to raise any capital to grow. Its long-term assets are effectively non-existent, and the majority of its balance sheet consist of customer deposits that it holds. But overall, Wise’s balance sheet is of very little importance (as long as it manages client funds prudently and ethically).

Management

I’m not going to put it in the Risk section because I’m going to talk about it here, but Wise’s management situation is both scary and impressive. On the one hand, you’ve got one co-founder (Kristo Kaarmann) still there, leading the company as CEO through very impressive growth. His company is making great progress around the world, partnering with some of the leading financial institutions, and making customers happy.

But you’ve also got a situation where the other co-founder has already exited, the CFO is leaving soon, and the CEO has had a small (but maybe significant, depending on how you view it) issue with his taxes in the recent past.

At the time of the IPO, the co-founder Taavet Hinrikus stepped down as chairman of the company. Unfortunately, the CFO – Matthew Briers (who was also a director) – has announced recently that he is also leaving in FY 2024. First, I’ll say that a lot of peoples’ radar goes up when a CFO announces he is leaving. Sometimes it signifies that there are issues with the company that the CFO doesn’t want to be a part of. I don’t know if that’s true here, but, as noted above, there have been issues with Kaarmann’s personal taxes recently. I don’t necessarily think the two are connected, but it’s something to watch out for. The reasoning for leaving is also kind-of strange. And I’m not trying to say anything negative here, but Briers and Wise announced that he is leaving to recover from a bike accident in 2022. That was supposedly a year ago, and he is now leaving to recover from it? It is kind-of strange, but maybe I shouldn’t read too much into it. Also, Briers seems to have been a very important part of the team. He served as a director, and handled all of the questions and the summary on every earnings call. Wise’s financial director, Kingsley Kemish, will be serving as the interim CFO.

The company, impressively though, added David Wells as Chairman to replace Hinrikus. Wells, as some people may know, served as the CFO of Netflix for the majority of its streaming growth years. Given his history, I think he may be able to step into a CFO role as well now that Briers is leaving. But I don’t know, and it may not even be the best move. Regardless, Wells has an impressive background, and has experience growing a tech company that’s disrupting a pretty old industry.

In June of 2022, the CEO, Kaarmann, was hit with a £365,651 fine for failing to pay a tax bill in 2018 worth more than £720,000. The UK Financial Conduct Authority (FCA) launched an investigation into the conduct. And while this doesn’t seem that serious on its face (to me at least – could have been a mistake), the UK’s laws work in such a way that Kaarmann could be forced to step down as CEO of a publicly-traded company if he fails his “fit and proper test.”

This is all pretty strange, and it is a risk. If the company loses its CEO, this could be a major problem. And there’s also risk around how this reflects on Kaarmann and the company, and how the UK government views them. The good news is that the company has a tested Chairman (who specialized in financial matters at Netflix) to help them through something like this.

Today, Kaarmann is still the largest shareholder in the company, with ~18% of the shares outstanding. He also owns a significant number of special voting shares that give him effectively 48% of the voting power. The co-founder Taavet Hinrikus is the fourth largest shareholder with just over 7% of total shares outstanding.

Competition

I think the bottom line here is that Wise has competition, but that doesn’t mean it won’t succeed. I personally like to find companies with very limited competition, and I think Wise does have limited competition. It has some direct competitors, and a lot of indirect competitors. But keep in mind that most of the market is still being serviced by traditional banks, who really can’t compete with Wise.

And having competition isn’t the end of the world, honestly. I think of Wise kind-of like the online brokerage market. There are a decent number of online securities brokerages, but a few of them still dominate and are still great businesses. Wise doesn’t have to be completely without competition to generate great returns going forward, it just has to be the market leader – which I think it can be.

Western Union and MoneyGram

Western Union is the oldest (over 170 years), and the largest pure-play company (based on revenue) in the global cross-border payments market. It focuses mainly on the remittance market, and, because of its long history, has a network of in-person agents that Wise just can’t compete with. And Wise shouldn’t want to compete with them on this. Wise isn’t going to take away the unbanked or underbanked population who use Western Union unless they decide to use a digital Wise account (which very well may happen).

Western Union moves a few hundred billion in volume a year and generates a few billion in revenue, so it’s still larger than Wise. But Wise is gaining pretty fast. Keep in mind that Western Union has been in business for over 150 years. Wise has been in business for just over 20 and is doing over £100 billion a year in volume.

MoneyGram, like Western Union, is also focused on the global remittance market. It, also like Western Union, was publicly traded. Though in 2023, it was acquired by private equity firm Madison Dearborn Partners for around $1 billion.

Western Union and MoneyGram are, for the most part, going after a different segment of the market than Wise. For the most part, they serve the unbanked immigrant market. But they do intersect with Wise in a few areas. Both companies have introduced digital solutions and are trying to acquire the kinds of personal customers that typically use Wise. This could obviously be a competitive threat to Wise, but I think Wise’s full package of offerings probably puts them safely ahead in the digital market for now. It’s still something to keep an eye on though. Both Western Union and MoneyGram are large companies that have a long history of dominating the remittance market. Their brand names alone may be enough to drive their growth in the digital remittance market.

Remitly

Remitly is probably the most direct competitor to Wise in this market. It was started the same year as Wise, but in the U.S., and it largely offers something similar – digital cross-border payments. As of year-end 2022, Remitly had 4.2 million active customers (growth of 48%) and $28.6 billion in volume (growth of 40%). So, it’s a good bit smaller than Wise, but still growing pretty fast.

However, Remitly doesn’t seem to have the brand recognition that Wise does. For instance, to generate growth that is slower than Wise’s, Remitly is spending around 26% of revenue on marketing (compared to Wise at less than 5%). And it just doesn’t seem to have generated the kind of viral growth that Wise has. As a result, Remitly is operating at a loss and is burning significant cash to grow – a far cry from Wise’s sustainable growth that doesn’t (at the moment) require any new capital to fuel.

Remitly also doesn’t seem to have the same kind of infrastructure that Wise does. Remitly offers lower rates than Wise in some corridors, but mainly operates over the standard banking network. It doesn’t operate its own network, but it still seems to be able to offer quick and cheap transactions (it claims that 90% of its transactions are completed in less than an hour). The fact that Remitly seems to be able to offer the same or lower rates at the same speed (maybe not in every area) does make me wonder, though, why it can do this but the banks it’s using can’t.

Finally, from Remitly’s annual report, it seems that they are more focused on the remittance market than the banked or business markets that Wise is focused on. Hopefully that remains the case, but only time will tell. Remitly, though smaller, is a serious competitor that has a chance of taking market share from Wise.

Xoom

Xoom has been around since the early 2000s, but to be honest, hasn’t made much progress in the cross-border payments market. I don’t know a ton about the company, but apparently it (like a lot of the remittance companies) has consistently kept prices – hidden prices in the exchange rate, mind you – much higher than Wise and Remitly. This article does a pretty good job of explaining Xoom’s problems.

In 2015, PayPal acquired Xoom for just under a billion dollars. And honestly, it looked like PayPal may be able to use Xoom to expand its already-large payments business into the cross-border market.

As of May 2023, however, it’s been reported that PayPal is exploring a sale of Xoom after just eight years of ownership. Apparently, activist investor Elliot Management is pressuring PayPal to focus on its core business, so it has decided to sell-off what appear to be slower-growth businesses like Xoom.

I don’t know how exactly this will affect the cross-border market, but if a payments giant like PayPal has to exit this market, I think it bodes well for Wise.

Zepz

Zepz is another Wise competitor that’s taking an interesting approach to the international payments market. It operates as more of a holding company and owns money transfer firms WorldRemit and Sendwaves. But it recently laid off around a quarter of its workforce, after laying off 5% in June of 2022. And apparently, it’s on the lookout for more M&A bolt-on transactions.

Unlike Wise, Zepz still isn’t profitable as a whole, despite being roughly the same age as Wise. It is, however, still growing relatively fast, increasing its customer count by 30% over the last year.

But like Remitly, we see a smaller company in the cross-border payments space that still hasn’t achieved profitability. It’s interesting, because Wise isn’t without smaller competitors across Europe and the U.S. But most of them can’t turn a profit, which tells me either they haven’t reached scale (like Wise has) or that they can’t afford to offer their product at a price as low as Wise. Either way, I think the fact that both Remitly and Zepz are unprofitable and are failing to grow as fast as Wise is a good sign.

Visa Direct

Visa might be the scariest competitor Wise has. It already has an international payment network that the most consumers and businesses around the world rely on. And it’s known for being much more efficient than traditional bank ACH or cross-border networks. So, the question is will it actually make a move on the cross-border transfer market?

I don’t know for sure, but Visa Direct is a step in that direction. The good news is that, in my opinion, the threat with Visa Direct isn’t really to Wise’s customer-facing business (which is the majority of their business right now). Visa itself isn’t an issuer of cards, it provides the payment network. So, while most consumers are aware of Visa (they probably use a Visa card), they don’t actually interact with Visa itself. They get a card that’s issued by a financial institution or some other company. There isn’t a Visa app that people use to transfer money. In fact, the majority of people are using third-party money transfer apps for P2P payments or bank-to-bank transactions. It doesn’t matter that Visa interacts with millions of people every day when it transfers their money, it’s honestly operating more in the background.

I think Wise is operating more like the third-party money transfer apps. To some extent, it’s like the Venmos, Zelles, and Cash Apps of the world. Regardless of Visa’s dominance, consumers are going to use an app to transfer money, and the most popular/easiest one wins. Right now, that’s Wise for cross-border transfers. But where Visa Direct comes into play is the potential to disrupt Wise’s business by partnering with the banks.

First, this would directly affect Wise’s Platform business, which would effectively be doing what Visa Direct is trying to do with its banking partners – integrate its own payment infrastructure and technology with the bank’s white labelled money transfer offering.

But Visa Direct’s ambitions also pose another risk to Wise – and that’s the fact that it may actually make the traditional banking system more competitive with Wise. It’s already hard enough as it is for Wise to convince customers (the majority of whom still use the inferior banking system) to switch to Wise to transfer money. As easy as it is to open up a Wise account, most people don’t want to transfer money around between bank accounts. They’d rather keep everything with one bank, sometimes even if the bank charges them higher fees to do things like transfer money across borders.

And if it just gets easier and easier to transfer money across borders with your main bank, then Wise will likely run into a growth wall. I honestly don’t know enough about the technical money transfer rails all around the world to know for sure how quickly or easily Visa Direct could implement what it claims it can. But, if anyone knows about international payment rails, it’s Visa. So, this is for-sure a real threat to Wise’s business. But, keep in mind that people still us third-party apps for P2P transfers, this may continue to be the case for cross-border transfers as well – even with business customers. For Wise’s sake, I hope that’s the case.

Going Forward

Wise reported its Q1 2024 results recently, and showed revenue growth of 29% YOY to £240 million, total volume growth of 16% to £28.2 billion, quarterly active customer growth of 33% to 6.7 million, and total income growth of 66% to £311 million. So, obviously growth has slowed some compared to FY 2023. But that doesn’t necessarily mean things are looking down. Growth of ~30% a year is nothing to scoff at.

In addition, Wise grew its total deposits to over £11.5 billion by the end of the quarter and was earning an average of 3.5% on deposits and returning 0.9% to customers. Because of this, Wise’s total income grew much faster than its overall revenue, as cross-border transaction volume has slowed considerably in 2023 but interest rates have risen.

This is an interesting case study of diversification for Wise’s future though. The rising rates and slowing transactions may not have a perfect correlation, but they are definitely correlated. With the amount of deposits Wise is attracting (at a rate of close to £1 billion a quarter now), it can more than offset slowdowns in cross-border transaction volumes when rates rise or economic activity slows in general.

What is a little worrying – though maybe not too serious – is that Wise’s VPC actually decreased in Q1 2024. Total quarterly VPC decreased 3% QOQ from £4,400 to £4,200 and 13% YOY from £4,900 to £4,200. In addition, both Business and Personal VPC decreased as well – this wasn’t just driven by personal. The main reason for this, though, wasn’t a drop in total volume (though growth did slow). Instead, it was a corresponding slowing of volume growth and consistently high active customer growth. Wise’s total quarterly active customer count grew 9% QOQ and 33% YOY, while total volume grew 5% QOQ and 16% YOY. So, this may be nothing much to worry about. Wise is still brining in a lot of new customers at a high rate, but its volume growth is slowing. I think this probably has more to do with the macro environment than with Wise itself, but it’s still something to watch.

The Opportunity

There seems to be a common theme going around that the banks won’t adapt because they’re too greedy or are supporting other areas of their business with the profits they earn from the cross-border transfers. This isn’t the reason why they can’t adapt (notice I said can’t). It’s not a conscious choice. For most banks, cross-border payments are nowhere near their core business and are just something they have to sometimes do for customers. This market isn’t large enough to support some widescale price fixing, and it doesn’t generate enough revenue for the banks to fight about it. The banking and payment markets are massive, and this isn’t a huge part of their business. Businesses and customers around the world incur around $120 billion in transaction costs to move $20-some-odd trillion across multiple borders every year. This is a large number – it’s more than 100x Wise’s current revenue – but it’s pretty small compared to the global banking market. J.P. Morgan Chase’s revenue in 2022 alone was more than $120 billion.

For context watch this interview with the Kaarmann from 2017. In it, he says that the cost basis for most banks’ cross-border transfer business is really high (a lot higher than Wise’s), and even said that when Wise started getting a lot of customers in Hungary the customers told Wise that their bank sent them. Banks aren’t necessarily incurring extremely high margins to transfer funds across borders, their prices are higher than Wise’s because their cost base is higher. This plays into another huge opportunity I’m going to discuss below – the Wise Platform.

But for right now, let’s focus on why the banks can’t compete with Wise. If potential profits were the only thing keeping most banks from competing with Wise, I may not even be that interested in the stock. But they’re not – they never were. Like I stated above, network effects work both ways. Almost every bank in the world is using an out-of-date system, but it’s impossible to change because they’re all still using it, and none of them are bringing in customers based on their cross-border payments alone (ok, maybe some are, but they’re few and far between). There isn’t a large enough incentive for them to change.

As an example of this, SWIFT (in 2022) tried to implement the Global Payments Innovation – where it set a goal of making half of all transfers within 30 minutes or less. It partnered with 165 banks to do this (a small portion of the 11,000 on the system, but probably the larger ones that make up a majority of the volume), but as of 2023 it was running into problems. Apparently, some of the member banks were complaining that they couldn’t comply because of their own outdated technology and the outdated payment infrastructure in their countries.

This is all sort of laughable when you realize that Wise already makes 76% of its transactions in an hour or less and more than half of its transactions instantly. But it demonstrates a point – that most of the international banking system can’t operate on the level that Wise can.

So, what does this mean? Maybe it means that a lot of the £11 trillion in personal and business cross-border volume is up for grabs for Wise. You’ve got to take into account the remittance companies. Some of them will retain or even take share. But as the world becomes more digital, I think there’s even a good chance that Wise takes share from the Western Unions of the world who still have physical kiosks for the unbanked. More importantly though, Wise has the opportunity to take a large chunk of the bank-serviced market consisting of small businesses and personal accounts. This would be huge in and of itself.

But I think what most people don’t consider when analyzing Wise is that it also has a chance to take some of (if not a lot of) the enterprise market – which is larger than the personal and business markets combined. Through its Wise Platform arm, Wise could be white labelled by banks around the world. It’s already doing it with some banks and alternative payment platforms, but the majority of large banks keep their large accounts in-house.

But here’s the thing – the vast majority of the cross-border transaction come from personal and SMB transfers. Almost none comes from the massive enterprise market. The reason being that it’s more of a bespoke service that the banks offer to keep these customers happy. They already make most of their money off of these large customers in other ways, and they need their deposits and their loan business. This means that the large cross-border transfers for these customers are probably completely loss-making at most banks. That leaves room for someone like Wise to come in and offer their Platform in order to save these large banks significant amounts of money and take a difficult task off of their hands.

Now, I’m not an expert in large cross-border transactions. And if you go back and read the StoneX Group Inc. write-up, you can see an example of a white label partner that’s helping banks today. Companies like StoneX specialize in helping banks make large cross-border transactions, typically in more illiquid and esoteric countries and currencies. And they charge very high fees to do it. It seems, though, that they go through the same payment routes that most banks go through – StoneX doesn’t have its own network like Wise does. Based on that, I think Wise has a pretty good chance of being white labelled itself inside a lot of larger and small banks around the world.

But there’s also the question of whether Wise would even be able to handle large enterprise transactions like this. At the moment Wise handles some large transactions, but there probably aren’t too many over £100,000 or £1 million. For all I know, this could be a whole different ball game. It may be much more difficult for Wise to balance its accounts across borders in different bank accounts when it’s transferring £100 million at once.

In addition to its Platform business, Wise also has a huge opportunity in the Accounts business. I’ll discuss it more in the Valuation section below, but just keep in mind that the vast majority of interest income Wise brings in is going to the bottom line. Its deposit base has grown by 10x in roughly 4 years, so I think 50 billion or more in 5 years or so is a very reasonable assumption. If rates stay reasonably high and Wise doesn’t do anything stupid like put customer funds in long-date securities, then it will have a pretty large amount of additional income it will be earning basically for free.

As far as future growth estimates in the money transfer business go, I honestly don’t think it matters if Wise offers the lowest price in every single market. What matters is that they are in every single market (of importance), and that they offer the easiest and most convenient way to transfer money. People aren’t comparison shopping 0.65% with 0.45%. They don’t care that much. If the experience is easy, and they can make all of their transactions in one place, they will go with that option. They only care if it’s a lot lower than the average bank or remittance fee of 2-6%. It’s like CarMax. CarMax doesn’t offer the best prices to customers when it buys cars from them, and it probably doesn’t offer the lowest prices for used cars. But the prices are good, and everything is easy. Price matters, and then it doesn’t.

Now, it’s funny I’m saying this because Wise has said that wants to keep decreasing price, and maybe event eventually go to zero on transaction costs. At the moment, it looks like Wise is caught between being a Visa and being a Charles Schwab. Charles Schwab doesn’t make any money off of transaction fees any more. Instead it makes pretty much all of its money off of interest earned on funds in client accounts. Visa, on the other hand, doesn’t offer deposit services. It makes its money off of relatively high transaction fees because it owns the entire payment network.

Which one of these will Wise be? I don’t know for sure, but what I do know is that Wise looking like either one of those – or even looking like PayPal or Block (minus the potential user base issues) – would be a great outcome. I think, as far as the opportunity goes, most investors should just keep in mind that Wise is primarily competing with the global banking market, and that market is largely fragmented, inefficient, and unwilling to change.

Just think very carefully about this – is it more likely that (1) Wise will capture a relatively large chunk of the traditional banking market for cross-border payments, or (2) the banking market as a whole will change the way they do cross border payments?

I personally think choice 1 is more likely, but you’ll have to decide for yourself if you want to invest in Wise.

Risks

Customer Service Issues/Fraud

This is the scariest thing about Wise as a company. Almost every company out there has bad reviews somewhere on the internet – especially if they’re large enough to reach millions of people. But it seems like, more recently, Wise customers are complaining more and more.

Check out this page on Consumer Affairs. While the overall rating is not bad, there seem to be a lot of recent comments that say things along the lines of: “I’ve been using Wise for years (mainly back when it was TransferWise), and now it’s gotten much worse. The company recently flagged my account/transfer and now my money is tied up with Wise and customer service has done nothing about it for months.”

This is a hypothetical summary, but it describes the situation that many are posting about. Like I said, I don’t know for sure if this is a new thing or it’s just happening because Wise has more customers than ever now. But it’s worrying that customers who say they have been using the app for years are just now having more problems. It’s also worrying that most of the negative comments are saying that they can’t get any real help from Wise.

This is why I said that the Servicing employee hiring may be the most important investment that Wise is making. These kinds of issues are things that make customers leave the Wise platform. And they’re the kinds of things that destroy Wise’s viral growth. Right now, their growth depends on customers bragging about them. The minute that stops or even reverses, Wise may have to start spending like Remitly does to get customers (26% of revenue on marketing spend instead of 5%).

You have to keep in mind that they have tens of millions of customers, and only a very small amount are actually writing negative reviews online. You also have to take into account the fact that most reviews online are going to skew to the extreme. No one is going to leave a review if everything went as planned.

Banks Partner with Visa/Find a Way to Make Transfers Easier

In terms of the fintech competitors, Wise seems to have the majority of the customer mindshare. Remitly, Xoom, and Zepz are potential threats, but their small size and slightly slower growth seems to imply that Wise doesn’t have any real competition in the digital cross-border payments market. Their real competition, as I’ve said before, is the traditional banks.

At the moment, the majority of cross-border transfers between banks are still slow and expensive. And the real challenge for Wise isn’t necessarily in trying to beat out fintech competitors, but make the banking customers aware of their superior service. A lingering risk in all this, though, is the potential for the banks to dramatically improve their service.

I discussed above why I don’t think most of the traditional banks will be able to or even really want to compete with Wise on a price or speed basis. But where that thesis gets kind of tricky is when Visa Direct or something like it comes into the picture. For these banking competitors, it really comes down to whether they will all adopt some third-party technology or infrastructure that effectively improves their cross-border transfer capabilities in-house.

Of course, Wise itself is doing this with its Wise Platform offering, and it very may well capture a large majority of the banks as a user base, even as it’s taking customers from them. Like I said, this isn’t really the banks’ core competency or core focus. But if someone like Visa comes in and offers them all a better payment route, Wise could have a problem.

This is partially why Wise’s customer relationship is so important. As long as the Visa Direct platform can’t take Wise’s direct customers away, Wise still has a great business that’s growing, even if its Platform business starts to get beaten out by Visa Direct.

CBDCs/Ripple

I think it’s a little out there, but blockchain may still be a risk that we need to at least acknowledge. It seemed to be much more of a potential threat back in 2017-18 and 2020-21 when banks and financial institutions around the world were starting to implement some kind of blockchain capabilities.

A lot of that hype has died down today, but there is still some risk around (1) CBDC development and (2) Ripple implementation. CBDCs, for those of you that don’t know, are Central Bank Digital Currencies. And although none of them have really been truly developed or implemented, central banks around the world have been discussing and even building out systems for the last few years.

The threat with these revolves around their potential to offer instant payments/transfers 24/7 in most developed countries around the world. This all sounds sort-of conspiracy-theory heavy, and it may be. And betting on central banks and governments around the world to coordinate something like this seems unlikely. But it may honestly be more of a long-term threat. I don’t see anything happening in the near future, no matter how much hype or fear keeps popping up in headlines. I think the banking systems in every country are going to be hard to “disrupt”, but if CBDCs do eventually become widespread, Wise may have some serious problems.

The same goes with Ripple – which seemed like much more of a threat back in 2017. Today, Ripple is a blockchain and crypto company that is trying to get banks to adopt its blockchain technology to offer real-time and cheap cross-border transactions. MoneyGram was even using Ripple a few years ago, but dropped them as a customer in 2021.

Recently, Ripple received a favorable ruling from New York court declaring that their XRP token is not a security. This has apparently emboldened them to begin claiming that multiple international banks will probably begin using XRP to make cross-border transfers. There isn’t really any evidence of this, and I think Ripple’s acceptance by banks around the world is really a long shot.

Valuation

Valuing Wise comes down to a couple of questions. Do you think Wise can take a significant share of the cross-border payment market, and do you think it can generate margins of ~15%? That’s one part of the business. But you also have to take into account the potential growth from the Wise Platform and the interest income generated from the Wise Accounts.

Right now, if we just look at Wise as a pure cross-border payments company, we can estimate a potential value in a few different ways. The first is just to take an annual revenue growth rate, apply it, apply 15% margins, and slap a 15x multiple on the final result. Yes, I know this is a low multiple, but I want to make sure I can make money even if the multiple compresses significantly.

So, what would happen if you apply a 30% growth rate to Wise’s revenue for the next 8 years. Say Wise has ~£1 billion in revenue in 2023 (FY 2024 in Wise terms), and it grows at an annual rate of 30% for 8 years. This would give potential revenue of £8.16 billion after 8 years. Applying a margin of 15% and a multiple of 15x to that would give you a potential market cap of £18.36 billion – that alone is a return of 2.5x. But keep in mind this doesn’t take into account growth in customer deposits and subsequent interest earned, and it doesn’t take into account growth through the Wise Platform.

Another way to do this is to look at the total market and give Wise a future market share you think they deserve. If I look at the cross-border payments market specifically, I think it’s reasonable that Wise can capture 20% of it. Mind you, I’m applying this 20% to the £11 trillion portion of the market I think Wise can capture. This excludes any portion of the enterprise market. That would give Wise an annual volume of £2.2 trillion. If you apply a take rate of 0.8% (the current take rate, although I know they said they’re trying to lower it), you’re left with estimated revenue of £17.6 billion. Assume 15% net margins given economies of scale and you get £2.64 billion in net income. If you apply a 15x multiple to this, you get a market cap of £39.6 billion – a potential return of 5x.

I know, I know, you might think this sounds a little crazy – and maybe it is. But this is a more mature Wise – maybe a Wise 8-10 years down the road or further. But I know what you’re still thinking – this is assuming an elevated growth rate. Yes, that’s right. It seems counterintuitive, but I actually think there’s a good chance that fast growth will be easier for Wise the larger it gets. Wise has been growing through word-of-mouth for most of its existence, but honestly that’s still a pretty small base of people. Maybe they’re all early adopters, and word-of-mouth growth will be harder in the future. But I’m inclined to think that the larger their customer base grows, the wider-spread their name recognition will become. Once Wise reaches what some call a critical mass of customers, I think attracting customers may actually become easier.

Right now, Wise is generating the majority of its growth through word-of-mouth, and still I bet most people or businesses you know of don’t know about Wise. They only have 650,000 business customers, after all. There are 33.2 million small businesses in the U.S. and 24 million small businesses in Europe. Of course, not all of these are transacting across borders, but I think a decent number may be. And honestly, the business doesn’t have to be that large to transfer an average of £39,000 across country lines in a year (the current annual average VPC for Wise Business customers).

So, I don’t think it’s out of the question that Wise can sustain its growth rate in the future or even end up growing faster as its gains more traction and develops more of an internal network of users. And we know from dissecting Wise’s financial statements that it doesn’t really need any capital to grow. It has to hire the right number of people, but there’s nothing really holding it back from growing extremely fast.

In addition to the core money transfer business, Wise also has a huge opportunity with its Wise Accounts. Right now, it has ~£11.5 billion in deposits across its platform. Growth in deposits has been over 50% (sometimes over 100%) every year since 2019. I don’t it’s crazy to assume that Wise could grow deposits to £50 billion in five years or so (35% CAGR). Applying a 2.5% net interest rate would give Wise a total of £1.25 billion in interest income. Pretty much all of this would go straight to the bottom line, so Wise’s net income could be juiced by roughly £1.25 billion just from an increase of deposits, which seems inevitable to me.

If you add this to Wise’s £2.64 billion in earnings estimated above, you get a total of £3.89 billion in potential net income. With a multiple of 15x, you could be sitting on a market cap of £58.4 billion. This may sound crazy, but keep in mind that the multiple would likely be much higher, and this isn’t even taking Wise Platform growth into account. The potential for Wise to take a share of the massive enterprise market by white labelling its product through bank partners isn’t really something that can be quantified right now, but it’s definitely something you want to see in a stock you invest in – potentially asymmetric upside, even if it can’t be put into numbers.

Overall, I think that although Wise looks expensive on current numbers, it is operating a great business that is growing very fast in a large market without the need for additional capex to support that growth. My estimations above are bull cases, but I think they’re relatively reasonable bull cases. I don’t think Wise will look like the same exact company 5 years from now, and I don’t think the international payments market will look the same either. Something is likely going to change, and I think that Wise is going to be at the center of it.

Conclusion

Wise is the unquestioned leader in digital cross-border transactions. The traditional banking system as well as older remittance companies are all, for the most part, operating on outdated payment rails, while Wise has been developing its own internal cross-border payments infrastructure for the last decade.

The overall market is massive, and while Wise does have competition, the economics of its business combined with its viral growth, superior product, and inherent network effects are making it formidable competition for both the incumbent banks and fintech competitors.

While there are significant risks, I think Wise’s potential for massive growth is much higher than most companies you can find trading today. I don’t know for sure, but I have a hunch that if Wise was trading in the U.S. stock market, it would be worth significantly more than it is today (probably $20-$30 billion), giving investors a very enticing risk-reward trade-off at today’s stock price.

This Publication is for informational purposes only, and nothing we say should be taken an investing advice. Past performance is not predictive of future returns. If you are considering a purchase of securities, please consult a licensed financial advisor. This is not a solicitation or an offer to buy any of the securities mentioned. This is not advice to buy, sell, or hold any of the securities mentioned. The author of this Publication may have positions in the securities mentioned or may initiate a position in the securities mentioned in the near future.